Bottom Hunting

Market Watch with Austin Schroeder

January 19, 2024

Bottom Hunting

If you look at the grain charts, it looks pretty ugly. This week alone corn posted 3+ year lows and March crept to fresh life of contract lows. Nearly the same can be said about Kansas City and Minneapolis wheat, as they hit to the 2 ½ year lows. Chicago didn’t have it quite that bad, but has still be under pressure. Soybeans explored 2+ year lows as well. As we are looking down the barrel of a short crop long tail pattern, we’ve been getting a number of calls, “’Is it over?’, ‘When will it stop?’” Our main answer is to remember that we have a 2+ bbu carryout on corn, and the total South American crop is still a record. With that said, there is likely some out there hunting for a bottom. It’s likely we get something at some point, just ask the cattle guys. Remember we’re not in the same environment of the last few years. We need to have several things come together on the charts in terms of support, and just as importantly, we need fuel (a story)! As we continue to go hunting for that pesky bottom remember, don’t get greedy! Bottom pickers can get stinky fingers, as Alan always says.

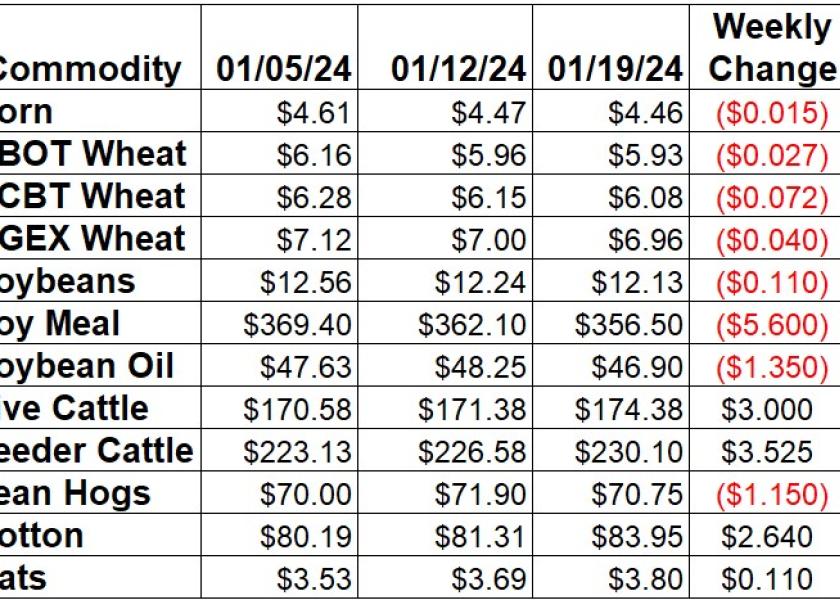

Corn explored new life of contract lows in the March contract this week and ended with a 1 ½ cent loss since last Friday. December took the week a little harder, with a drop of 5 ¾ cents. EIA data indicated ethanol production dropping back 8,000 barrels per day in the week ending on 1/12 to 1.054 million bpd. Stocks saw a massive 1.32 million barrel buildup, to 25.695 million barrels, likely due in part to logistics issues from the winter storms. Friday morning’s Export Sales report showed corn bookings expanding to a 5-week high of 1.251 MMT during week that ended on 1/11. Export commitments for corn are now 36% above last year’s total for the same week. They are also 59% of the USDA forecast, compared to the average pace of 63% for this time of year. Actual shipments are 27% of the USDA number, 2% below the average pace, but picking up recently. Friday’s Commitment of Traders report indicated managed money specs in corn futures and options adding another 29,819 contracts to their net short position during the week ending January 16. That took their net position to -260,819 contracts. Commercials held a net long position of 25,449 contracts, the largest since April 2019, as commercial longs were busy adding upside protection.

The wheat market continued its slide, as Kansas City was the bear leader this week, down 7 ¼ cents (1.18%). Chicago March futures were 2 ¾ cents lower since last Friday, a 0.46% loss. Minneapolis spring wheat had a downward move of 4 cents (0.57%). An extreme cold snap last weekend and early this week likely had little effect on much of the US winter wheat acres, as snow cover across many of those same acres helped to protect against any winter kill. The 2-week forecast is calling for above normal temps. The weekly Export Sales report tallied all wheat bookings at the second largest this marketing year of 707,632 MT. That was larger than the three weeks prior combined. That took export commitments to 82% of the USDA full year export projection, now even with the 5-year average pace. Actual shipments are running a little slower, with 51% of the USDA forecast fulfilled compared to the 59% average. The weekly Commitment of Traders report indicated spec funds in CBT wheat futures and options adding back 10,587 contracts to their net short position as of January 16. They took that to 68,575 contracts. In KC wheat, they added 4,426 contracts to their net short, at 38,652 contracts as of Tuesday.

