Rocky Start

Market Watch with Austin Schroeder

January 12, 2024

Rocky Start

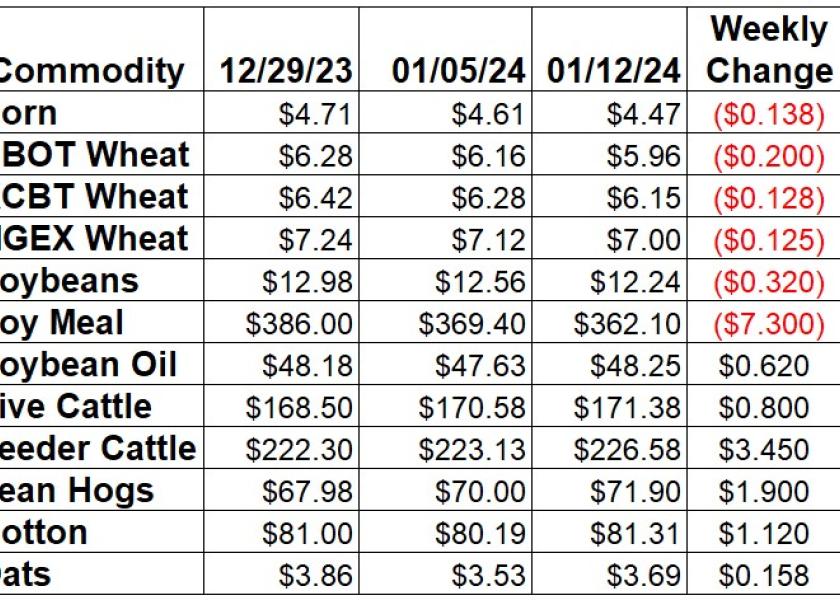

Grains have not had the best start in the first 12 days of 2024. Between corn, beans, and the three wheat exchanges, the front months are down anywhere from 3.4% to 5.5%, led by the beans. That was exacerbated by the USDA on Friday releasing some less than bull friendly US yield numbers. To say the grains have been off to a rocky start is nothing short of accurate. Of course, that will happen when high prices from the last few years have incentivized expanding acreage here in the US and abroad. Just as low prices cure low prices, high prices can cure high prices. As we get further into 2024, just remember that prices don’t always go down. They are mean reverting, which means they will go back to average. In the long run that might be bearish, but in the short run, they just need a little help from not bearish numbers to generate a bounce! With that said, they may spend more days than not leaking lower as we creep further into that long tail part of the short crop, long tail pattern.

Corn sank to new contract lows this week amid pressure from Friday’s USDA data. March was down a total of 13 ¾ cents since last Friday for a -2.98% move, while new crop December lost 12 ¼ cents. NASS raised the US corn yield by 2.4 bpa to a new record 177.3. Harvested acreage was trimmed by more than 563,000 acres to moderate the production increase, but it was still raised by 108 mbu to 15.342. That took the projected US carryout 31 mbu higher to 2.162 bbu, while the world ending stocks figure was up a huge 10 million tonnes to 325.22 MMT on a surprisingly large Chinese increase. EIA showed ethanol production back up 13,000 barrels per day in the week ending on 1/5 to 1.062 million bpd, while stocks rose 792,000 barrels to 24.371 million. Weekly Export Sales rose slightly from last week’s MY low of 487,609 MT during week that ended on 1/4, but were still down due to the holiday disrupted week. Export commitments for corn are now 57% of the USDA forecast, compared to the average pace of 62% for this time of year. The weekly Commitment of Traders report showed the managed money specs in corn futures and options adding another 33,397 contracts to their net short position in the week ending January 9. That took their net position to -230,723 contracts as of Tuesday, the largest since March 2020 in the depths of COVID.

The wheat market extended last week’s weakness, with Chicago back in the $5 range and down 3.25% on the week for a 20 cent loss. Kansas City was down another 12 ¾ cents for a 2.03% loss. MPLS spring wheat futures slipped below the $7 mark, as March was down 1.76% or 12 ½ cents. Friday’s USDA reports showed all wheat stocks on December 1 at 1.41 billion bushels, a 19 mbu increase vs. the average trade guess. The WASDE ending stock projection was trimmed by 11 mbu to 648 mbu. However, on the world side of things carryout was up 1.8 MMT to 260.03 MMT. The Winter Wheat Seedings report showed 2024 acreage at 34.4 million acres, which was 1.3 million below of estimates and even further below last year. Most of that shortfall came via HRW, at 24 million acres, with SRW at 6.86 million and white at 3.54 million acres. Thursday’s Export Sales report showed all wheat bookings falling to the lowest since mid-June at 128,058 MT. That took export commitments to 78% of the USDA full year export projection, compared to the 81% average pace. CFTC’s Commitment of Traders report indicated spec funds in CBT wheat futures and options trimming 2,289 contracts from their net short position as of January 9. They took that to 57,988 contracts by Tuesday.

