Kick In the Shorts

Market Watch with Austin Schroeder

January 26, 2024

Kick In the Shorts

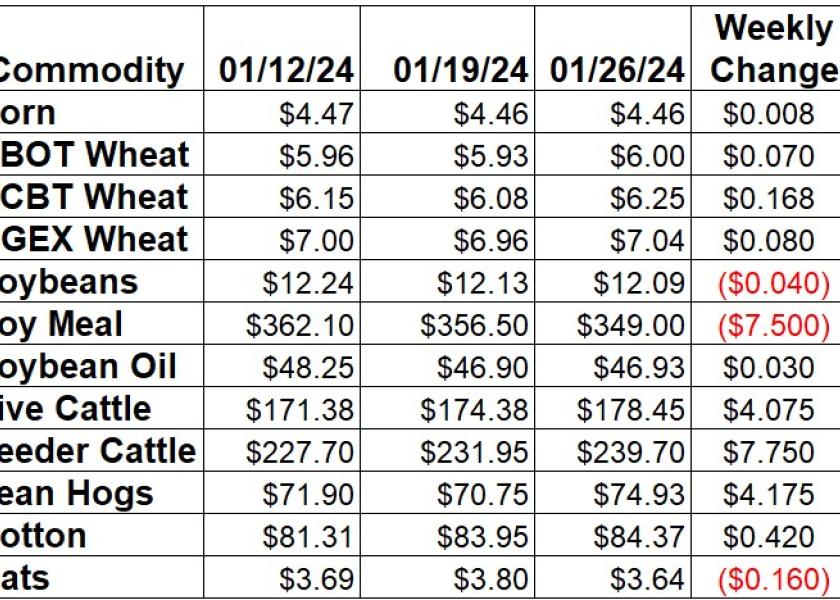

The theme of last week's MarketWatch column was hunting for a bottom. Based off this week's price action in the ags, it looks as though the bulls may have attempted to shoot at something that resembles a bottom. The wheat market got the bulls the most excited, though it was no Boone & Crockett trophy. That spot was reserved for the livestock contracts. The corn, and soybean action was disappointing for would be bulls. Corn and cotton, while up vs. last Friday, still managed to let most of the early week gains go for naught. Soybeans gave back all the first half of the week gains in the last two days to close with a 4 cent loss wk/wk, dragged down by the soy meal. For some of the grains, even though we didn’t sustain the rally, we held the lows from the week prior. As I’ve heard several times in my life, “better than a kick in the shorts!” As for new crop beans posting a new low for the move, a kick in the shorts may have been more welcomed.

Corn tried to bounce this week but faced some late week pressure, with March closing just ¾ cent higher since last Friday. December was up just a tick in that same timeframe. EIA data showed a massive 236,000 barrel drop in ethanol production during the week ending on 1/19 to 818,000 bpd as frigid temps had an impact on operations. Stocks saw a 120,000 barrel increase, to 25.815 million barrels. The weekly Export Sales report indicated corn bookings slipping to 954,796 MT during the week that ended on 1/18. Shipped and unshipped export commitments for corn are now 35% above last year’s total for the same week. They are also 61% of the USDA forecast, compared to the average pace of 65% for this time of year. Actual shipments are 29% of the USDA number, now just 1% below the average pace. The weekly Commitment of Traders data release showed money managers in corn futures and options adding another 4,743 contracts to their net short position during the week ending January 23. That took their net position to -265,285 contracts. Commercials held a net long position of 26,054 contracts, the largest since April 2019, as commercial longs continue to add coverage on the three year low in prices, but elevators aren’t getting much grain from producers.

The wheat market was the bull of the grain market this week as all three exchanges were higher. Kansas City was the leader with 16 ¾ cent gains (2.75%). Chicago futures were 7 cents higher since last Friday, a 1.18% gain. Minneapolis spring wheat saw an 8 cent gain, a 1.15% move. Export Sales data had all wheat bookings totaling the 7th largest weekly total this marketing year at 451,368 MT. That took export commitments to 84% of the USDA full year export projection, now 1% back of the 5-year average pace and 3% larger than the same point last year. Actual shipments are running a little slower, with 53% of the USDA forecast fulfilled compared to the 60% average. Friday’s Commitment of Traders report showed spec funds in CBT wheat futures and options trimming 4,034 contracts from their net short position as of January 23. They took that to 64,541 contracts. In KC wheat, they cut just 312 contracts from their net short, at 38,340 contracts as of Tuesday.

