USDA's December Reports Unwrap No Major Surprises, And Analysts Argue Corn Prices Are Stuck For Now

There wasn't much excitement in Friday's USDA reports. Despite weather concerns sprouting in Brazil, USDA didn’t make any major adjustments to the South American corn or soybean crop, but USDA did acknowledge the increased appetite for U.S. corn and wheat from China, as well as increased buys of corn from Mexico. Those recent reported sales prompted the agency to make minor cuts to U.S. ending stocks for both corn and wheat. Overall, analysts say it was a typical USDA report for December.

"This is probably the least important report of the 15 reports released during the year, we shouldn't expect anything big," says Jon Scheve, president of grain trading for Superior Feed. "I think our focus is now solely on weather in South America for the soybean crop."

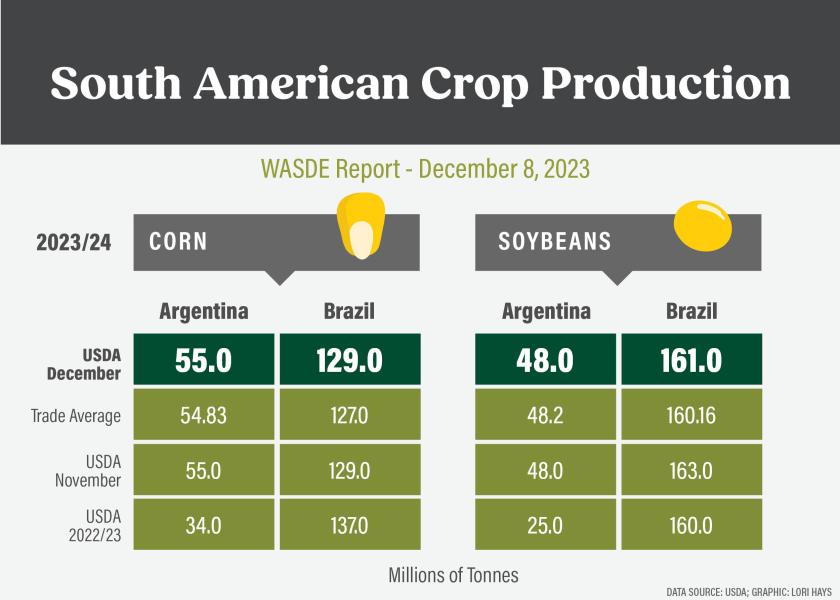

USDA trimmed its estimate for Brazil’s soybean crop, but left Brazil’s corn and Argentina’s corn projections unchanged. USDA’s December report now has the following projections penciled in:

- Cut Brazil’s soybean estimate by 2 MMT from the November report to 161 MMT

- Left Brazil’s corn production estimate at 129 MMT

- Left Argentina’s corn production estimate unchanged at 55 MMT

Scheve thinks USDA's decision to not make any major adjustments to the South American crop was due to timing.

"Basically from December 20 through January 20, that'll be the biggest timeframe for South American weather for soybeans. Also, the exports will pick up for U.S. beans during that timeframe. So, if we're going to see fireworks, it's going to happen during that time, and especially depends on what the weather is like for that," Scheve says.

He says the timeframe for possible fireworks in the corn market is even later.

"I don't see any reason to worry about South American weather for corn until we get to April or May when that second crop goes into reproductive stage. And then maybe we can have fireworks for corn. But until that time, I just look at a farmer who wants to get $5 for corn in the U.S. So that's going to be trouble for them to sell it. And I think the end users want to buy it at $4.50. So we're probably stuck in a range somewhere around that $4.75 to $4.80 mark, up or down 20 cents, from there."

Mike North, president of the producer division for Ever.Ag, agrees that USDA didn't make any major adjustments due to the time of year.

