Jerry Gulke: 10 Thoughts on the Paradigm Shift in Global Agriculture

The world changed quickly over the last days, requiring a reassessment and perhaps “reset” in thinking. There are too many things now affecting the complex flow of grains globally. Here goes some thoughts.

1. Cash Flow: As farmers, we all know the importance of cash flow.

2. Marketing Contracts: You will deliver hedge-to-arrive contracts come hell or high water. Think about the accumulator contracts — they may have just bought your entire production.

3. Force majeure: The seller of products has a way out, you may not — get possession of stuff you bought but isn’t delivered. Every car in the US will want to stay topped off causing abnormal demand for gas.

4. Food Supplies: Look for consumers to stock up on basic needs. We may see long lines at Costco again. Cost is not the issue!

5. Energy Supplies: We don’t have enough in surplus, thanks to the last 14 months of “green thinking” to meet needs if Putin shuts off energy to the West. The is going to be a HUGE reassessment of our energy policies. The short sighted “green” focus is in big trouble. In the meantime, Russia will supply China while they both inflate the US.

6. China Support: I’ve discussed the fallacy of Biden pushing China to fulfill their Phase 1 — who is wining that one?

7. Wage and Price Controls: I was with my father on the farm when Nixon did it because gas and labor was causing inflation. These are not your father’s and grandfather’s markets per se, they are much more complex with outcomes possibly similar. I fully expect at some point if things don’t calm down quick, a possible moratorium on trading commodities and equities may be enacted. In a global crisis, we don’t need speculators, so think out of the box. Politicians will have to convince the move to destroy fossil fuels is gone or energy producers won’t expand. Our political leaders have forced Russia and China to agree to cooperation in their recent 5,000 word document signed during the Olympics.

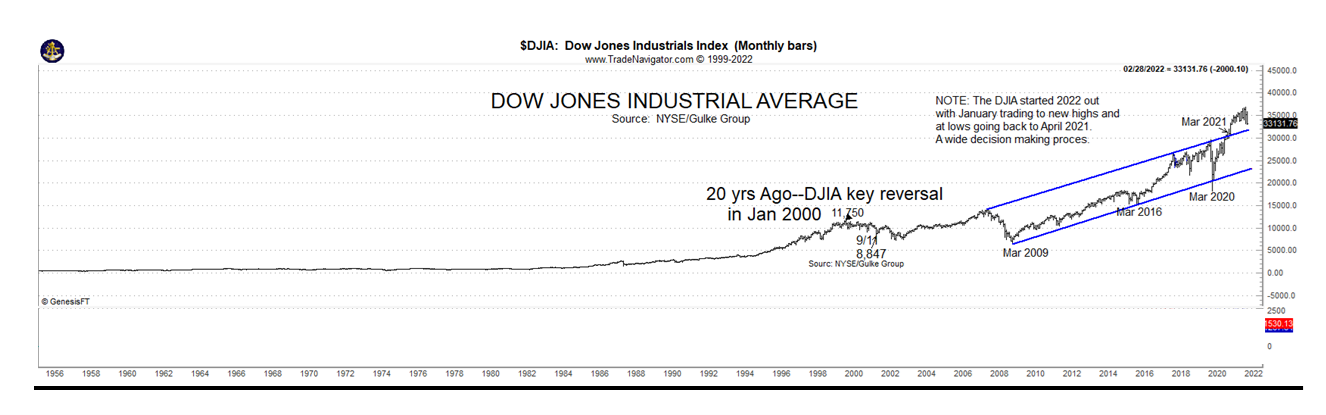

8. Preservation of Capital: I’ve been negative stock market for a few months. Remember, if you are in mutual funds, if you decide to cut back, you won’t get filled until the end of the day — stock indexes trade instantly.

9. Outlook for Commodities: China, through supporting Russia, has just picked up a vast land of corn and wheat, which it needs. This will upset the flow of grain, logistics and price in a manner we have not seen in our lifetime. Logistics is being disrupted in Canada by government action, let’s hope it doesn’t happen in the U.S. The oilseed issue in South America is a big influence but not impacted as much as wheat and corn (Ukraine). This paradigm shift in global ag started months ago and is expanding requiring new policies and actions with US producers having to think out of the box and be pro-active and above all “flexible enough to adapt to changing times.”

10. Don’t Panic — but think out of the box: There is always the call by cable news to not panic and that is wise but also consider your personal situation and your risk bearing ability, and understand that what has happened in Ukraine, the implications of the perceived alliance between Russia and China. Our world changed quickly and probably for decades. Hopefully there is some common sense in world leadership — we shall find out!

