Jerry Gulke: Are the Harvest Price Lows Behind Us?

Prices have come a long way since I sold my first load of corn decades ago for 90¢ per bushel net. I remember complaining about the drying and shrink, and the elevator manager in Cherry Valley, Ill., replied: “If you don’t like it, build your own %#^% bins.”

I did, and on-farm storage proved to be as profitable as any capital asset. Of course, holding grain doesn’t always pay. A fundamental price outlook can be even more important to financial success. Timing is everything — whether you are planting a crop or selling it.

We’ve all heard the common saying that “no one knows where prices are headed.” When I hear this, I reply: “Take a look at the corn chart and think again.” Times and situations change, but the laws of economics and supply and demand do not.

Price discovery doesn’t care about how new our machinery is or if we are the most efficient farmer in the universe. It cares about if a user of our grain can make money by adding value to our products.

CORN PRICE HISTORY LESSON

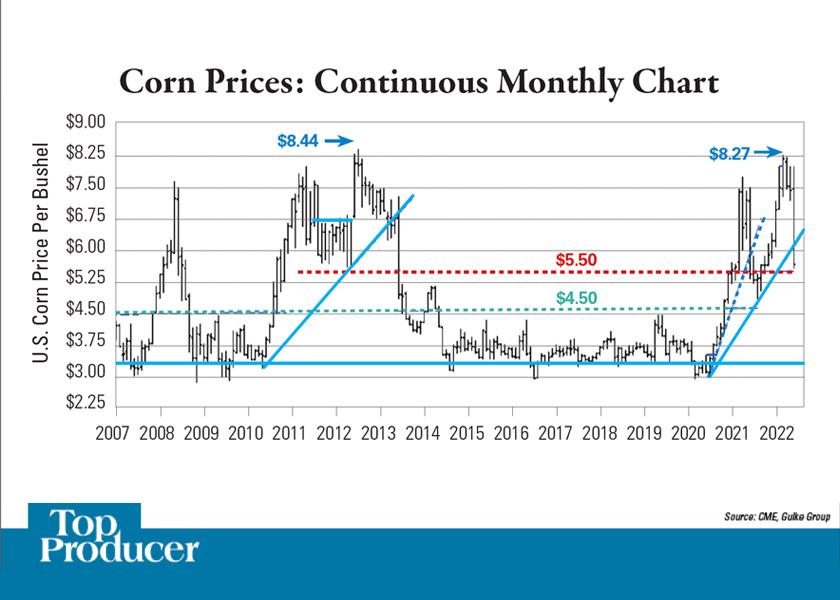

The history on the corn chart above shows some startling observations.

New highs were set in 2011 and 2012 on supply reduction, and the war-influenced prices of 2022 could not exceed those levels. Coincidentally or not, prices collapsed in July 2012 and July 2022 (price highs were made in June 2011 and June 2021).

Regardless of one’s rationale, prices always boil down to price discovery based on the events of the time (weather, politics, wars and rumors of wars).

Prices peaked in 2011 and 2012 based on U.S. supply problems with global demand destruction evolving as prices got too high. The recent attempt at a new high price were first based on South American weather concerns and then Russia invading Ukraine, which threatens global supply.

Even such macro concerns could not excite the global community enough to cause prices to exceed previous highs by 20% to 25% — in spite of the worst inflation in 40 years.

Did prices get high enough in the past to prove there is mega-price resistance at those prices, regardless of timing? Or are we in a new paradigm that makes previous high levels a springboard to higher prices?

Note the significance of $4.50 and $5.50 corn in the past decade. It now looks like a level of support. Given the evolution of larger and larger farms, prices may “have” to be elevated to sustain the current reality.

ARE HARVEST LOWS BEHIND US?

The question then remains, is it deja vu all over again? Are we looking at six to eight years of base-building before the next bull market, albeit from levels higher than the seven years of sub-$4.50?

With the price premiums for war, trade distortion, demand destruction and weather fully discounted in the July price collapse, it suggests the stars are still aligned for more fireworks. It also increases the potential harvest lows are behind us.

From a 10-year cash flow projection standpoint, the $4.50 low point seems valid with a mid-point of $5.50. This does not negate the opportunity to sell cash corn for $8.50 to $10. Tight supplies proved that this year. Being prepared is being forewarned.

Check the latest market prices in AgWeb's Commodity Markets Center.

Jerry Gulke farms in Illinois and North Dakota. He is president of Gulke Group Advisory Services. Disclaimer: There is substantial risk of loss in trading futures or options, and each investor and trader must consider whether this is a suitable investment. There is no guarantee the advice we give will result in profitable trades. Past performance is not indicative of future results.