Groundhog Day

Market Watch with Austin Schroeder

February 2, 2024

Groundhog Day

I was reminded by my son on the way home from school yesterday afternoon that, “Dad, tomorrow is Groundhog Day!” How a 4-year old knows when the annual hype-up of Punxsutawney Phill takes place is beyond me. However, it brought back to me the movie Groundhog Day. If you’ve ever watched it, you may know where I’m headed with this. A weatherman played by Bill Murray heads to cover the annual event in Pennsylvania and suddenly has to relive February 2 repeatedly Suddenly as we look at the grain markets, the last couple weeks feels like the plot to the movie. We have seen early week strength, with corn and beans looking to get out of their funk, only to be faced with sell pressure late in the week. Wheat can’t seem to break out of the sideways pattern, only seemingly going through the motions on a day-to-day basis. The few exciting (bullish) moves come from the livestock market, with both cattle and hogs continuing their trend higher. As you know, similar to the movie, we will eventually break out of the same patterns and change direction. Somebody just needs to cry uncle first.

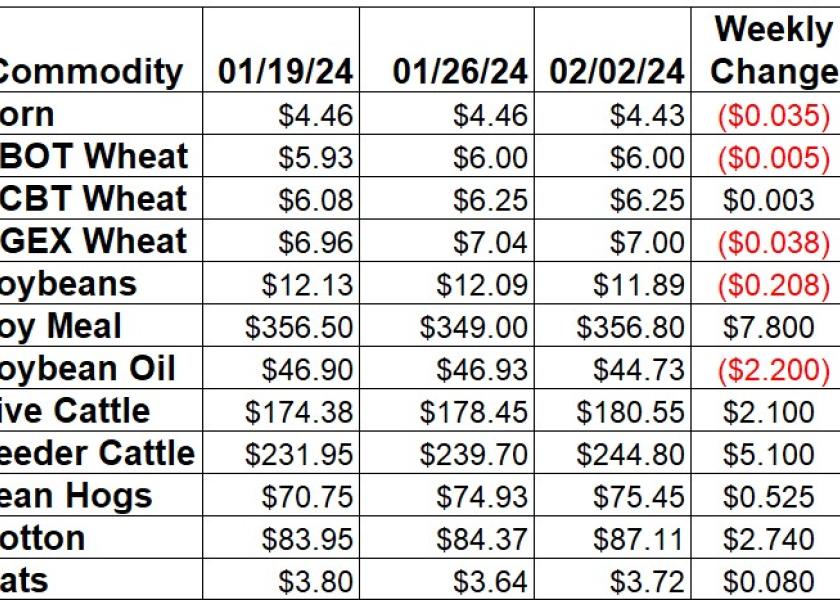

Corn again suppressed an early week rally attempt this week, as March was down 3 ½ cents since last Friday. December was actually up ½ cent on the week. The weekly EIA report showed a rebound in ethanol production, up 173,000 barrels per day to 991,000 bps in the week ending on 1/26. Stocks saw a massive 1.545 million barrel draw to 24.27 million barrels with a bulk of the drop in the Gulf and West Coast, implying a large export pull. Monthly data from the USDA Grain Crushing report showed December with a 481.7 million bushel corn grind total, a 6-year high for the month, and the largest monthly total since August 2018. Thursday morning’s Export Sales report showed corn bookings improving to 1.2 MMT during the week that ended on 1/25. Shipped and unshipped export commitments for corn are now 63% of the USDA forecast, compared to the average pace of 70% for this time of year. Actual shipments are 31% of the USDA number, only 1% below the average pace. Friday’s Commitment of Traders report indicated money managers were still adding to their bearish bet in corn futures and options by another 14,866 contracts during the week ending January 30. That took their net position to -280,151 contracts. Commercials held a net long position of 18,000 contracts, a small 8,054 contract reduction on the week.

The wheat market was mixed around in the three exchanges this week. Kansas City was the lone market to gain any ground, up just a tick. Chicago was down 2 ticks for just a ½ cent drop on the week. Minneapolis spring wheat slipped 3 ¾ cents lower since last Friday. The quarterly Flour Milling report from USDA showed October-December with a total of 226.1 million bushel of wheat ground for flour in the US. That was a 3.3 mbu reduction from the same period last year. Weekly Export Sales data had all wheat bookings slipping to a 3-week low of 322,516 MT, which is still a decent pace for this time of year. That took export commitments to 86% of the USDA full year export projection, even with the 5-year average pace and 4% larger than the same point last year. Actual shipments are running a little slower, with 54% of the USDA forecast fulfilled compared to the 62% average. That implies a backloaded second half of shipments. The weekly Commitment of Traders report tallied spec funds in CBT wheat futures and options adding just 277 contracts to their net short position as of January 30. They took that to 64,818 contracts. In KC wheat, they cut 4,985 contracts from their net short, to 33,355 contracts as of Tuesday.