Soybeans extended their weakness another week as March futures were 11 cents lower for a 0.9% drop. November was also down 10 ¼ cents. March soybean meal was down another $5.60 since last Friday, with soy oil back down 135 points. Tuesday’s NOPA report showed an all-time high for any month’s crush at 195.328 million bushels for December. That was 2.9% above the previous record set back in October. Soybean oil stocks increased 12.07% from last month to 1.36 billion lbs at the end of December. The delayed Export Sales report from Friday showed a 3-week high in US soybean bookings to 781,277 MT during the week that ended on January 11th. The total of shipped and unshipped sales is now 78% of USDA’s forecast total, now 1% below the 5-year average pace. Accumulated shipments are 53% of that total, 4% below the average pace. CFTC’s Commitment of Traders report tallied spec funds in soybean futures and options increasing their net short by another 45,549 contracts in the week that ended on last Tuesday. That took them to the largest net short since February 2020 at 76,797 contracts.

Live cattle remained firm and continued their slow climb back higher, as Feb was up another $3 (1.75%) this week. Cash trade this week has been in a standoff, as bids are ranging $170-172 with asks of $175 as of Friday afternoon. A few $274 sales in the beef were reported in Nebraska, even to $2 higher from the previous week. Feeders followed along with the fats, as January was up $3.52, or 1.56%. The CME Feeder Cattle Index was down a net 74 cents this week to $227.26. Friday’s Cattle on Feed report showed December placements at 1.704 million head, a 4.5% drop vs. a year ago, with marketings down 0.92% at 1.725 million head. January 1 on feed inventory was at 11.93 million head, a 2.12% increase vs. last year. Wholesale boxed beef prices extended their bounce back this week, with the Chc/Sel spread narrowing to $12.45 Choice boxes were up another $6.24 (2.2%) to $295.50, while Select was $11.20 higher (4.1%) to $283.05. Weekly beef production was up 13.2% vs. last week as transportation wasn’t as big of an issue this week. That was also 1.8% below the same week last year. Actual slaughter totals in the first few weeks of the year are down 9%, with production 6.3% lower, as carcass weights have been heavier. Weekly Export Sales showed 21,381 MT of beef booked during the week that ended on January 11th. Shipments were back up from the week prior to 15,239 MT. Spec funds in live cattle futures and options added a few more shorts in the week that ended on January 16, for a net move of 777 contracts and taking the long down 12,993 contracts as of Tuesday.

Hogs slipped back lower after hitting some resistance on the charts, as Feb was down $1.15, or 1.6%. The CME Lean Hog Index was $1.10 higher this week to $67.87. USDA’s Pork Carcass Cutout was up $2.48 this week (2.9%) this week to $88.56. The belly (14.9%), loin (3.5%), and butt (1.88%) were the drivers to the upside. Weekly pork production was 22.4% higher vs. the week due to transportation issues the previous week, but down 5.6% vs. a year ago. Slaughter for the first few weeks of the year has been down 5%, with the 5.6% drop in production indicating lighter weights. USDA’s weekly Export Sales report showed pork export bookings totaling 33,428 MT in the week that ended on January 11. Actual export shipments were 28 tallied at 31,378 MT. Weekly CFTC data showed money managers in lean hog futures and options trimming their net short position by 4,782 contracts to -1,807 contracts as of last Tuesday.

Cotton futures were in rally mode this week as March was up 2.64 cents, for a 3.25% jump from last Friday. Export Sales data was a big reason for the strong Friday action, as sales were the second largest this marketing year at 420,047 running bales during the week that ended on January 11th. China came back in for 227,708 RB. Shipments also ballooned to a MY high of 257,695 RB. Cotton export sales commitments for 23/24 are now 9.306 million RB, which is 82% of USDA’s current cotton export forecast matching the 81% average pace for this point in the MY. Shipments thus far in the marketing year are ahead of pace at 33% of the USDA forecast vs. the 32% average. The FSA raised the Average World Price for cotton by 119 points on Thursday, to 65.47 cents/lb. Friday’s Commitment of Traders report showed spec funds cutting 4,856 contracts from their new net short position now at 2,016 contracts in cotton as of the week ending on January 16.

Market Watch

We will start out next week with traders reacting to Friday afternoon’s Cattle on Feed report, followed by USDA’s release of the Export Inspections report on Monday morning. Fast forward to Wednesday, and EIA will put out their weekly petroleum report showing ethanol stocks and production. NASS will also release their monthly Cold Storage report on Wednesday afternoon. On Thursday, USDA’s weekly Export Sales report will get back to its normal schedule. January Feeder Cattle futures and options will expire on Thursday. February serial grain options will expire on Friday.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2024 Brugler Marketing & Management, LLC. All rights reserved.