Newton’s First Low

Market Watch with Austin Schroeder

February 16, 2024

Newton’s First Low

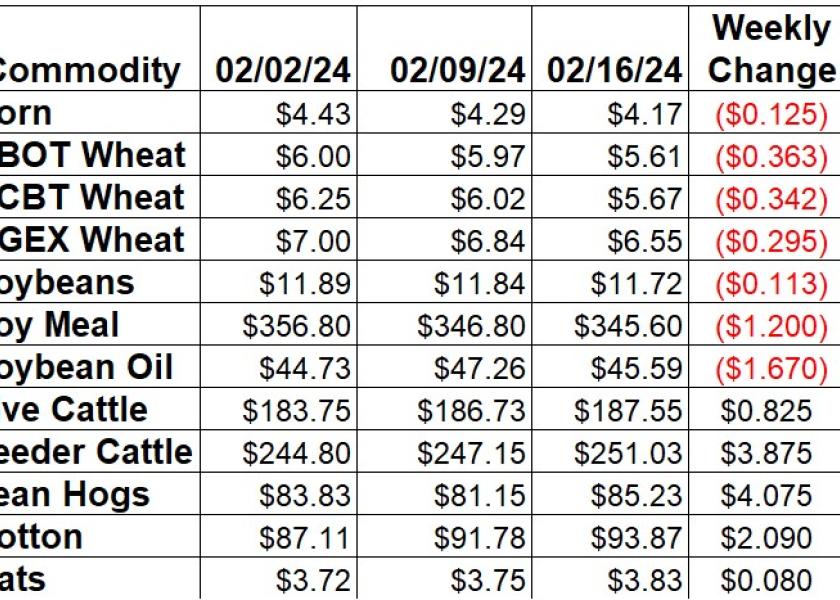

Over the past several weeks we have seen a repetitive market across the ags, with the grains continuing the slide lower, and cattle/cotton continuing the rally higher. That brought the themes of ‘Groundhog’s Day’ and ‘More of the Same’ from the last 2 Market Watch columns. I could hit the copy/paste button for this week, but that’s not very creative. So, for this week, we’re going with Newton’s First Low (typo intended) of Motion: an object in motion remains in motion unless acted upon by a force. Well, we have not seen an opposite force acting upon this market, as the trend has continued for another week. For the grains, gravity continues to win, with the livestock and cotton seemingly defying gravity.

Corn is getting closer to the round number of $4, as March was another 12 ½ cents lower this week to $4.17. December was down another 9 ½ cents on the weekly move. The weekly EIA report showed ethanol production up another 50,000 barrels per day to 1.083 bpd in the week ending on 2/9. Stocks saw a 1.031 million barrel build up to 24.779 million barrels. The weekly Export Sales data had booking extending to a 4-week high in corn bookings at 1.31 MMT during the week that ended on February 8. Shipped and unshipped export commitments for corn are now 68% of the USDA forecast, compared to the average pace of 73% for this time of year. Actual shipments are 34% of the USDA number, only 1% below the average pace. Commitment of Traders data from Friday afternoon showed the large spec funds holding their second largest net short position on record as of February 13. That was a 16,597 contract addition during that week, as they took the position to net short 314,341 contracts. Commercials added another 16,736 contracts to their net long, at 40,206 contracts by Tuesday. That came from a fairly even split of increased longs and fewer shorts.

The wheat market was in full on collapse mode across all three exchanges this week. Kansas City slipped back lower with a 34 ¼ cent loss or -5.69% move. Chicago extended the selling streak with a drop of 36 ¼ cents (6.07%). Minneapolis spring wheat was down 29 ½ cents since last Friday. Weekly Export Sales slipped slightly from the previous week to 349,300 MT. That took export commitments to 90% of the USDA full year export projection, now 2% above the 5-year average pace and 6% larger than the same point last year. Actual shipments are running a little slower, with 58% of the USDA forecast fulfilled compared to the 63% average. Friday’s Commitment of Traders report showed spec traders in CBT wheat futures and options cutting 11,066 contracts from their net short position as of 2/13. They took that net short to 55,672 contracts, the smallest it has been since August. In KC wheat, they added back 3,011 contracts to their net short, at 36,408 contracts as of Tuesday.

