Sentiment Takes a Dive in Purdue's Latest Ag Economy Barometer

The current state of commodity prices and input costs have led to souring farmer attitudes in Purdue’s January ag economy barometer.

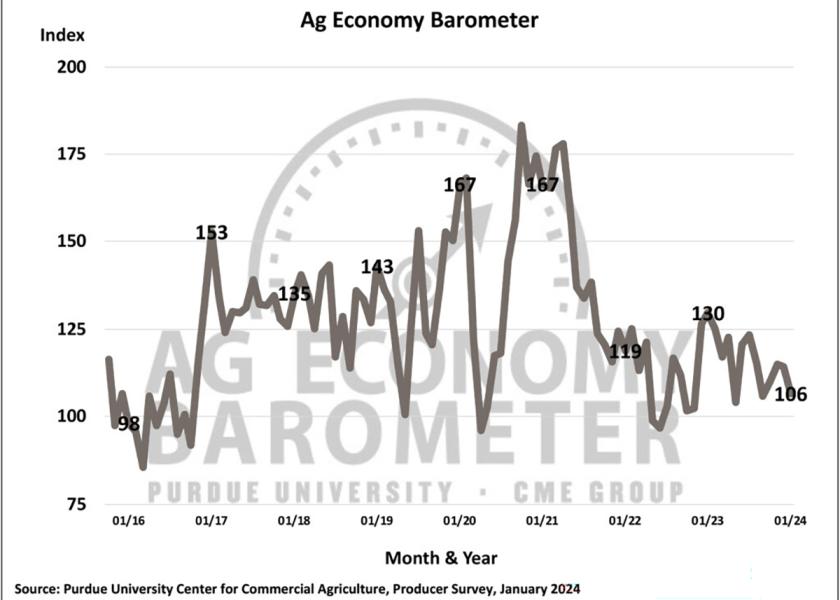

The barometer reported its lowest reading since May 2023, falling seven points from December and 24 points from January 2023. Michael Langemeier, associate director of Purdue’s Center for Commercial Agriculture and a professor in the university’s department of economics, joined AgriTalk to share his insights to this month’s reading:

“There are two things we can point to. One of them is that the last WASDE report was not very positive with the increases in corn and soybean yields. And keeping in mind that about half the people that we survey on a monthly basis are primarily corn and soybean producers, it was not surprising that the ag economy barometer and the two sub-indices were down,” Langemeier says. “The other signal is their biggest concern, and certainly the lower crop and livestock prices that we expect to see in 2024 are on people's minds.”

The barometer’s farm financial performance index is down 12 points from December to a reading of 85. Just over 31% of respondents are expecting weak financial performance in 2024, up 11% from December. However, 53% are still forecasting income to remain about the same.

Top Concerns

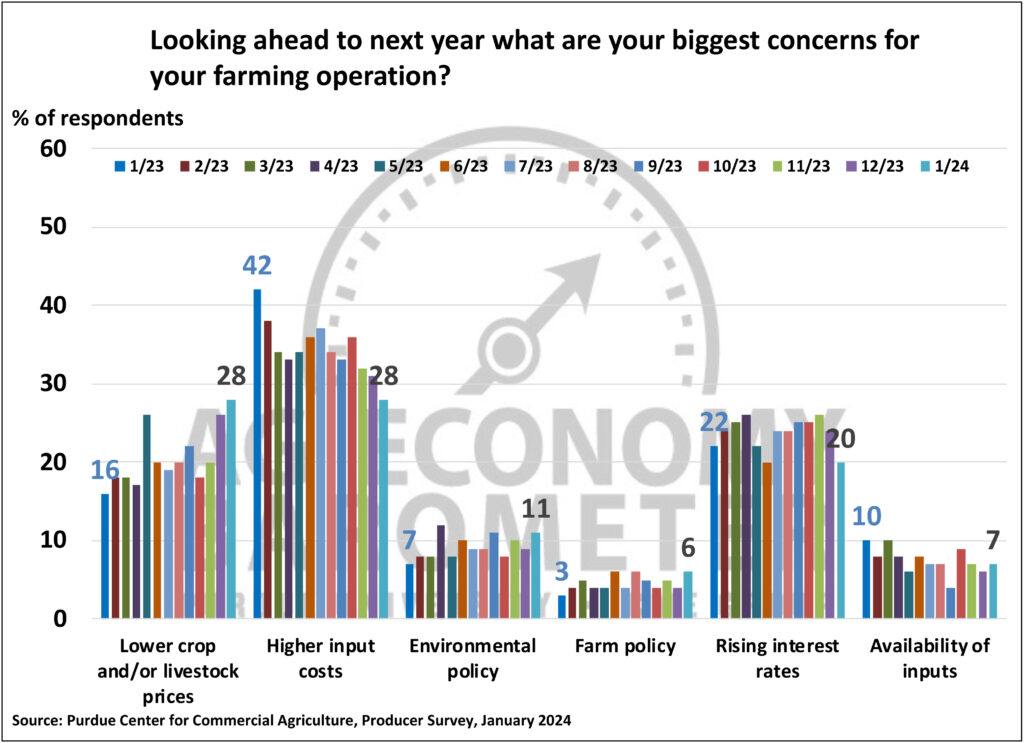

While ag input expenses have remained top of mind for some time, the risk of lower crop and/or livestock prices tied that category for the top producer concern this month.

“The fact that both of them are there as the top concerns just tells us how worried producers are about this price cost squeeze,” Langemeier says. “We’re had some relief from production costs. Your breakeven price for corn is down about 9% primarily due to lower fertilizer costs. But nevertheless, it’s still well about 5% for a lot of products. And with cash prices down in the $4.25 to $4.50 range, it’s considerably below most people’s breakeven.”

Other concerns were rising interest rates, environmental policy, availability of inputs and farm policy. Environmental policy, specifically, jumped from 7% of respondents’ top concern this time last year to 11% this year.

“Policy concerns are higher this month than they have been for a while,” Langemeier says. “It’s not only environmental policy, but also immigration policy, trade policy and the farm bill. If you look at government payment forecasts for 2024, they’re really low. I think producers are very concerned about where the safety net is at the current time.”

Carbon Remains Consistent

Since 2021, nine of Purdue’s ag economy barometer surveys have asked producers if they have engaged in discussions surrounding carbon capture. Of the January survey respondents, 8% have had those conversations. And of that group, 61% were offered a payment rate of less than $10 per metric ton while 12% were offered over $30 per ton.

“When you look at the payments, they’re still relatively low. That’s been a consistent story the last three years and that really hasn’t changed,” Langemeier says.

Perspective Matters in Operating Loan Balances

According to the barometer, more producers anticipate their operating loan to be about the same as last year while fewer producers (15%) said they expect it to be larger. Of those expecting the loan to grow this year, 17% say unpaid operating debt, 23% say increase in operation size, and 61% say increased input costs – which is down from 80% this time last year.

“We’ve built up a lot of liquidity in the agriculture sector the last three years. So, when you look at the operating loan question, yes, financial stress looks like it’s ticking up. But it’s still really low compared to what it was even in 2020,” Langemeier says.