More of the Same

Market Watch with Austin Schroeder

February 9, 2024

More of the Same

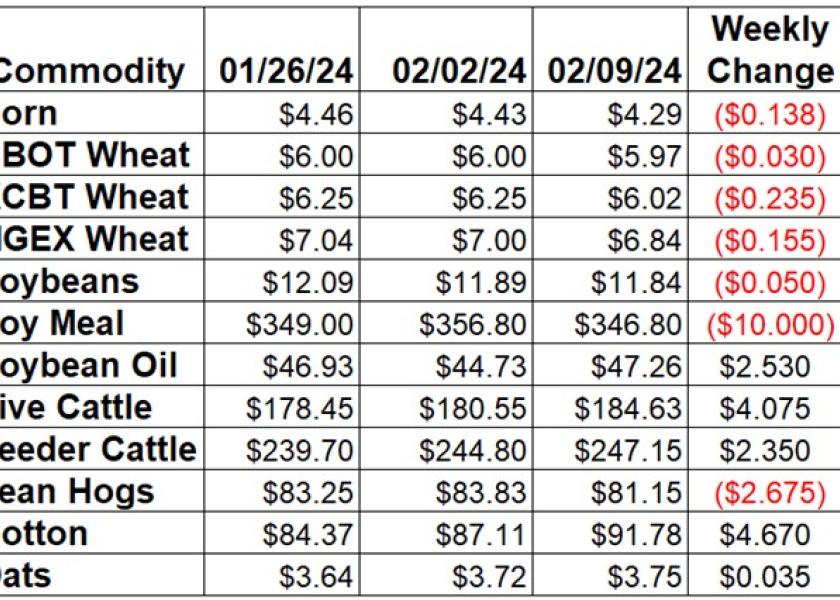

Last week’s theme covered Groundhogs Day and how the plot of the movie was playing a similar role in the markets having a repetitive nature over the past couple weeks. In terms of an overall market standpoint, we saw more of the same this week (Groundhogs Day #2?). The grains just can’t seem to find any footing, no matter how ‘cheap’ we get. Of course, the definition of cheap is relative when the South American are selling beans at a $1-2 discount. USDA was not helpful with some less than bullish US balance sheet adjustments and not near as bullish of South American numbers. On the livestock side, we saw continued strength in cattle as they work to erase last fall’s collapse. The cotton market is working out the tighter balance sheet by rationing demand via higher prices.

Corn continued their selling streak this week, as nearby March was down 3.11% since last Friday for a 13 ¾ cent loss. December was down 8 ½ cents on the weekly move. The monthly WASDE update to the US and world balance sheets showed US carryout up 10 mbu to 2.172 bbu on a cut to FSI use. On the world side, though, Brazilian production was trimmed by 3 MMT to 124 MMT. That was not as drastic as the CONAB adjustment, which had a 3.9 MMT drop to 113.7 MMT. The weekly EIA report showed ethanol production up another 42,000 barrels per day to 1.033 bpd in the week ending on 2/2. Stocks saw a 509,000 barrel build up to 24.779 million barrels. The weekly Export Sales data indicated a 3-week high in corn bookings at 1.22 MMT during the week that ended on February 1. Shipped and unshipped export commitments for corn are now 65% of the USDA forecast, compared to the average pace of 72% for this time of year. Actual shipments are 32% of the USDA number, only 1% below the average pace. CFTC Commitment of Traders data showed managed money adding another 17,593 contracts to their bearish bet in corn futures and options during the week of February 6. That took their net position to -297,744 contracts.

The wheat market was lower across the three exchanges this week. Kansas City slipped back lower with a 23 ½ cent loss or -3.76% move. Chicago extended the selling streak but eased things this week with a 3 cent loss. Minneapolis spring wheat was 15 ½ cents lower since last Friday. USDA’s update to the S&D tables had a 10 mbu increase for the US, with a reduction to food use, as stocks for the end of May are now projected at 658 mbu. Weekly Export Sales rebounded from last week to 378,399 MT. That took export commitments to 88% of the USDA full year export projection, now 1% above the 5-year average pace and 6% larger than the same point last year. Actual shipments are running a little slower, with 56% of the USDA forecast fulfilled compared to the 63% average. The weekly Commitment of Traders report tallied spec traders in CBT wheat futures and options adding just 1,920 contracts to their net short position as of 2/6. They took that to 66,738 contracts. In KC wheat, they added back 42 contracts to their net short, at 33,397 contracts as of Tuesday.

