8 Charts to Analyze from the 2022 FAPRI Baseline

Taking the long view in agriculture can provide guidance for decisions you make on your farm today. Russia’s invasion of Ukraine, the continuing COVID-19 pandemic and volatile markets make the outlook uncertain and ever-changing.

Farm commodity prices, production costs and consumer food prices are higher than would have been expected a few months ago, according to the 2022 U.S. Baseline Outlook report compiled by Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri.

The report is prepared based on market information in January 2022. FAPRI uses their models to develop a range of projected market outcomes that consider major sources of uncertainty about future supply and demand conditions.

“This report is prepared using market information that was available in January 2022,” “We recognize that much has happened since then and some of the possible implications are discussed throughout the report,” said Patrick Westhoff, director of FAPRI, in a news release. “Based on the available information in January 2022, we were projecting lower prices for most crops in the 2022/23 marketing year. A weather-reduced soybean crop in South America and the war in Ukraine have both pushed oilseed and grain prices higher, at least in the near term.”

Here are eight key data sets and projections that give insights into the outlook:

Source: 2022 FAPRI U.S. Agricultural Market Outlook

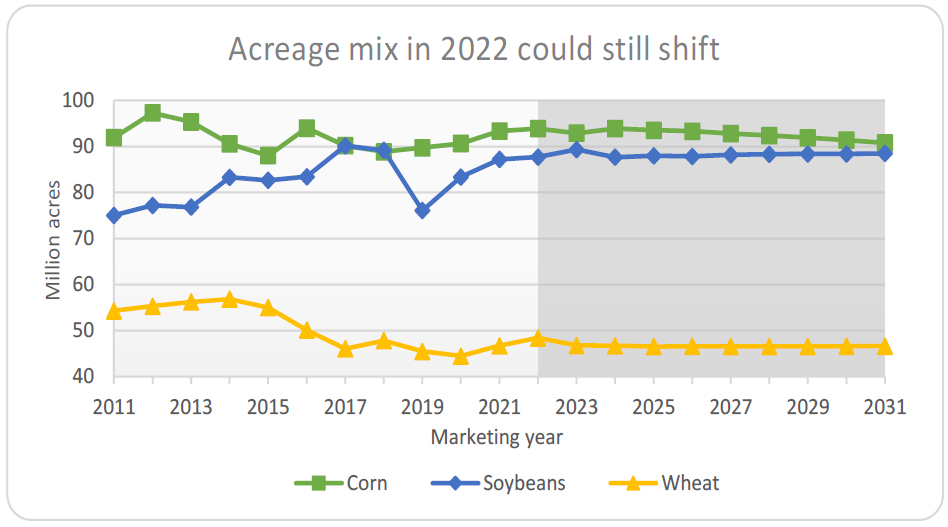

For 2022/23, FAPRI estimates 93.9 million acres of corn, 87.7 million acres of soybeans and 48.4 million acres of wheat. Over the next decade, expect acres for major crops to remains fairly steady.

