Chip Flory: The Big Grain Market Movers for 2023

Let’s start with the obvious – weather.

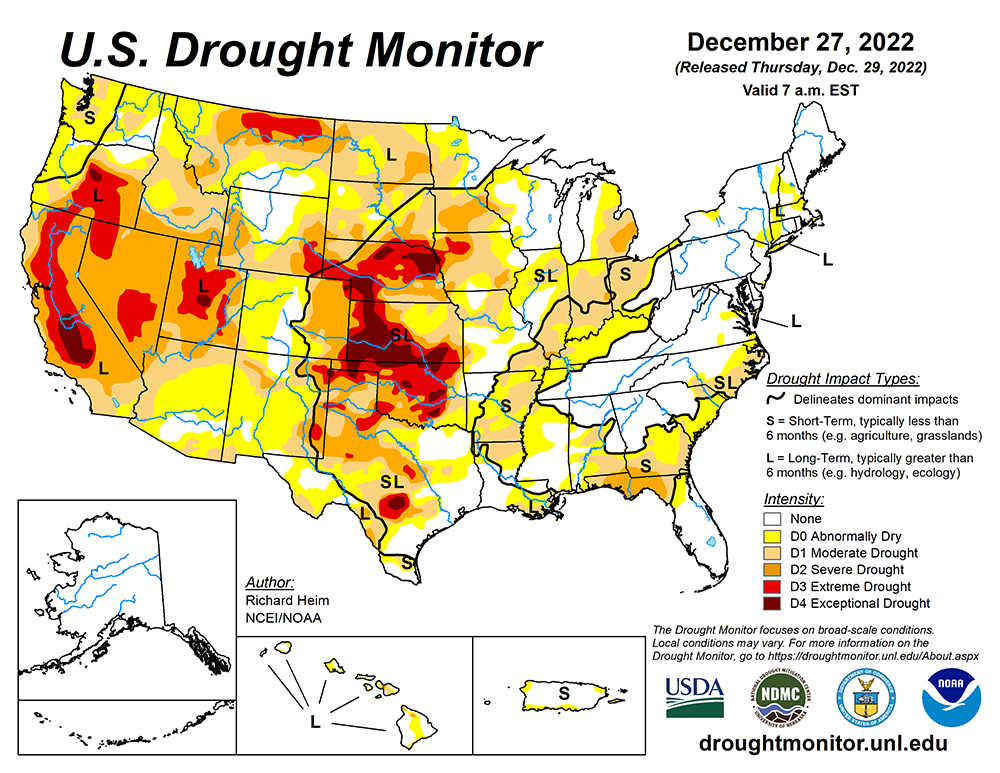

As of late December, Corn Belt soils from central Ohio to Nebraska and North Dakota to Texas were at least “abnormally dry” on the U.S. Drought Monitor map. Hard red winter wheat went into dormancy with the worst crop condition ratings on record.

Western Corn Belt acres were under “moderate” to “exceptional drought.” Conditions were dry – and getting drier in the Ohio River Valley. When droughts start in the fall the year before, they typically have a major impact on Corn Belt yields.

The trends, however, are favorable. La Nina is expected to weaken by the end of winter, creating a potential corridor for moisture to flow from the Pacific Northwest into the middle of the country. If that shift in ENSO conditions doesn’t happen, tight U.S. corn and soybean stocks will put traders’ focus fully on weather by March 2023.

Geopolitical Tensions

Russia will not invade Ukraine, but the expansion of Russia’s war in Ukraine could force the head of the United Nations to enforce more aggressive sanctions on Russia in the year ahead. How Russian President Putin might react is a coin flip, but the availability of wheat and corn from the Black Sea region will continue as a market-mover.

China’s struggles to adjust to “life with COVID” continued at the end of 2022. Food demand and food-supply management by the Chinese government will create demand uncertainty in 2023.

Some China-watchers also cautioned China could attempt to divert attention from COVID mismanagement and civil unrest by aggressively pushing plans to absorb Taiwan – a move that would undoubtedly draw criticism and sanctions from the rest of the world.

China’s quick dispatch of phytosanitary red tape to allow for imports of Brazilian corn in 2022 is one of China’s efforts to prepare for those potential sanctions.

Here Comes The Crush

U.S. petroleum refiners’ investments in soybean crush won’t be derailed by “disappointing” blending obligations for bio-based diesel under the Renewable Fuels Standard.

Another Shot Of Octane

The Inflation Reduction Act in 2022 included an additional $500 million to build up the infrastructure to deliver higher blends of ethanol to more consumers and that process will get started in 2023. Year-around availability of E15 is likely in 2023 after the American Petroleum Institute signaled its support for the plan. As retailers upgrade facilities, E15 will begin to replace E10 as the standard consumer fuel.

That will happen with support from refiners that will make up for “lost” petroleum-based fuel sales with another cut to refining costs. E15’s 88 octane level will migrate to the pump-minimum 87 octane after refiners use high-octane ethanol to offset an even lower-quality gasoline blend stock.

Corn-for-fuel demand will begin an important (and surprising to most) expansion in 2023.