Nitrogen Prices Now Seeing a Resurgence For Fall, and Natural Gas Isn't the Only Driver

High input prices continue to be a pain point for farmers planning their 2023 crop needs, and nitrogen prices are now seeing a resurgence heading into fall. Experts say the price of natural gas isn’t the only driver fueling the market as farmers look to book their fall needs.

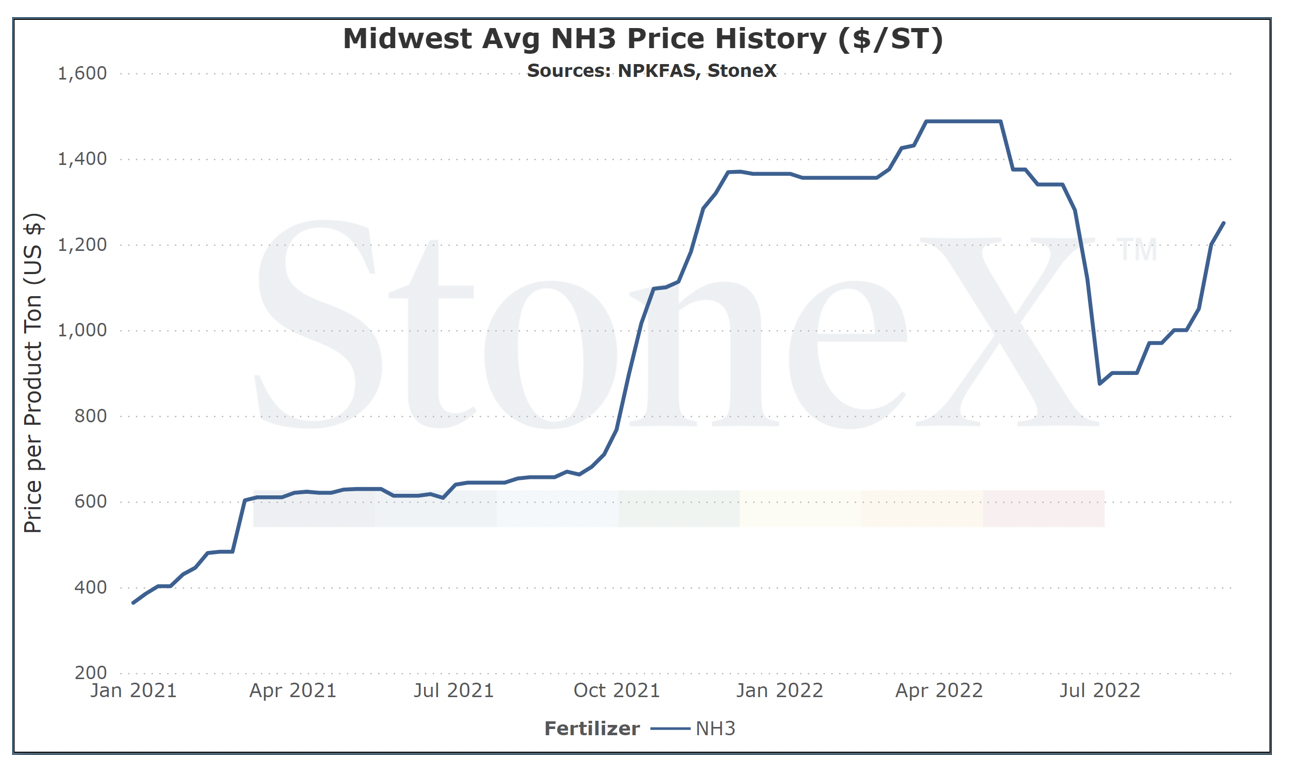

Nitrogen prices averted a major disaster on Friday when rail companies and rail unions reached a tentative agreement and avoided a possible strike. Even with the positive news, this chart from StoneX Group shows prices are climbing back toward the highs producers saw last spring.

One ag retailer in Missouri told AgWeb anhydrous prices for falls needs were:

- $800 per ton during the fall of 2021

- $1500 during the spring of 2022

- Farmers booking fall anhydrous today are paying $1325

A retailer located in Iowa also reported a fertilizer price increase this fall. The location reported:

- Prices started around $700 during the fall of 2021 and jumped to $1500 by the end of last fall

- Prices jumped to $1,700 during the spring of 2022

- Farmers looking to book for fall of 2022 saw prices that started at $1000 per ton, but now it's more than $1400 per ton

What's Behind the Price Increase for Fall?

What's fueling the price increases now? Ag Economists say natural gas used to be the main indicator, but that's not the case anymore.

“Historically we might have thought fertilizer is primarily an energy cost input,” says Brad Lubben, agricultural economist with the University of Nebraska-Lincoln. “Energy drives the cost of fertilizer, but so does output so does the price of corn. So do the supply shocks overseas in terms of foreign suppliers. So do the current energy shocks in Europe, which leaves all kinds of questions about the winter natural gas supply and availability, as well as transportation and everything else that we see going on here with the challenges we’re seeing today. Volatility is something producers are going to have to manage.”

Outside of the global energy battle, some economists and analysts argue the larger driver of nitrogen prices today is the price of corn.

“You have a lot of factors at play there,” says Cory Walters, an agricultural economist with University of Nebraska- Lincoln. “You have corn prices heading back up. You have issues over in Europe, you have tariffs, you have you have transportation costs, it's everything across the board is leading to this price level and this level of volatility. And I'd expect more of that going forward, as we as we move into the fall and winter.”

Josh Linville of StoneX Group says there were reports Friday that two European nitrogen plants are planning to come back online. He says that will likely be with the help of government assistance in an effort to beat the cold temperatures this winter. As a result, NOLA January futures were down $30 from the highs on Thursday.