Source: 2022 FAPRI U.S. Agricultural Market Outlook

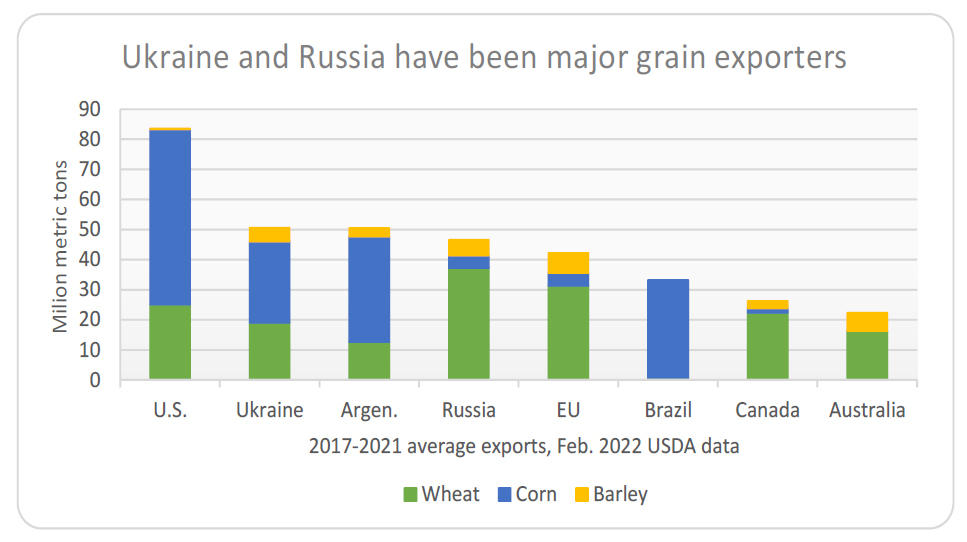

The global grain marketplace is facing intense uncertainty as the Russia and Ukraine conflict continues. The two countries are major grain exporters. Ukraine’s exports of corn, wheat and barley have averaged about 50 million metric tons per year since 2017, second only to U.S. exports of those three grains. Russia has been the world’s top wheat exporter in recent years. The war in Ukraine has disrupted trade flows and creates the potential for higher prices and uncertainty over the market outlook, FAPRI reports.

Source: 2022 FAPRI U.S. Agricultural Market Outlook

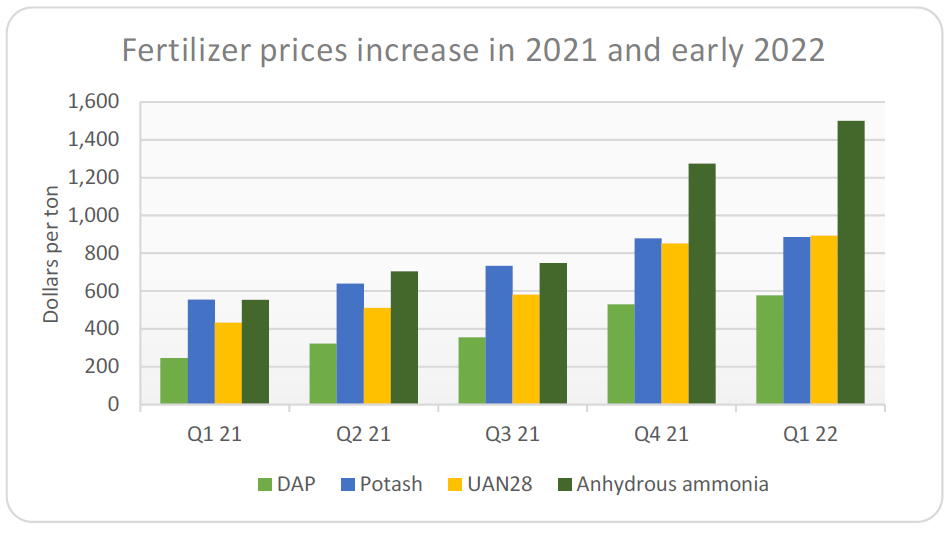

Fertilizer prices increased sharply even before the outbreak of the war in Ukraine, with sharp increases in the fourth quarter of 2021. Production costs will increase more for crops like corn and wheat that use larger amounts of nitrogen fertilizer, than for soybeans, which does not. Fuel and other production expenses have also increased since 2020. The war may limit Russian exports of natural gas, petroleum and fertilizer, raising global prices for those farm inputs, according to FAPRI.