“It is too early, and when you look at this time of the year, we often don't make adjustments,” says North. “The fact that they lowered bean production by 2 million metric tons kind of falls in line with some of the boots on the ground analysis. Some are talking about the early weather maybe taking the cream off of the top for yield, especially in northern Brazil. But it really is too early to know. As we saw with our own soybeans this year, it's way too early in the game to be destroying yield when we're just getting them in the ground.”

Is the South American weather story a bigger issue for corn or for soybeans? Scheve says when you base it simply on timing, it’s soybeans.

“I think the weather first has to be a story for soybeans because that's the first one that's going to be affected. There could be a bit of an argument made that if the bean crop is delayed a little bit from its plantings that possibly that could push plantings back on the second corn crop which would then end up in the May dry season and maybe hurt the yield a little bit, but since their yields are already only 80 bu. per acre across the country in general, I don't know that it's going to be a substantial drop,” says Scheve.

The other thing to keep in mind, according to Scheve, is the scope of the growing area in South America.

“It's a massive area. When you look at from the top of Mato Grosso to the bottom of Argentina, you're talking about 2000 miles. Compare that to Fargo, North Dakota to Jackson, Mississippi, which is only 1200 miles. So, it’s massively big area, it's spread out over a much bigger area. And the weather is way different across all of that area,” he says.

