USDA Painted a Very Bearish Picture for Grain Prices This Week, Here's One Thing That Could Cause Prices to Rally

USFR-RT1-021724

If farmers were looking for something that could change the expectation that grain stocks will continue to grow, USDA's Ag Outlook Forum held in Washington D.C. didn't provide any. The reality is grim, and analysts at National Farm Machinery Show say the report was what many expected.

“It's really bearish,” says Joe Vaclavik of Standard Grain. “USDA painted a very negative picture of the future in that report, and none of it was surprising. It's not anything the market or traders or farmers should have been surprised by.”

After the report came out, Vaclavik started plugging in the numbers and looking at what scenarios could change the stocks and price picture, including a switch in acres.

“It's very, very difficult to paint a friendly picture, no matter how you slice the numbers,” he says. “What you're going to need to see, in all likelihood, to really change things is a weather issue, whether it's South America with their second corn crop in Brazil, or something in the U.S. spring or summer. It just seems very, very difficult to fathom a situation that turns friendly all the sudden without some sort of supply disruption.”

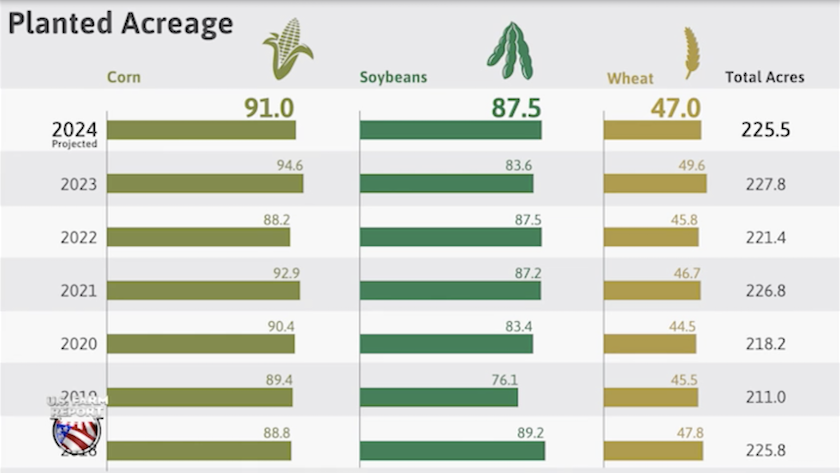

2024 Acreage Outlook

USDA’s Ag Outlook forum projected a drop in corn acres and an increase in soybean acres. USDA’s first acreage forecast for 2024, which is not farmer survey based, showed:

- 91 million acres of corn, down 3.5 million from 2023

- 87.5 million acres of soybeans, up nearly 4 million from 2023

- 47 million acres of wheat, down 2.6-million from last year

“I saw a couple of people comment right off the bat , after the Ag Outlook numbers were released, saying 91 million acres of corn could have been worse, but the bottom line is that even at 91 million acres, using the USDA as methodology, you're talking 2.5 billion bushel carryout,” says Matt Bennett of AgMarket.net. “Last time we had over a 2-billion-bushel carry was back in 2018 time, and your average cash price for corn was $3.66 per bushel then.”

Bennett says he also struggles to find a bullish scenario without some sort of major weather issue.

“Again, it would be a supply driven type rally. It's more of a flash in the pan than building demand, which is what we sorely need to do right now,” says Bennett.

2024 Price Projections

USDA also released price projections, putting corn at $4.40 a bushel. Soybeans at $11.20 per bushel for the ‘24/’25 year.

Alan Hoskins of American Farm Mortgage says from an ag lender’s perspective, farmers are having a difficult time deciding what to plant. However, the conversations he’s having, his says soybeans pencil better than corn.

“If you look at the predominant areas that we’re in, soybeans are better than corn. Certainly, corn is the more challenging number. I think that’s where a lot of folks are looking, but also they're trying to fine tune their pencils, make sure that they understand how the input costs work, and develop that marketing plan around those numbers,” says Hoskins.

A Battle for Acres? Not Quite.

As the acreage debate heats up, will corn need to rally ot buy acres this year? According to Vaclavik, the answer is no.

“It's not a battle. It's like a war of attrition,” Vaclavik says. “We could stand to lose 5 million acres, and probably still be comfortable overall. The fact of the matter is the corn soybean pie, if you want to put it that way, it's going to stay about the same for the most part. And if you move 2 million here and move 2 million there, I just I think it still leaves you with kind of a negative looking situation, big picture.”

“Here's the challenge that the U.S. producer has the fall of 2023,” says Bennett. “Just a few months ago, the pencil worked better for corn versus beans, which I'm sure Alan would agree with. The problem is that whenever the pencil works better for corn versus beans, that's an economic decision that you're making on acreage, we need to do something about what is making us make that decision, which was the price of corn at the time versus the price of soybeans. And so now, you're in similar position if you didn't sell corn the ‘23 crop, unfortunately, because we spend a lot of money on inputs and didn't sell the corn. Now we're in the same pickle we were in before and I think your swing acres probably go to beans.”

Bennett says he agrees with Vaclavik, there are simply too many acres right now, so corn and soybeans prices don’t need to buy acres.

Farmers Weigh Ways to Cut Back

With the bearish outlook, some farmers are looking to cut back, and Hoskins says there’s one area farmers always look to cut first.

“First and foremost, the first thing that to look at always inputs,” says Hoskins. “I don't necessarily think that that's the best strategy at times. I think there's a lot of other areas that can be considered. There's items, for example, and this is never a popular one, but living expenses is one of the things that's the most difficult to cut, but in many instances, that is an area that needs to be looked at.”