Source: 2022 FAPRI U.S. Agricultural Market Outlook

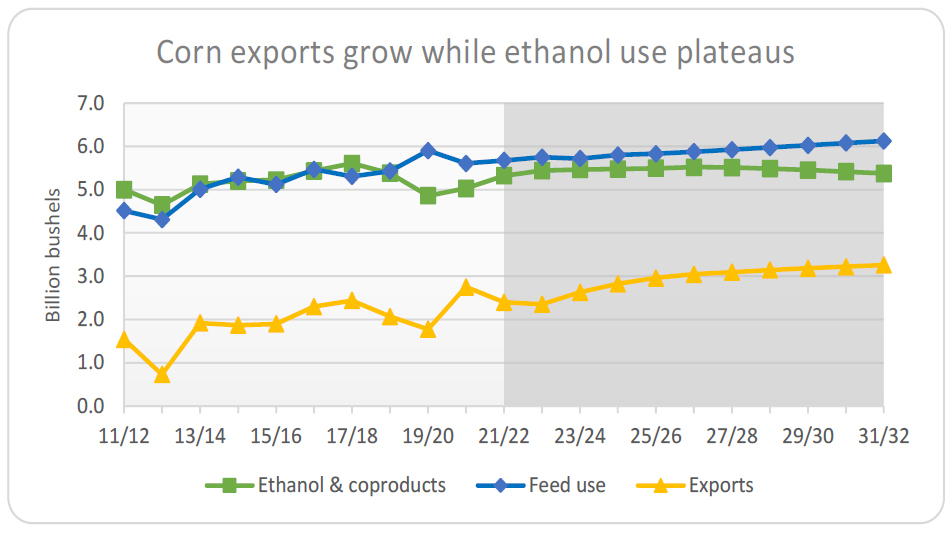

Brazil’s weak production and exports and China’s strong imports supported U.S. corn exports and prices in 2020/21. Before the Ukraine conflict, U.S corn exports were expected to decline in 2021/22, but then grow steadily over the next decade with rising growth in global corn use, per FAPRI. Domestic ethanol production rebounded from a pandemic low and is expected to remain steady with reductions in domestic ethanol use largely offset by increasing U.S. ethanol exports.

Source: 2022 FAPRI U.S. Agricultural Market Outlook

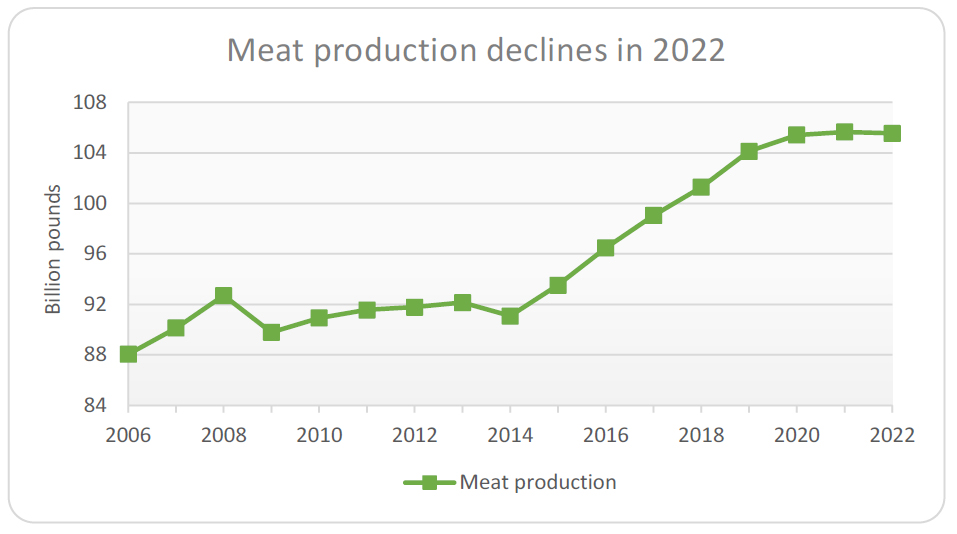

Following seven consecutive years of growth, combined U.S. beef, pork, chicken and turkey production is projected to decline in 2022. Higher feed costs, multiple years of drought in key cow-calf production areas and increased farm-retail margins since the beginning of the pandemic are some of the factors driving the reduction. The smaller meat supply puts upward pressure on prices.