Soybeans losses were limited this week with help from a higher Friday move, as March was down 11 ¼ cents, or 0.95%. November lost 15 ¼ cents on the week. Soybean meal losses were not as bad this week, but March still lost $1.20. Soy oil gave back most of the previous week’s gains, with a loss of 167 points. NOPA’s monthly crush update showed a January record 185.78 million bushels of soybeans crushed during the month. That was a 3.78% increase compared to the previous week but down 4.89%. Stocks were up 10.78% from December, with January 31 stocks at 1.5 billion lbs. This week’s Export Sales report saw soybean bookings up slightly from the week prior at just 353,800 MT for the week of February 8. Brazil FOB prices are still sharply undercutting US offers. Export sale commitments for soybeans are now 83% of USDA’s new forecast total, 1% below the 5-year average pace. Accumulated shipments are 65% of that total, below the average pace of 66%. This week’s Commitment of Traders report showed spec funds slightly increasing their net short in soybean futures and options another 4,200 contracts in the week that ended last Tuesday. That took them to the 5th largest net short all time at 134,500 contracts.

Live cattle were higher again this week, despite an early week pullback, as April was up 82 cents. Cash trade pulled back from last week’s strength, with the South mostly at $180 and a few at $181. The North saw action at $180-182. That would be down from the $182 last week. Feeders were the leaders this week, as they posted a $3.87 rally since last Friday, a 1.57% move. The CME Feeder Cattle Index was up another $2.47/cwt this week to $244.58. Wholesale boxed beef quotes were higher this week, with the Chc/Sel spread at $9.54. Choice boxes were up $2.16 (0.7%) to $296.20, while Select was $1.58 higher (0.6%) to $286.66. Weekly beef production was down 2.5% vs. last week and 1.5% below the same week last year. Actual slaughter totals in the first several weeks of the year are down 5.6%, with production 4.2% lower. Weekly Export Sales data showed 16,600 MT of beef sold for export in the week of 2/8. Shipments were 16,400 MT. Spec funds in live cattle futures and options added another 6,384 contracts to their net long position as they continue to build back from last fall’s liquidation. They took the net position to 42,472 contracts as of Tuesday.

Hogs were in full-fledged rally mode, with April up $4.07 (5.02%) on the week. The CME Lean Hog Index was another $1.12 higher this week at $75.12. USDA’s Pork Carcass Cutout was back up $4.60 this week (5.4%) this week to $90.57. The belly (11.4%), ham (7.5%) and rib (5%) were the drivers to the upside, with the rest of the cuts slightly higher. Weekly pork production was down 2.5% compared to last week but was 3.2% larger vs. a year ago. Slaughter for the first few weeks of the year is now up 0.3%, with a 0.3% increase in production. USDA’s weekly Export Sales report showed a massive pork export book for the week of 2/8 at 71,900 MT. Actual export shipments were the largest since October 2019 at 75,900 MT. Weekly CFTC data showed spec traders in lean hog futures and options taking net long 2,144 contracts higher to the largest since last September. The net position stook at 33,791 contracts as of Tuesday.

Cotton futures continued their ascent as March rallied another 209 points (2.28%) on the week. US Export Sales were 160,500 RB for cotton in the week of 2/8. That was 29% lower vs. the week prior, though sales are still running at a solid pace. Cotton export sales commitments for 23/24 are now 10.307 million RB, which is now 89% of USDA’s current cotton export forecast matching the 89% average pace for this point in the MY. Shipments backed off from the previous week’s MY high to 276,100 RB during that week, taking the MY total to 42% of the USDA forecast, 3% ahead of normal. The FSA raised the Average World Price for cotton by 3.4 cents on Thursday, to 73.44 cents/lb. This week’s Commitment of Traders report revealed managed money spec funds piling on another 25,215 contracts to their net long in cotton futures and options, the second largest weekly bull move on record, behind the move from 3 weeks prior. They took that net position to 71,559 contracts as of February 13.

Market Watch

We start next week a day late, with the market and government closed on Monday in observation of President’s Day. The weekly Export Inspections data will be released on Tuesday. Skip ahead to Thursday and EIA will release weekly ethanol stocks and production data. On Friday, we will get the weekly Export Sales report in the morning, with the NASS Cold Storage and Cattle on Feed reports that afternoon. Friday is also the expiration day for the March grain options.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2024 Brugler Marketing & Management, LLC. All rights reserved.