Soybeans couldn’t hold the heading into the Friday session, with the March contract down 5 cents on the week. November slipped 7 ¼ cents lower for the week. Soybean meal was a driver to the downside, with losses of $10/ton to explore new contract lows. Soy oil got back all of the previous week’s losses, with a gain of 253 points. Thursday’s monthly WASDE release showed less than friendly news for the bulls, as USDA slashed 35 mbu from the US export projection to 1.72 bbu. That increased the estimated carryout for Sep 1 by the same amount to 315 mbu. For the world, WAOB trimmed the Brazilian production for 23/24 by just 1 MMT to 156, while back adjusting 22/23 production 2 MMT higher. CONAB was friendlier with a 5.9 MMT reduction to 149.4 MMT and joining several private estimates below the 150 MMT mark. This week’s Export Sales report saw soybean bookings up slightly from the week prior at 340,788 MT for the week of February 1. Brazil FOB prices are sharply undercutting US offers. Export sale commitments for soybeans are now 82% of USDA’s new forecast total, 1% below the 5-year average pace. Accumulated shipments are 62% of that total, below the average pace of 65%. This week’s Commitment of Traders report showed spec funds pushing their net short in soybean futures and options another 22,053 contracts in the week that ended last Tuesday. That took them to the largest net short since May 2019 at 130,300 contracts. Commercials increased their new net long to 38,792 contracts, their largest net long position in beans since May 2019.

Live cattle continued their charge back to the all-time high posted last fall, as February was up $4.075 for a 2.26% move. Cash trade is trying to keep up with Friday after a standoff, with late Friday action at $182. Feeders were the followers this week, as they posted a $2.35 rally since last Friday, a 0.96% move. The CME Feeder Cattle Index was up another $2.94/cwt this week to $242.11. Wholesale boxed beef quotes were back higher this week, with the Chc/Sel spread down to $8.96. Choice boxes were up $0.96 (0.3%) to $294.04, while Select was $1.61 higher (0.6%) to $285.08. Weekly beef production was back down 3.2% vs. last week but 0.6% above the same week last year. Actual slaughter totals in the first several weeks of the year are down 5.9%, with production 4.3% lower. The cold weather and muddy pens have backed off weights from the early Jan records. Weekly Export Sales data showed 20,631 MT of beef sold for export in the week of 2/1. Shipments were 16,090 MT. Census tallied December beef exports at 252.3 million lbs. Spec funds in live cattle futures and options added another 8,917 contracts to their net long position, taking it to 36,088 contracts as of Tuesday.

Hogs slipped back lower this week, trying to hold at some technical support by week-end, with April down $2.675 (-3.19%). The CME Lean Hog Index was another $1.29 higher this week at $74.00. USDA’s Pork Carcass Cutout was down $2.43 this week (2.7%) this week to $88.40. The belly (-16.2%), and loin (-1.0%) were the drivers to the downside, with all other cuts higher. Weekly pork production was down 2.8% compared to last week but was 6.7% larger vs. a year ago. Slaughter for the first few weeks of the year has been down 0.2%, with a 0.1% drop in production. USDA’s weekly Export Sales report showed pork export bookings slipping below the previous week at 39,220 MT in the week that ended on Feb 1. Actual export shipments were the largest since May 2021 at 41,768 MT. December pork exports were the second largest all time for the month at 643.8 million lbs according to Census. Weekly CFTC data showed spec traders in lean hog futures and options extending their bullish move in the week of 2/6, adding 6,611 contracts to their new net long position. That took their net long to 31,647 contracts as of Tuesday.

Cotton futures rallied to their highest levels since October 2022, with March up 467 points (5.36%) on the week. The monthly USDA update to the balance sheets showed increased exports of 200,000 bales to 12.3 million, with the US use dropping 150,000 bales. That along with other adjustments took the ending stocks projection to 2.8 MMT. US Export Sales data tallied bookings of 284,057 RB for cotton in the week of 2/1, slightly lower vs. the week prior. Shipments backed off from the previous week’s MY high to 245,512 RB during that week. Cotton export sales commitments for 23/24 are now 10.146 million RB, which is now 89% of USDA’s current cotton export forecast matching the 87% average pace for this point in the MY. Shipments thus far in the marketing year are 1% ahead of pace at 39% of the USDA forecast. The FSA raised the Average World Price for cotton by 2 cents on Thursday, to 70.04 cents/lb. This week’s Commitment of Traders report revealed managed money spec funds piling on their net long in cotton futures and options by an additional 17,697 contracts, taking that net long position to 46,344 contracts as of Tuesday.

Market Watch

Next week starts out with the weekly release of the Export Inspections report on Monday morning. The Bureau of Labor and Statistics will give us CPI data on Tuesday, with PPI data released on Friday. On Wednesday, EIA will release their weekly petroleum report showing ethanol stocks and production. The midweek session is also the last trade day for February Lean Hogs futures and options. Weekly Export Sales data will be released on Thursday morning. Later that morning, we will get the monthly NOPA report showing January crush data.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2024 Brugler Marketing & Management, LLC. All rights reserved.