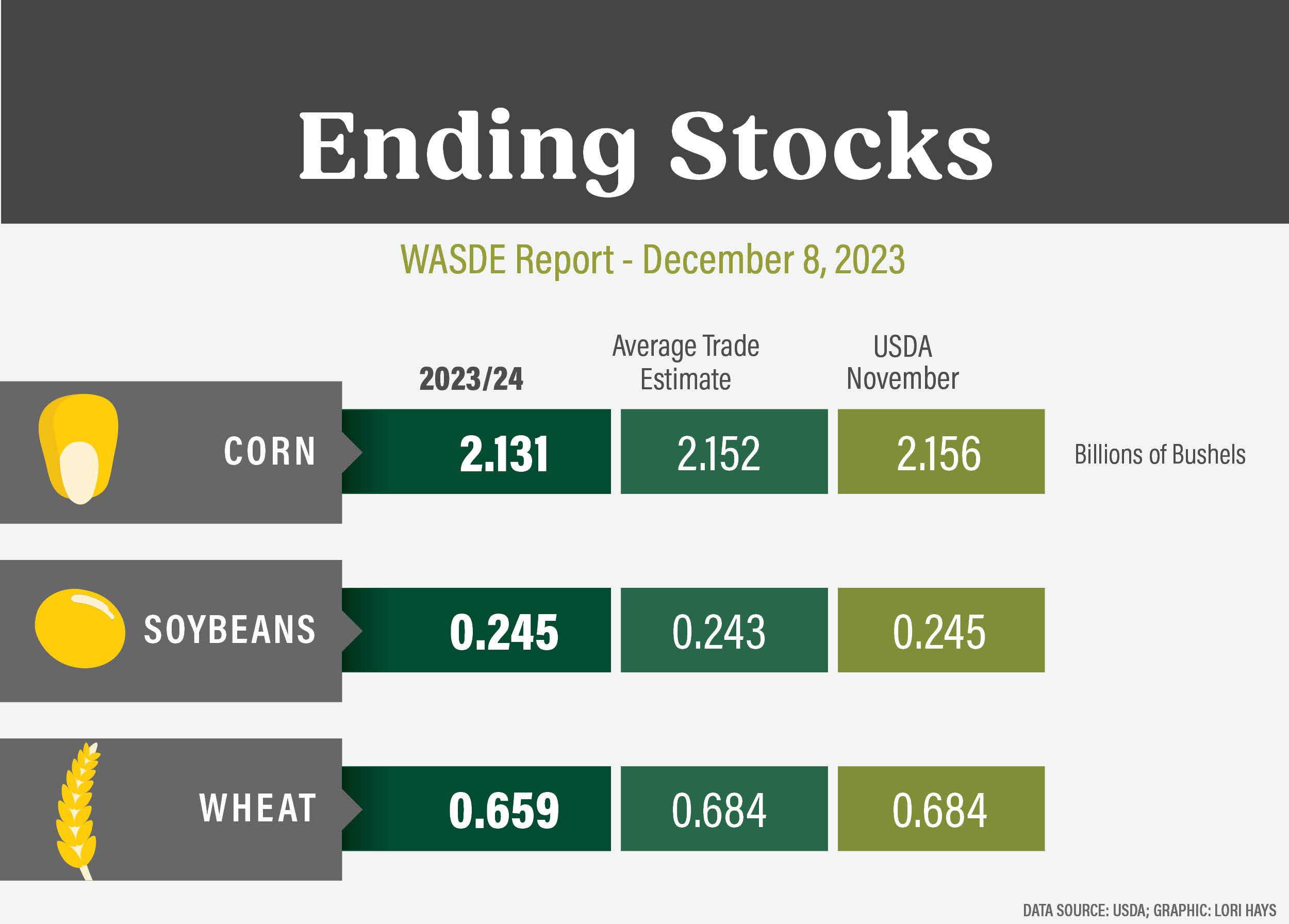

USDA Trims Ending Stocks

As Mexico and China ramp up buys of U.S. corn, it prompted USDA to cut its U.S. corn ending stocks estimate by 25 million bushels in the December report. China has also increased its purchases of U.S. wheat, which took 25 million bushels off the wheat balance sheet.

USDA’s updated look at U.S. ending stocks estimate shows:

- Corn down 25 million bushels to 2.13 billion bushels.

- Soybeans unchanged at 245 million bushels.

- Wheat down 25 million bushels to 659 million bushels.

China continues to buy U.S. corn and wheat. USDA confirmed another purchase of soft red winter wheat from China, this sale totaling 4 million bushels. What's behind the buys? Scheve says it goes back to concerns with their domestic wheat crop.

"I think it's just a function of that they've had some poor quality around the world," says Scheve. "They're seeing an opportunity right here. They've seen some value on prices, and that's giving them a quick opportunity to add a little bit into their storage."

North thinks China is just one of several countries seeing some potential production issues with wheat.

"That short crop in China has what's it's definitely been what's inspired him to come to the market. I think as you look elsewhere in the world, Australia has had some real issues with their wheat crop and downgraded a bunch of their soft red. We've got certainly available supplies and growing inventories here in the United States," says North. "If I look to places like Argentina to try to fill in gaps, everybody's still scratching their head waiting to see what the new president does with export tax. So, if I'm China, and I know I have a short crop, I'm going to try to get ahead of that. And for the U.S., this is a great opportunity right now, especially with the US dollar coming down 3% here over the last few weeks."

What's Next? USDA's Big January Reports and Potential Fireworks

After USDA’s raised its U.S. corn yield forecast by nearly 2 bu. per acre in the November Crop Production Report, Scheve says the worst-case scenario for corn prices is if USDA increases the yield forecast again in the January reports. Based off conversations he’s having with producers, he thinks an increase in the national yield is a possibility for next month's report.

"I think best-case scenario is that they don't change the yield at all in January," says Scheve. "I think the worst-case scenario is that they add another two to three bushels per acre to the national yield."

Scheve says based on conversations he's having with producers, the "better than expected" yield story played out again this fall.

"I've talked to people across the entire country, and everyone is absolutely surprised by their yields," he says. "Most of them are all to the positive. I would say I had less than 10% of clients that were telling me that the yields were worse than they expected, and that was only if they were in kind of a middle of Nebraska to Sioux City area. That was the only area that kind of saw some really bad potential outside of Northeast Iowa."

USDA's January reports are scheduled to be released on Friday, January 12, 2024.

Related News:

Grains See Profit Taking Post WASDE with Minor Adjustments: Cattle and Hogs See Relief Rally