Soybeans continued the collapse this week, with the March low nearing $12 and the close down 32 cents or 2.55% this week. March soybean meal was down another $3.70 since last Friday, with soy oil back up 62 points. The story this week was continued improving weather out of Brazil, as well as a not so friendly USDA set of data. In a surprise to the market, NASS raised their US yield by 0.7 bpa to 50.6 bpa, which took the US production total 36 mbu higher to 4.165 bbu. That helped to push the US ending stocks total 35 mbu higher to 280. December 1 stocks also came in 24 mbu above estimates at 3 bbu. On the world stage, USDA did trim Brazil production by 4 MMT to 157 MMT, but raised Argentina by 2 MMT to 50. This week’s Export Sales report showed a slight recovery from the previous week’s MY low in US soybean bookings to just 280,398 MT during the week that ended on January 4th. The total of shipped and unshipped sales is now 77% of USDA’s forecast total, matching the 5-year average pace. CFTC’s Commitment of Traders report tallied spec funds in soybean futures and options increasing their net short by 19,619 contracts to 31,248 contracts as of Jan 9.

Live cattle closed out the week with Feb showing an 80 cent gain. Cash trade was steady but finished softer this week, as cattle exchanged hands at $172-174, with a few $175 reported earlier in the week. Feeders took full advantage of the weaker corn action, as Jan was up $3.45 (+1.55%) since last Friday. The CME Feeder Cattle Index was down a net 9 cents this week to $228.00. Wholesale boxed beef prices bounced back this week, with the Chc/Sel spread narrowing to $17.41 Choice boxes took back most of the previous week’s losses, up $12.10 (4.4%) to $289.26, while Select was $12.32 higher (4.7%) to $271.85. Weekly beef production was down 0.2% vs. last week as transportation issues plagued slaughter capacity. That was also 14.7% below the same week last year. Actual slaughter totals in the first couple weeks of the year are down 10.2%, with production 8% lower, indicating heavier average carcass weights. USDA’s WASDE update showed projected 2024 production up 120 million lbs from December to 26.11 billion lbs, a 3.2% drop yr/yr. Weekly Export Sales data indicated 12,200 MT of beef booked for 2024 export in the week that ended on January 4th. Shipments came back down from the week prior to 13,033 MT. Spec funds in live cattle futures and options added a few more shorts in the week that ended on January 9, taking the net long down 3,645 contracts to 13,770 contracts as of Tuesday.

Hogs were again the bull leaders this week, with Feb another $1.90 or 2.71% higher. The CME Lean Hog Index was up 91 cents this week to $66.77. USDA’s Pork Carcass Cutout was back up $1.88 this week (2.2%) this week to $86.08. The belly (14.6%), rib (3.4%), loin (2.6%), and butt (2%) were the drivers to the upside. Weekly pork production was 3.7% lower vs. the week and down 16.1% vs. a year ago on transportation issues due to a couple winter storms. Slaughter for the first couple weeks of the year has been down 8.9%, with the 7.7% drop in production indicating lighter weights. WASDE data showed projected pork production at 27.97 billion lbs for 2024, a 240 million lb increase from their Dec number, expected mainly in the first half of the year. Pork export sales for 2024 totaled 23,300 MT in the week that ended on January 4. Actual export shipments split between 2023 and 2024 were 28,352 MT. CFTC data showed money managers in lean hog futures and options trimming their net short position by 11,013 contracts to -6,589 contracts as of last Tuesday.

Cotton futures recouped some losses from last week back to close 1.4% higher for the week. The monthly Crop Production update put cotton production 350,000 bales smaller than last month at 12.43 million bales. That tighter production also had WAOB trimming exports by 100,000 bales to 12.1 million, with the projected 23/24 carryout at 2.9 million bales, down 200,000. The world ending stocks were up 1.98 million bales to 84.38 million as they raised Chinese production and dropped consumption out of India, Indonesia, and Pakistan most notably. USDA Thursday’s Export Sales data showed a nice bounce from the previous week to 262,478 RB for upland cotton sales in the week that ended on January 4th. China came back in for some more. Shipments also recovered to 228,062 RB. Cotton export sales commitments for 23/24 are now 8.886 million RB, which is 77% of USDA’s current cotton export forecast. That trails the 81% average pace for this point in the MY. The FSA trimmed the Average World Price for cotton by 68 points on Thursday, to 64.28 cents/lb. Friday’s Commitment of Traders report showed spec funds adding 2,484 contracts to their new net short position now at 6,872 contracts in cotton as of the week ending on January 9.

Market Watch

Next week starts a day late, as both the government and markets will be closed for Martin Luther King Jr. Day on Monday. Tuesday will start the week with the Export Inspections report in the morning, with monthly NOPA crush data out as well. Skip ahead to Thursday, and EIA will release their weekly data showing ethanol production and stocks. Finally on Friday, we round things out with the weekly Export Sales report in the morning and monthly Cattle on Feed report from NASS that afternoon.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2024 Brugler Marketing & Management, LLC. All rights reserved.