2022 Soybean Planting Projections are a Moving Target, Prices will Whipsaw

With input prices trending higher for corn, some traders in recent weeks have predicted more crop acres could move to soybeans in 2022. Not everyone is on-board with that projection, however.

Arlan Suderman, chief commodities economist for StoneX Group, is looking at production in South America as he ponders 2022 U.S. soybean plantings.

“I think I'm going to struggle (to predict U.S. acres) particularly because Brazil looks like they're going to have a big crop, and we have yet to see what Argentina is going to do,” Suderman says.

For now, he predicts U.S. farmers will plant 89 million soybean acres next spring – 1.5 million acres above USDA’s current forecast of 87.5 million planted acres.

“I think that 89 million is kind of the top right now for soybean acreage, given soybean’s current price relationship with corn,” Suderman says.

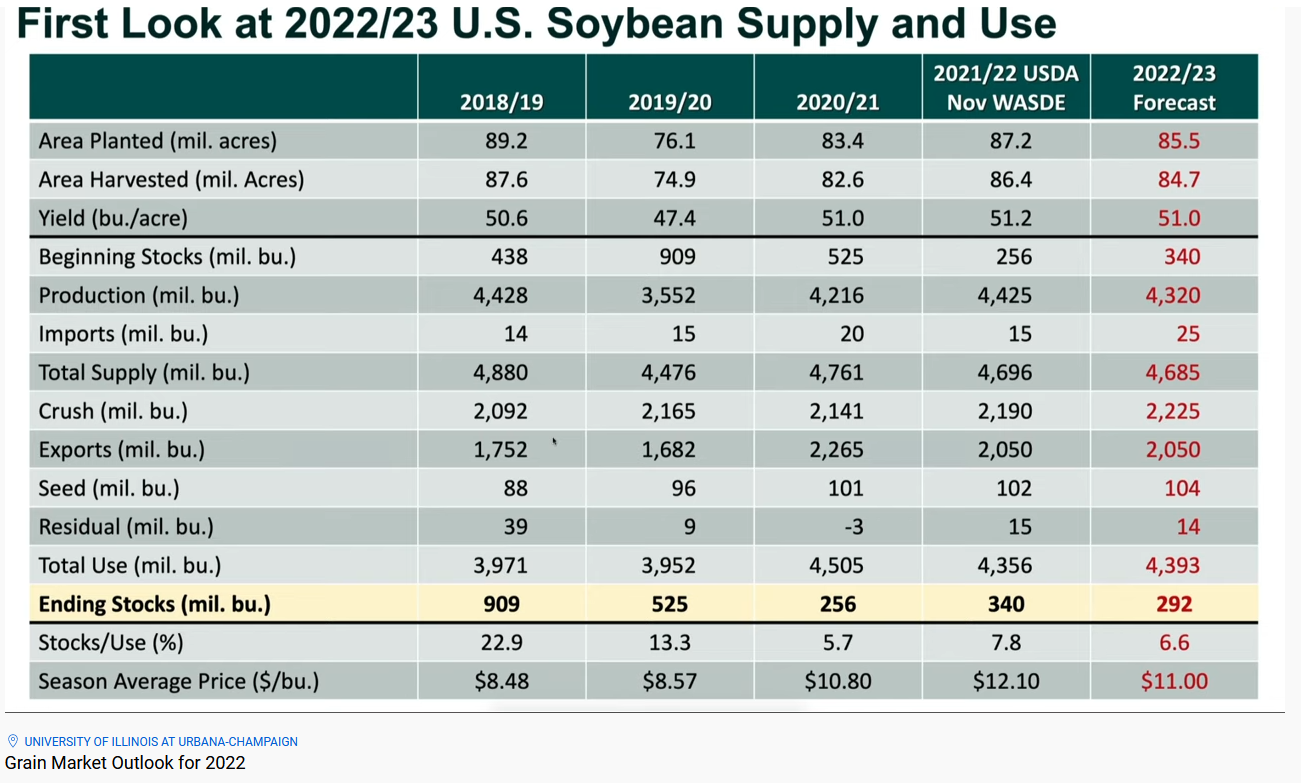

Scott Irwin, University of Illinois agricultural economist, is not optimistic that soybean plantings will go as high as what either Suderman or USDA anticipate. If anything, Irwin expects movement in the opposite direction, based on his economic models which indicate 2022 soybean planted acres in the U.S. will dip to 85.5 million acres. That’s 1.7 million planted acres less than the 87.2 million acres farmers planted this past spring.

Plenty of time for acreage shifts

With the heart of planting season still months away, soybean acreage forecasts have plenty of time to move higher or lower.

Like Suderman, Jon Scheve, Marketing Against the Grain, is keeping a close eye on the Brazil soybean crop. Scheve says dry weather conditions that moved into the southern third of the country’s soybean growing area this past week could exact a yield toll there that would benefit the U.S.

“Over the next 60 days most of Brazil will be in the heart of the flowering stage and the beginning of the pod-fill stage,” Scheve reported on Monday. “Two-week forecasts indicate limited precipitation, and many traders think it might cause a yield reduction.”

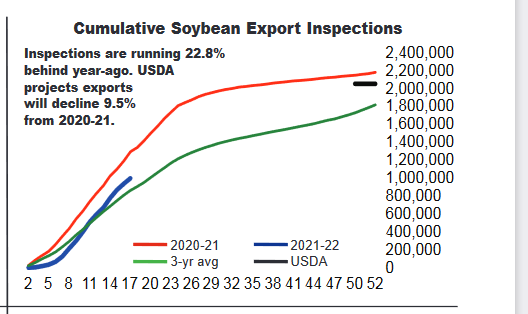

In addition to weather, export opportunities will shape market opportunities and U.S. farmers’ planting decisions. Pro Farmer reported on Monday that cumulative soybean export inspections are running 22.8% behind a year ago and that USDA projects soybean exports will decline 9.5% from 2020/21.

“We still have some soft demand coming into China because of poor hog feeding margins, and we’ll need to monitor that,” Suderman adds.

Which way will prices go?

The November USDA World Agricultural Supply and Demand Estimates (WASDE) report pegs the season-average soybean price forecast for 2021/22 is $12.10 per bushel. The price forecast went unchanged in the December report.

Irwin tells farmers to anticipate lower prices further into the new year. His economic models show soybeans at $11 per bushel for 2022/23.

Chip Flory, Farm Journal economist and AgriTalk host, says farmers can expect soybean prices to be whipsawed by a transitioning soy market in 2022.

“Because of renewable diesel and investment in U.S. soybean crush, traders are getting used to the idea of crushing for oil and potentially being buried by meal,” he says. “I’d like to claim knowledge of how this will ultimately impact soybean prices, but it’s a transition I haven’t seen in my 35 years of watching markets.”

Flory shares three trends he’s watching:

1. A year ago, upside price momentum was building. At the beginning of December, “sideways” was the only way to define the trend in new-crop soybean futures.

2. A year ago, China was buying more soybeans as a hedge in case La Niña clipped Brazilian production. This year, China importers appear confident in Brazil’s soybean supply and are waiting for lower U.S. prices to fill demand holes.

3. A year ago, the markets were battling for acres. This year, corn’s rising input prices has the soybean market on the defensive to prevent a big-time switch to soybeans in 2022.

Here are additional 2022 outlook stories:

Drought and Demand Drive the 2022 Wheat Outlook

2022 Outlook: Why Corn’s Sweet Spot May Be Below $6 in the New Year