Source: 2022 FAPRI U.S. Agricultural Market Outlook

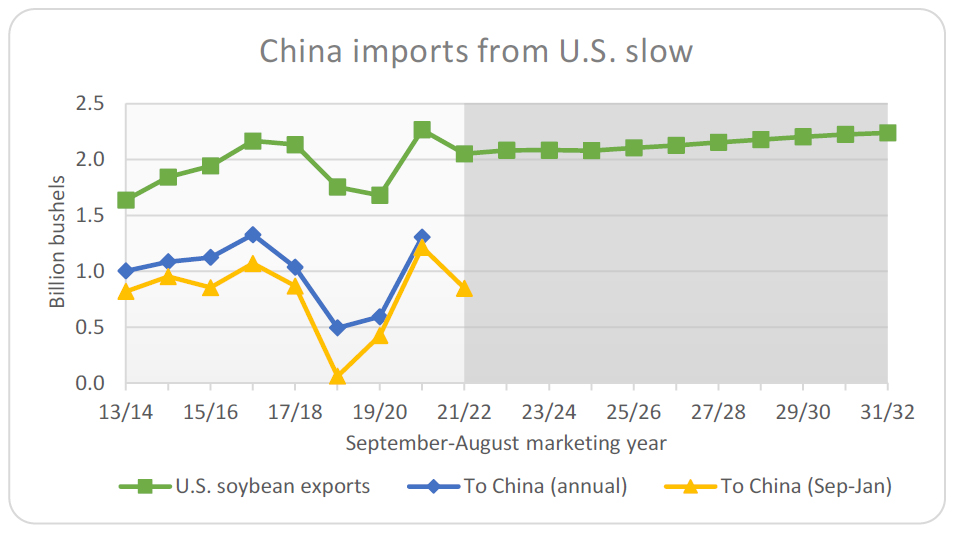

China’s imports of U.S. soybeans rebounded to record levels in 2020/21. A recovery to China’s pork industry from ASF and the U.S.-China Phase 1 deal both played a role in the increase. FAPRI predicts U.S. soybean exports decline in 2021/22 in part as profitability of China’s pork production hit a temporary snag and softened its soybean crush demand for meal and slowed import demand for U.S. soybeans in the first half of the marketing year.

Source: 2022 FAPRI U.S. Agricultural Market Outlook

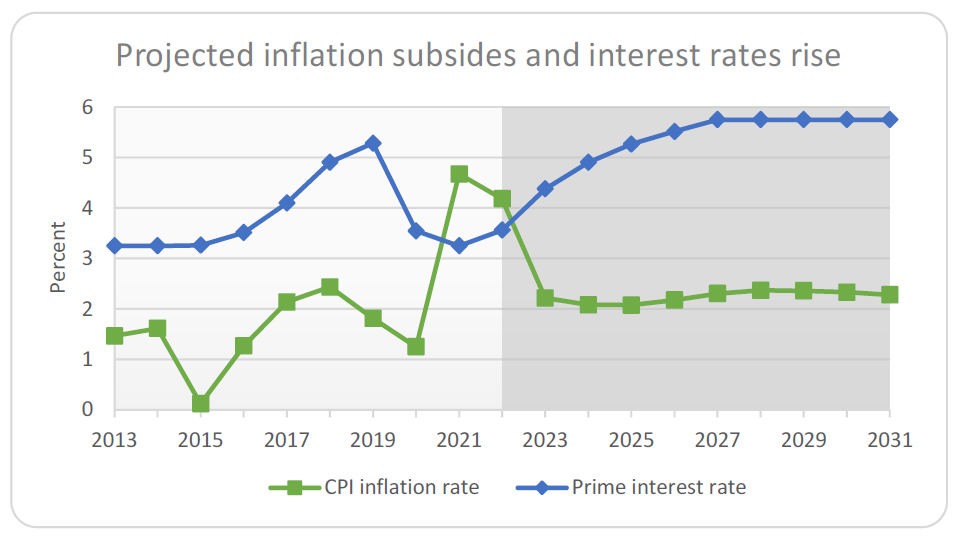

Inflation jumped in 2021, while the Federal Reserve kept interest rates low. Year-over-year inflation remains high in early 2022, and higher energy prices caused by the war in Ukraine may delay the return of lower inflation rates. In January, IHS Markit (S&P Global) forecast inflation would fall to 2% per year beginning in 2023. The prime interest rate is forecast to rise each year from 2022 to 2027. Higher interest rates would in-crease farm borrowing costs and could put downward pressure on land values.