Jerry Gulke and his consulting group offer daily comments and advice. For more information on services including brokerage and attending his spring outlook conference March 17-18 in Lombard, Ill., visit GulkeGroup.com, email info@gulkegroup.com or call Jamie at 707-365-0601.

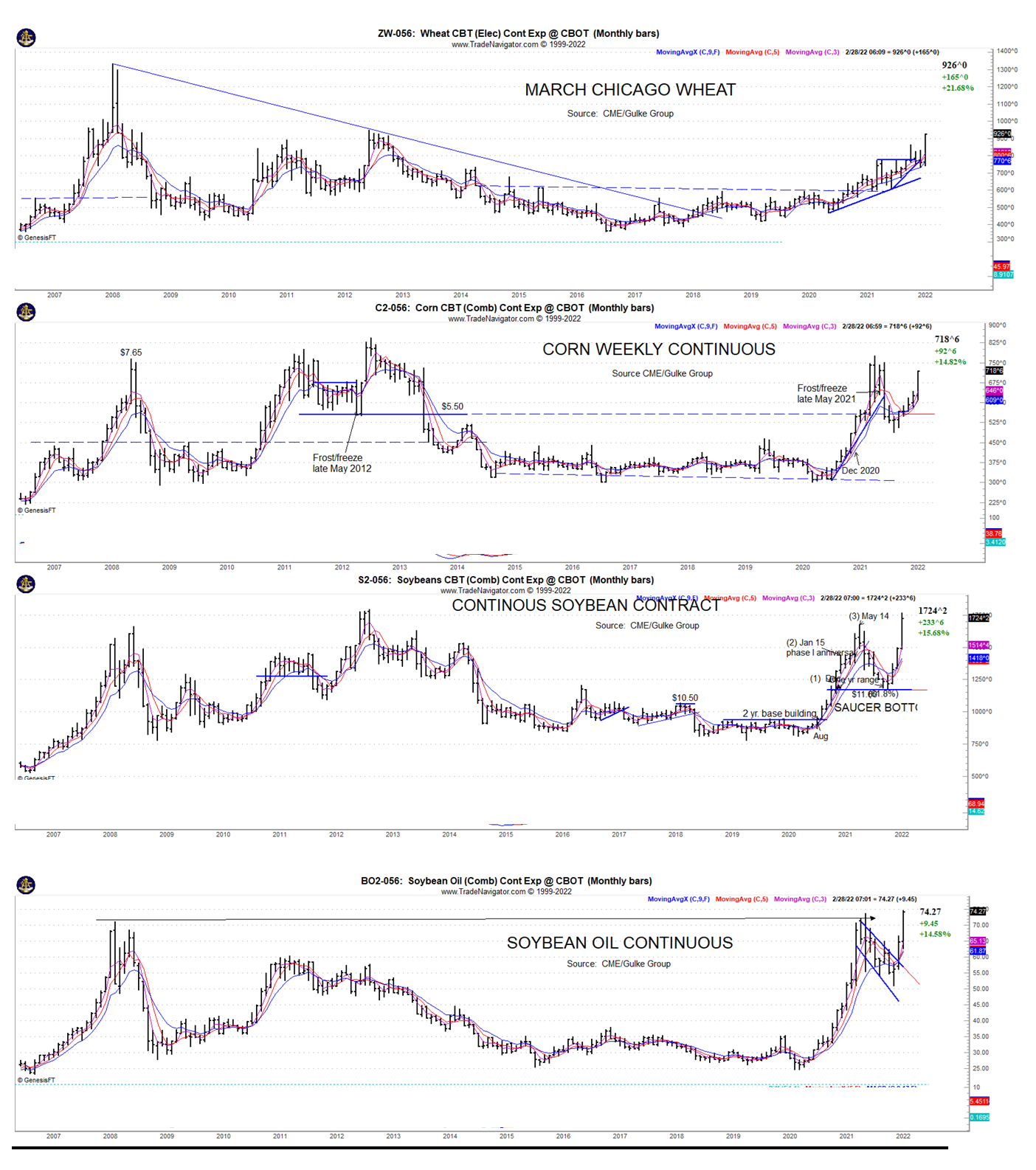

Grain Price Outlook

The long-term price charts shown below reflect overnight volatility that is sure to continue with wide ranges offering the trading world opportunities up and down, a until market psychology calms down. USDA’s Agricultural Outlook Forum started today and likely will influence thinking based on previous supply and demand influences that likely have changed, if not considerably. It won’t be easy to put it all into perspective.