EPA Issues Existing Stocks Order For Dicamba Products

On February 14, the EPA issued an existing stocks order for dicamba products previously registered for over-the-top use.

This order addresses use of the dicamba products effected by the Arizona federal court decision vacating their registrations earlier this month. It authorizes limited sale and distribution of existing stocks that are already in the possession of persons other than the registrant. The existing stocks provision applies to stocks of previously registered pesticide products (Engenia, Tavium and XtendiMax) currently in the U.S and packaged, labeled, and released for shipment prior to February 6, 2024.

Read the full existing stocks order here

EPA stated: “The issuance of this existing stocks order will help to ensure that growers who have already purchased dicamba-tolerant seeds and thus are reliant on the availability of dicamba for the 2024 growing season:

- apply dicamba formulations designed for use over the top of dicamba-tolerant soybean and cotton, rather than misusing more volatile dicamba formulations which could lead to greater offsite movement (and thus potential damage to non-dicamba tolerant crops and other plants); and

- apply these dicamba products consistent with restrictions intended to reduce offsite movement and protect human health and the environment.”

In its announcement, EPA cited letters from the Agricultural Retailers Association, the American Soybean Association, American Farm Bureau Federation, and the National Cotton Council.

EPA said its primary concerns were:

- “In the absence of any action by EPA, the court’s vacatur of these registrations would render all sale or distribution of the formerly-registered dicamba products unlawful under FIFRA….as of February 6, 2024, FIFRA would prohibit downstream distributors from even returning previously purchased product to the manufacturer for relabeling or shipment by any actor to disposal or export facilities. Among other things, an existing stocks order can permit those in possession of these products to distribute them for return to the manufacturer, export, or disposal.”

- “Because the effect of the court’s order resulted in these products becoming unregistered, EPA is issuing this order to ensure that users apply dicamba following the restrictions on the previously approved labeling (including instructions intended to protect human health and the environment). By doing so, any use inconsistent with the previously approved labeling is prohibited, reducing the potential for harm to the environment from unrestricted use. The below provisions for the disposition of existing stocks address these concerns. Further, allowing the limited sale, distribution, and use of existing stocks will reduce the potential for offsite movement and protect human health and environment during the 2024 growing season by encouraging growers to apply the formerly-registered lower volatility dicamba formulations designed for use over the top of dicamba-tolerant soybean and cotton—rather than applying other dicamba products not registered for over-the-top use.”

- “As described in numerous stakeholder letters received by the Agency from across the country, growers have purchased dicamba-tolerant seed in the period between the completion of briefing in the District of Arizona case and the issuance of the court’s order and judgment vacating these dicamba registrations, therefore making them reliant on the availability of dicamba for over-the-top use... Additionally, distributors and end-users may have possession of stocks of XtendiMax, Engenia, and/or Tavium purchased in good faith after EPA issued the registrations permitting sale and distribution of the products in commerce and establishing conditions pertaining to the use of the products.”

Read the full existing stocks order here

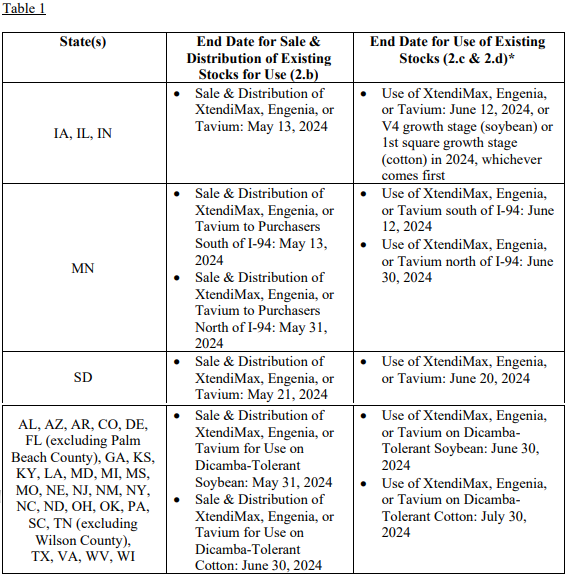

Here is the table in the EPA document timeframes and end dates for sale and use.