Consumer food price inflation increased to 3.9% in 2021, and the CPI for food exceeded year-ago levels by 7.9% in February 2022. Even if food inflation slows in the months ahead, the annual rate for 2022 is likely to be the highest since 2008.

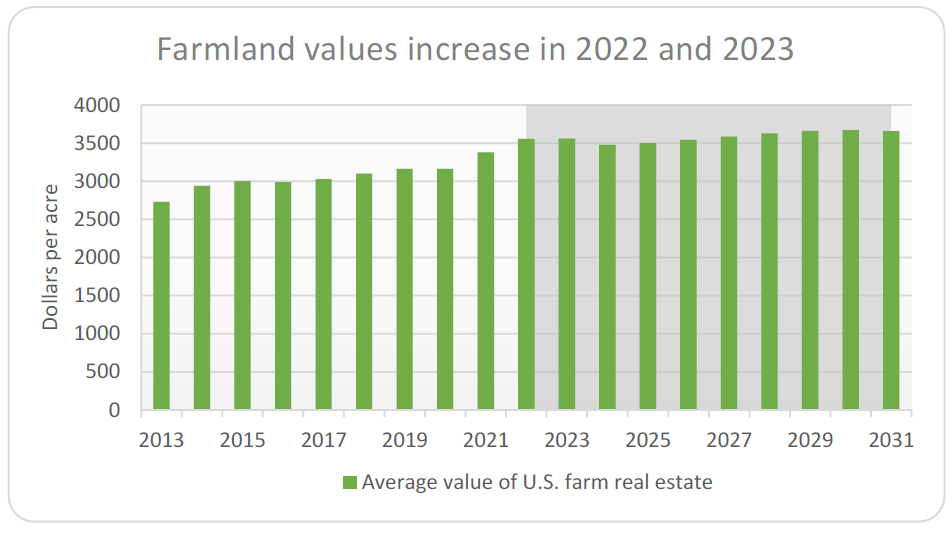

Higher farm income and delayed interest rate hikes support a 5% projected increase in farm real estate value in 2022. After 2022, climbing interest rates reduce real net farm income and limit upward support for farmland value.

Other highlights from the 2022 FAPRI Outlook:

- Livestock sector prices have been supported by strong consumer and export demand. High production costs and other factors have limited growth in supplies of meat and milk. Projected cattle and milk prices increase sharply in 2022, and prices for hogs and poultry remain well above the 2020 pandemic levels.

- After the low in 2019/20, the continued rebound in ethanol production into 2022/23 coupled with lower-than-historical stock levels have all contributed to the higher 2021/22 prices. Corn ethanol use averages 5.46 billion bushels throughout the baseline. Stocks continue to increase steadily throughout the baseline and prices gradually fall, helping increase exports in 2023/24 and later years.

- Many firms have announced renewable diesel fuel expansion plans. If even a fraction of the planned capacity is installed and operated, the demand for soybean oil and other fats and oils would surge. This new vegetable oil market force puts upward pressure on prices, reduces U.S. exports and could lead to substantial U.S. imports.

- Ad hoc programs to respond to trade disputes and the pandemic pushed government payments to farmers to record levels in 2020. In this current-policy baseline, payments drop back to less than $7 billion in 2023. Crop insurance accounts for about half of projected outlays on farm-related programs over the next ten years.

- Net farm income increased in 2021, as sharply higher crop and livestock receipts more than offset reduced government payments and increased production expenses. Projected net income declines in 2022 as the reverse is true. Recent events add uncertainty to the outlook, as both receipts and expenses could exceed projected levels.