Soybeans couldn’t hold the early gains this week, as March was down 4 cents for a 0.33% loss. November slipped 6 ¼ cents. March soybean meal was a pressuring factor, with a $7.5/ton loss. Soy oil was just 3 points higher. Thursday morning’s Export Sales report from USDA tallied soybean bookings down from last week, but higher than the holiday weeks prior, at 560,869 MT during the week that ended on January 11th. Export sale commitments for soybeans are now 79% of USDA’s forecast total, 1% below the 5-year average pace. Accumulated shipments are 55% of that total, below the average pace of 60%. CFTC’s Commitment of Traders report revealed spec funds in soybean futures and options increasing their net short by another 15,045 contracts in the week that ended Tuesday. That took them to the largest net short since February 2020 at 91,842 contracts. Commercials held a net short position of just 1,556 contracts.

Live cattle hopped back on the rally train this week, with Feb chugging right along up $4.07. Packers were paying up for cattle this week, as trade was centered around $175 in the South, with $175-177 action reported in the North. Feeders posted a $7.75 rally on the week, a 3.34% move. The CME Feeder Cattle Index was up a total of $3.42/cwt this week to $230.68. Wholesale boxed beef prices extended their bounce again this week, with the Chc/Sel spread narrowing to $11.40. Choice boxes were up another $5.03 (1.7%) to $300.53, while Select was $6.08 higher (2.1%) to $289.13. This was the first time Choice boxes were above $300 since early November. Weekly beef production was down just 0.3% vs. last week and 3% below the same week last year. Actual slaughter totals in the first few weeks of the year are down 8.1%, with production 5.8% lower, as carcass weights have been heavier. Cold Storage data from NASS showed December 31 beef stocks at 485.13 million lbs. That was down 10.81% vs. last year but a 6.06% rise from November. Weekly Export Sales showed 22,363 MT of beef booked during the week that ended on January 18th, the largest weekly total since last February. Shipments were back up from the week prior to 16,249 MT. Spec funds in live cattle futures and options added 4,174 contracts to their net long mainly on short covering, taking the net position to 17,167 contracts as of Tuesday.

Hogs put it in some rally time this week, as February was up $4.17 since last Friday. The CME Lean Hog Index was another $1.80 higher this week at $69.67. USDA’s Pork Carcass Cutout was up 95 cents this week (1.1%) this week to $89.51. The belly (8.7%), picnic (1.5%), and rib (3.6%) were the drivers to the upside. Weekly pork production was up 3.7% compared to last week and was 7.1% larger vs. a year ago. Slaughter for the first few weeks of the year has been down 2.3%, with the 2.5% drop in production indicating lighter weights. The NASS Cold Storage report showed 427.3 million lbs of pork in coolers on December 31. That was a 6.37% decline from last year but 2.8% larger than November. USDA’s weekly Export Sales report showed pork export bookings totaling 24,127 MT in the week that ended on January 18, the lowest weekly total since early October. Actual export shipments were tallied at 28,443 MT. Weekly CFTC data showed spec traders in lean hog futures and options flipping back to a net long position of 2,483 contracts as of 1/23 a flip of 4,290 contracts for the week ending on Tuesday.

Cotton futures got an early jump to the week, with strength in the first half being offset by Friday weakness for a 42 point gain. Export Sales slipped back from the previous week’s strong total to 207,044 RB, a 3-week low. Shipments backed off of last week’s MY high to 162,249 RB during the week that ended on January 18. Cotton export sales commitments for 23/24 are now 9.513 million RB, which is now 84% of USDA’s current cotton export forecast matching the 84% average pace for this point in the MY. Shipments thus far in the marketing year are on pace at 34% of the USDA forecast. Cotton Ginnings data from NASS was released early in the week, showing 371,100 RB ginned in the first half of January. That brought the marketing year total to 11.558 million RB. The FSA raised the Average World Price for cotton by 217 points on Thursday, to 67.64 cents/lb. The Friday Commitment of Traders report showed spec funds cutting flipping to a net long by a total of 26,518 contracts, with a net long position of 24,502 contracts as of 1/23. That was the single largest weekly bull move on record.

Market Watch

Next week starts out with the weekly release of the Export Inspections report on Monday morning. The Fed meets next Tuesday and Wednesday, with no interest rate move expected this month. Also on Wednesday, EIA will put out their weekly petroleum report showing ethanol stocks and production. NASS will also release their biannual Cattle Inventory report on Wednesday afternoon. On Thursday, USDA’s weekly Export Sales report be released in the morning. That afternoon, domestic consumption data will be released for December in the Grain Crushing, Fats & Oils, and Cotton Systems reports. February live cattle options will expire on Friday.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2024 Brugler Marketing & Management, LLC. All rights reserved.