As Input Prices Soar, 200 bu. per acre Yields may be The Ticket to Breaking Even In 2022

State of the Ag Economy 012122

2021 was one for the record books. Net cash farm income for the year is forecast to hit the highest level since 2014, and nearly 17% higher than the 20-year average. What made the year so unique is, contrary to 2014, the majority of U.S. farmers were able to see strong or even record yields, along with the improved commodity prices. However, 2022 could produce a different story, thanks to a rapid rise in input costs.

Kentucky Commissioner of Agriculture Ryan Quarles says the 2021 crop year produced the strongest cash receipts Kentucky farmers have ever seen, thanks to historic yields and strong prices.

“We just eclipsed $6 billion in farm-cash receipts in Kentucky, which is big news for us,” says Quarles. “But at the same time, I’m really concerned about that net farm income being chipped away with the rising cost of inputs, and so I’m eager as the next ag commissioner to try to figure out what the profitability is going to be for farmers. I'm afraid farmers are going to be squeezed coming off record high yields in 2021."

USDA’s latest look at net-cash farm income points to a nearly 15% jump from last year. Agriculture Secretary Tom Vilsack highlighted the strong net farm-income picture during a hearing before the House Ag Committee on Thursday.

“Our farm income is as good as it has been in the last eight years. We’ve had record exports,” Vilsack said.

USDA's Chief Economist, Seth Meyer, also talked about net farm income, and the drivers, in a recent interview with U.S Farm Report.

"Right now, when one thinks about net farm income, and what's driving net farm income, we had pretty good cash prices for the crops you just harvested,” says Meyer.

“Going into the year we see balance sheets in, candidly, a very good position. We see working capital, maybe better than we've seen it in a long time,” says Alan Hoskins, American Farm Mortgage.

While 2021 was strong, USDA is already acknowledging the 2022 farm financial picture may not turn out as positive. USDA’s forecast for 2021 net farm income already pointed to the fact higher production expenses are expected to partially offset those higher cash receipts for 2021.

Climbing Costs

When looking at the 2022 crop, producers are seeing glyphosate and glufosinate prices up as much as 300%, with fertilizer prices increasing two-fold or more. In fact, farmers who are booking anhydrous ammonia now are looking at prices north of $1,500 per ton. Just six months ago, prices were closer to $600 per ton.

With input costs increasing for the 2022 crop, Meyer says crucial conversations are happening at USDA.

“I signaled to the secretary, 'Hey, this is something we want to watch.' Several months ago, we did a briefing where we walked through a sample in Illinois, a central Illinois corn and soybean budget, just to go line by line and kind of illustrate what's going on for producers,” says Meyer.

Profit Projections

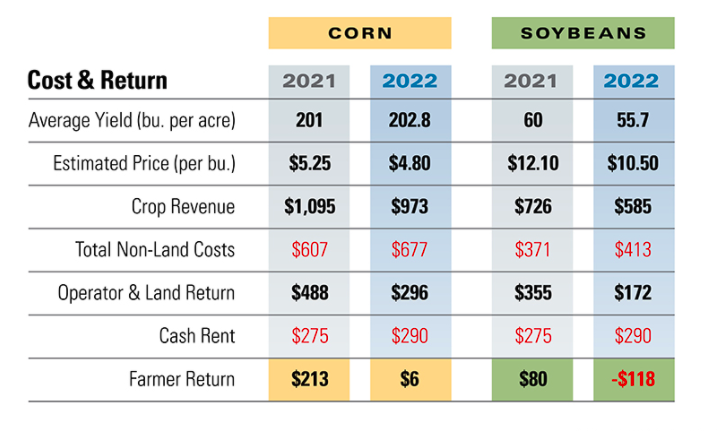

Profit potential in 2022 is showing a stark difference from 2021. Based on USDA forecasts and University of Illinois budget projections, Steve Johnson, retired Iowa State University Extension farm management field specialist, says farmers are looking at a return of $6 per acre on corn this year, compared to $213 per-acre average for 2021. Soybean projections are already in the red.

“Farmers have extreme risk in 2022,” says Johnson. “They have risks in crop yields, costs and prices, and they will need to manage all three simultaneously.”

The financial squeeze is something Hoskins and other agricultural lenders are already starting to see for 2022.

We've seen break-evens; if you look at bushels per acre, we've seen some at 170- to 200-bu. per acre on corn, if you want to just look at seed fertilizer and chemical,” says Hoskins. “I'm not saying this is the norm, but I’m saying we've seen numbers of $700 or $700-plus [in costs per acre] so far. So, it's definitely something that is different than I’ve ever seen in my career.”

Fertilizer Adding $128,000 in Costs

Texas A&M economists recently conducted a study on fertilizer prices, which found the average feed-grain farm in the state is facing fertilizer costs up $128,000 compared to last year. The survey found heading into spring planting, fertilizer prices are up 80% compared to 2021, and in some cases, farmers are seeing certain fertilizer prices more than double what they saw last year. But for the report, AFPC was conservative in its estimate, using a 50% increase in fertilizer costs.

"On our feed-grain farms, the impact was an increase in costs of about $128,000, just due to fertilizer costs alone. And so if you're a producer sitting here with no idea where prices are going to go in 2022, but knowing that you're trying to finance your operation and contemplating getting a crop in the ground here very soon, these are huge, huge considerations," says Bart Fischer, co-director of The Agricultural & Food Policy Center, Texas A&M University. "It's no surprise why there's so much angst among ag producers, because they're the ones trying to figure out how to pay for this increase in costs."

As input prices have soared, there are some signs of stabilization. But even if prices level off, economists and ag lenders fear the net farm income picture for 2022 could erode.

“I think when you look at the crop budget, and what I pointed out to the Secretary on the budget, it's not just the fertilizer line that's kind of threatening a squeeze,” says Meyer. “It's fertilizer, it's chemistry, it's repairs on trucks. The unusual part is almost every single line of the budget is showing some price pressure.”

The Bigger Picture

The higher costs are pinching producers of both crops and livestock right now, as it’s a question on whether commodity prices can offset the rapid increase in costs of various inputs and parts on their farms.

“We're very concerned going into the 2022 crop year about inflation, the rising cost of inputs and also sourcing inputs even,” says Quarles. “It's not just the price and making sure you can actually find it and get it into your farm shop and prepare for 2022. Some optimistic news, of course, is trade that's propping up prices. But we're a livestock state as well. And so we're concerned about the rising costs of feed. And, of course, all the other logistics that farmers have to go through planning out a crop year.”