A Look At The Current Macroeconomic Impact On Ag

My monthly columns in the past 15 months began with what a “black swan” event would look like for corn and later a reset(s) of ag prices that has evolved into my worst concern: producing too much of everything and potentially having an oversupply for more years.

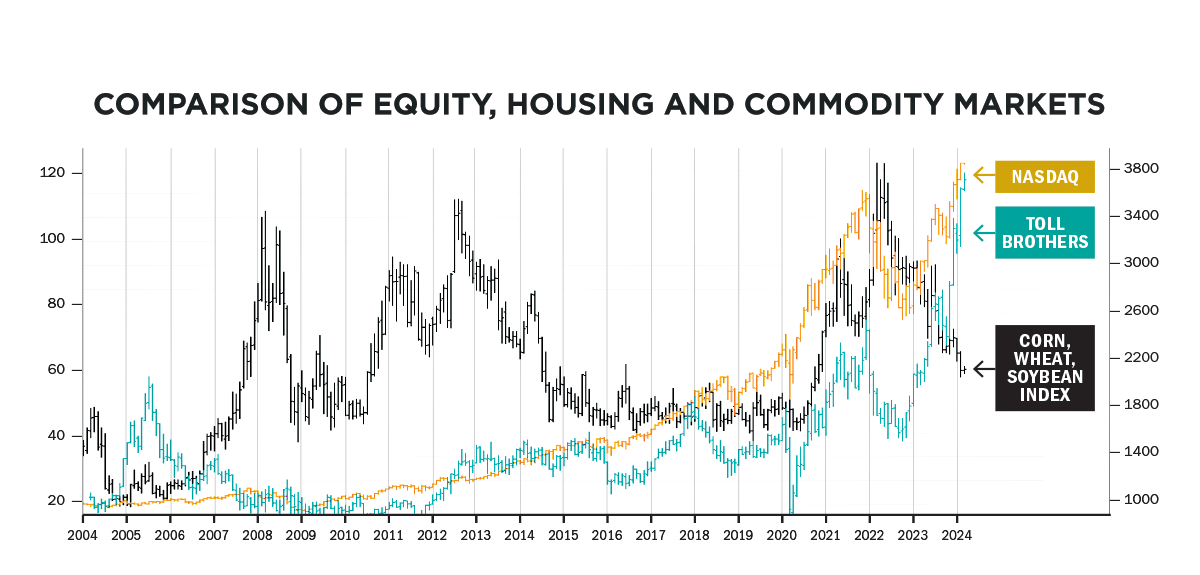

An analysis of the equities, housing and commodities chart leads to the conclusion things are out of whack. The reset the Federal Reserve desires is not complete. Achieving the slow growth and low inflation of the 20 years before 2020 may have unintended consequences.

- The NASDAQ (equities) market is at an all-time high.

- The housing market is thriving despite inflation, labor shortages and unaffordability.

- The inflation fight with high comparative interest rates isn’t solved yet.

- A recessionary “soft landing” doesn’t seem to be in the cards.

- The high cost of labor has replaced supply shortages and energy costs as a concern.

- Even wars on multiple fronts are being ignored by economists’ confused outlooks.

I don’t recall in my lifetime when the general economy and agriculture were both in recession, apart from the 1930s. One seemed to help offset the other. Yet today, ag is in the pits in just one short year, with a non-farm economy seemingly overheated and unresponsive to actions to correct.

The last farm recession was in the early 1980s when interest rates were double what they are today, however the costs of servicing higher debt makes today comparable.

Anyone in their forties or younger likely hasn’t had to deal with today’s circumstances. I experienced the worst ag recession of my lifetime in the post-Vietnam War era as my parents witnessed the second of theirs. They were well prepared and saw cash would be king, and debt was truly a four-letter word. I learned from the hard knocks of others.

We are at an inflection point between a pause that gives a refresher or an education for the millennials. I have three concerns:

- The “tigers” of today, might not have learned from history.

- Those influencing our government and the Federal Reserve might still believe we have to hurt the middle class and the economically disadvantaged (higher unemployment) in order to save us all, repeating history.

