4 Things to Know About the Renewable Fuel Standard

The U.S. biofuel blending program—the Renewable Fuel Standard (RFS)—gets a lot of headline time in agriculture as it directly correlates with corn and soybean production. Understanding the dynamics of RFS and the role government agencies play is another ballgame.

Here are the RFS basics:

1. RFS is a Federal Program

RFS is a program that requires transportation fuel sold in the United States to contain a minimum volume of renewable fuels. The program started with the Energy Policy Act of 2005 and grew through the Energy Independence and Security Act of 2007.

2. Blending Requirements Are Based on Fuel Availability

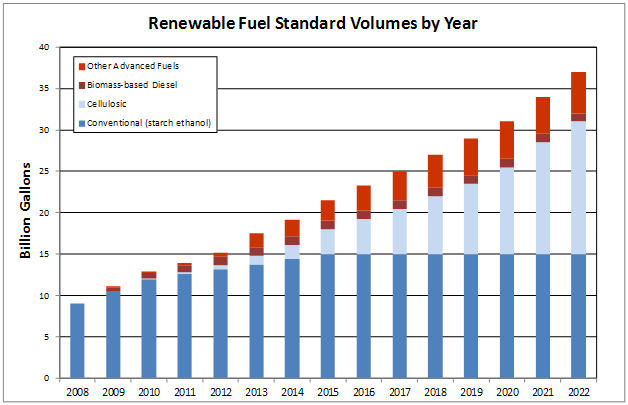

The Energy Independence and Security Act of 2007 (EISA) set yearly RFS volume requirements for each renewable fuel category. EPA sets an annual blending target that we can expect to increase yearly. For 2022, the EPA has set a target of 36 billion gallons.

3. Renewable Identification Numbers (RIN)

When a gallon of biofuel is created, it is given a RIN. The RIN is a type of credit or “currency” that stays with the gallon of fuel until it’s separated by any blender, gas station, trade shop or refiner.

Blenders, gas stations, trade shops or refiners have a Renewable Volume Obligation (RVO) to offset their gasoline or distillate, or blend components with a percentage of biofuels. They have the choice of purchasing the biofuel to blend themselves, or they can buy a credit – a RIN.

According to Jordan Fife, president of BioUrja Trading, if we are unable to blend the annual target biofuel amount set by the EPA, the RIN price increases.

“RINs are a tradable commodity. C-store chains like Casey’s, KwikTrip and RaceTrack have an advantage over refiners because they will buy gasoline and ethanol separate, then blend and sell those RINs,” Fife says. “They will increase their blends to E85, E15 or E20 to capture more of their RINs while the price of the credit—or RIN—is up.”

4. Small Refinery Exemptions (SRE)

A small refinery can be granted an exemption from its annual RVO, if it can prove that the RVO would cause economic hardship. Refiners that are given SREs do not have to buy, blend or retire RINs at the end of the year.

In December 2021, the EPA proposed to deny all SREs under the RFS program. An official determination on SREs has yet to be released.

What Does RFS Mean for Ag?

Fife says if the proposed complete denial of the SREs goes through, it will spark a positive chain of events in rural communities.

“If small refineries are completely denied, the RIN price will rise because you’ll need more blending to meet the obligation,” Fife says. “High priced RINs or fewer SREs will lead to increased production at biofuel plants, which will increase corn and soybean consumption.”

Chevron recently acquired the Renewable Energy Group (REG) while Phillips 66 opened their doors to renewable diesel. Fife says these major oil companies stepping into the renewable space is an “extremely” helpful added support to local agricultural communities that will likely continue in coming years.

Read more from AgWeb:

> Refiners Relationship with Ethanol Continues to be Faithful

> Chip Flory: Green Fuel Drives The Future Of Soybeans

> U.S. Supreme Court leaves in place limits on higher-ethanol fuel blend