Soybeans again had a good start out of the blocks but faltered after the Export Sales release. March was down a total of 20 3/4 cents for a 1.72% loss. November lost 14 cents for the week. Soybean meal found some solid footing, after holding at the March contract low, to post a $7.80 gain. Soy oil shed 220 points. Export Sales data was abysmal, showing soybean bookings for the week of January 25 at just 164,000 MT as Brazil FOB prices are currently undercutting US offers. Export sale commitments for soybeans are now 80% of USDA’s forecast total, 1% below the 5-year average pace. Accumulated shipments are 57% of that total, below the average pace of 62%. The monthly Fats & Oils report from Thursday was positive, but mostly expected following the NOPA release from a few weeks earlier. US crushers consumed a total of 204.3 mbu of soybeans during December, an all-time record for any month. Friday afternoon’s Commitment of Traders report found spec funds pushing their net short in soybean futures and options another 16,405 contracts in the week that ended last Tuesday. That took them to the largest net short since December 2019 at 108,247 contracts. Commercials flipped to a net long of 21,338 contracts, their first net long position in beans since June 2019.

Live cattle continued their charge back higher, as February was up $2.10 for a 1.18% move. Packers were again paying up for cattle this week, as trade was centered around a range of $177-179 and up $2 from the week prior. Feeders were the leaders this week, as they posted a $5.10 rally since last Friday, a 2.13% move. The CME Feeder Cattle Index was up a sharp $8.49/cwt this week to $239.17. The semi-annual Cattle Inventory report was released from NASS on Wednesday, showing all cattle and calves down 1.9% from last year at 87.157 million head. The beef cow herd was down 2.5% at 28.223 million head, with the number of beef replacement heifers showing no sign of retention, down 1.45% from last year’s revised lower total at 4.86 million head. The total of feeder cattle outside of feedlots was estimated at 24.22 million head, a 4.2% drop from last year and tightest since at least 1996. Wholesale boxed beef quotes were back lower this week, with the Chc/Sel spread down to $9.61. Choice boxes were down $7.45 (2.5%) to $293.08.53, while Select was $5.66 lower (2%) to $283.47. Weekly beef production was back up 2.7% vs. last week and 1.9% above the same week last year. Actual slaughter totals in the first few weeks of the year are down 6.8%, with production 4.8% lower, as carcass weights have been heavier. The cold weather and muddy pens have backed off weights from the early Jan records. Spec funds in live cattle futures and options added another 10,158 contracts to their net long, rebuilding the net long position to 27,171 contracts as of Tuesday.

Hogs rooted their way higher this week, as February was up $0.525 since last Friday for a 0.7% move. The CME Lean Hog Index was another $3.04 higher this week at $72.71. USDA’s Pork Carcass Cutout was down $1.11 this week (1.2%) this week to $88.40. The belly (-0.7%), picnic (-5.9%), butt (-3.7%) and loin (-1.7%) were the drivers to the downside. Weekly pork production was up 4.5% compared to last week but was 1.4% smaller vs. a year ago. Slaughter for the first few weeks of the year has been down 1.4%, with a similar 1.4% drop in production. USDA’s weekly Export Sales report showed pork export bookings totaling 42,941 MT in the week that ended on January 25, the largest weekly total since November. Actual export shipments were tallied at 30,070 MT, an improvement from the previous week. Weekly CFTC data showed spec traders in lean hog futures and options putting on their largest bullish move in one week on record, adding 22,553 contracts to their new net long position as of 1/30. That took their net long to 25,036 contracts as of Tuesday.

Cotton futures saw promising bull action this week as nearby March was a total of 3.25% higher, for a 2.74 cent gain. That was the highest weekly close on the nearby continuation since September. Export Sales data was part of the reason, with bookings totaling 349,365 RB, the 5th largest this marketing year. Shipments were a MY high and the largest since April at 396,711 RB during the week that ended on January 25. Cotton export sales commitments for 23/24 are now 9.862 million RB, which is now 87% of USDA’s current cotton export forecast matching the 86% average pace for this point in the MY. Shipments thus far in the marketing year are 3% ahead of pace at 38% of the USDA forecast. The FSA raised the Average World Price for cotton by 40 points on Thursday, to 68.04 cents/lb. This week’s Commitment of Traders report revealed managed money spec funds increasing their net long in cotton futures and options by a total of 4,145 contracts, with a net long position of 28,647 contracts as of 1/30.

Market Watch

Next week starts out with the weekly release of the Export Inspections report on Monday morning. Monday is first notice day for February live cattle. On Wednesday, EIA will put out their weekly petroleum report showing ethanol stocks and production. We will also get December trade data from Census on Wednesday. Weekly Export Sales data will be released on Thursday morning. Later that morning, we will get the monthly WASDE, Cotton Ginnings, and Crop Production reports from USDA. March cotton options will expire on Friday.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2024 Brugler Marketing & Management, LLC. All rights reserved.