- The U.S., and globally for that matter, could experience a black swan event where both ag and non-ag are in recession, disinflation or stagnation — a discussion not on the minds of economists.

I recently studied the 1930s stock market and learned a partial conclusion of why economists failed to see the crash coming was because the plight of the middle and lower class citizens had gone unnoticed until it was too late.

A Closer Look

To get a semblance of a neutral bias to the first chart, the non-equity markets need to retrace, commodities need to rally, or some of both. The main influence on grains is supply versus demand. Without enough supply, prices will rally until price rations demand. If there is too much supply, prices fall to discover new demand or curtail production. A 6-million-acre reduction in corn to soybeans is not possible without weather or an outside force in the marketplace.

Here’s what influenced me to lift all price hedges in late February:

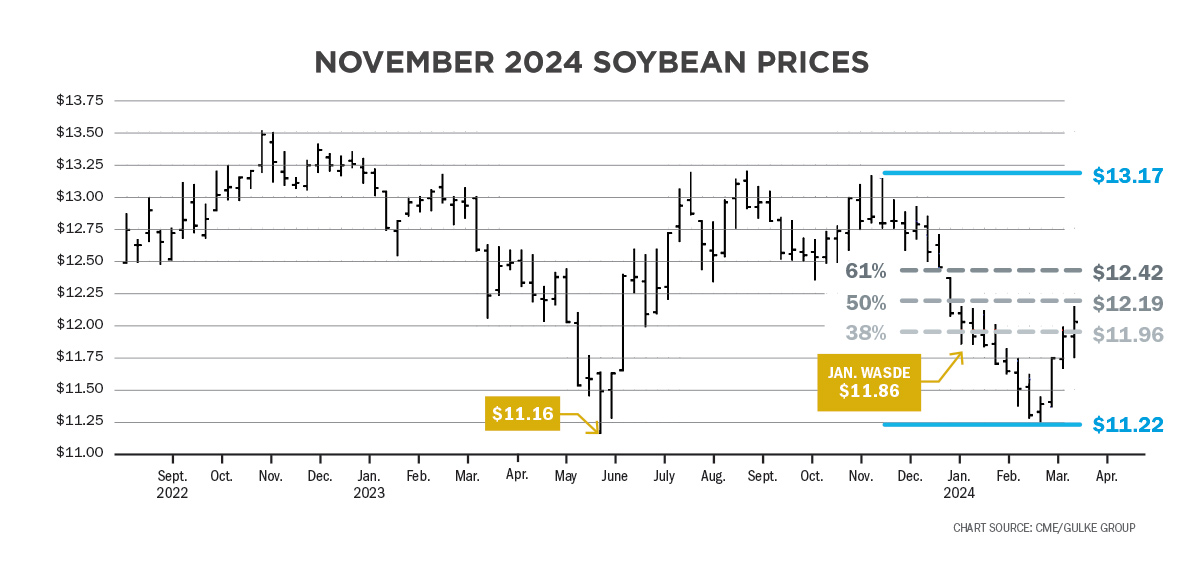

- November soybean prices signaled the January WASDE report could’ve lowered demand as prices were lower to start the year.

- The January WASDE report validated the down gap — ending the day at $11.86 versus $12.70 at the end of 2023.

- The February WASDE added insult to injury by going to a low of about $11.22.

- Subsequently, the March WASDE was viewed as a ho-hum of a report.

- A late surge extended gains right into the all important March 29 stocks and acreage report.

The chart above shows the first weekly close in early March above the previous week’s range since November 2023. As of press time, both new crop corn and soybeans could post a monthly reversal high.

The March USDA acreage report could be a game-changer. Brazil’s crops and U.S. acreage intentions are at the forefront, and it’s too late for crop insurance to influence the price incentive to plant soybeans.

February’s $12 high is a 38% retracement of the $2 move lower since November and has already been reached, leaving a retest of the $12.45 gap left to buy acres if needed.

If price discovery and price charts are hard to understand, turn the price chart upside down and decide if you’d want to own it. I’ve used this for years to benefit my bias.