9 Charts to Analyze from the 2023 FAPRI Baseline

This year looks to be a transitional one.

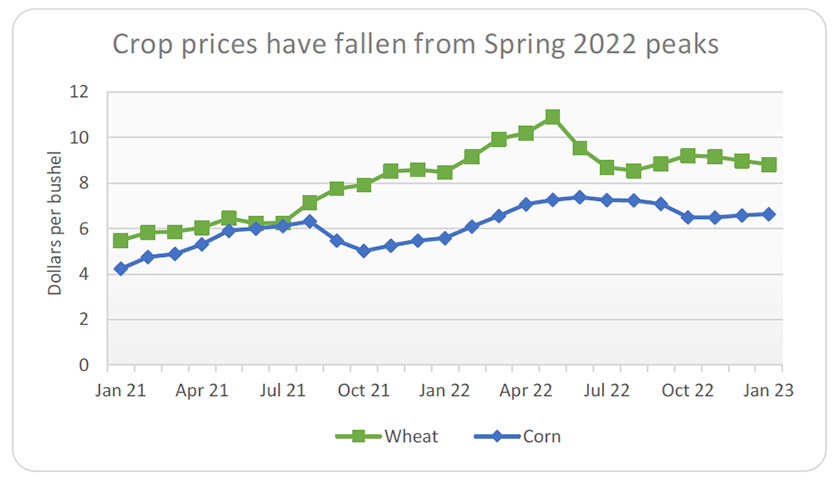

“What goes up, generally comes back down in agricultural markets,” shares FAPRI-MU director Pat Westhoff. “Projected prices for most crops, poultry and dairy products all retreat in 2023 from recent peaks, and so do some production expenses.”

If weather conditions allow crop yields to return to trend-line levels in 2023, prices for corn, soybeans, wheat, cotton and many other crops are likely to fall. Over the next ten years, average nominal crop prices are much lower than they have been in 2022/23, but they remain above the average of 2017/18 to 2021/22.

That’s according to the 2023 U.S. Baseline Outlook report compiled by Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri.

Based on projections from the report, Westhoff believes that after atypical conditions, a return to normalcy will impact producers and consumers alike.

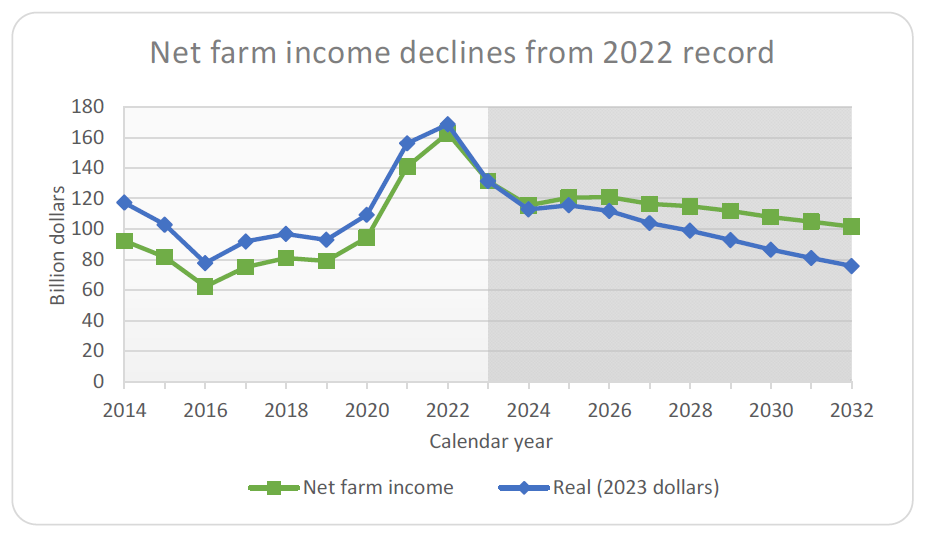

“Net farm income is likely to fall back from the record levels of 2022 and consumer food price inflation is also likely to slow in 2023,” Westhoff said.

Here are nine key data sets and projections that give insights into the outlook:

Net farm income hit a record level in 2022. Lower commodity prices will likely pull down net farm income in 2023 and 2024.

Prices for corn and wheat (and other commodities) dramatically jumped between January 2021 and spring 2022. But since the middle of 2022, prices have declined.

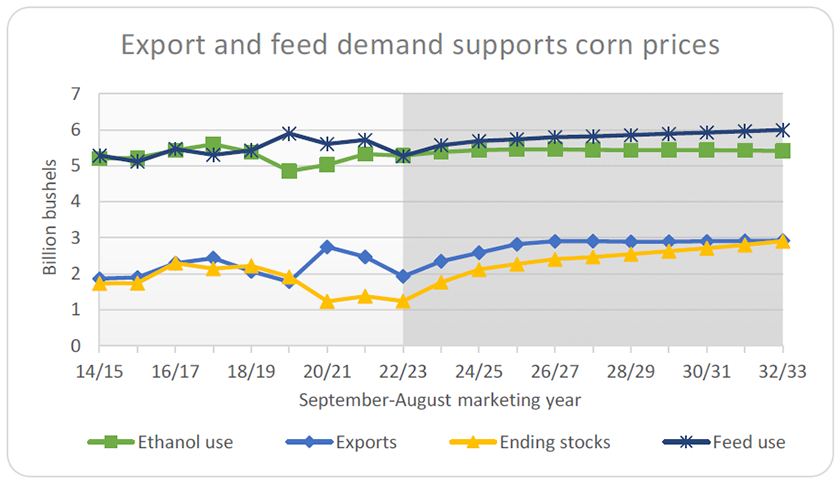

For corn, demand growth is projected to come due to feed use and exports, with ethanol use declining.

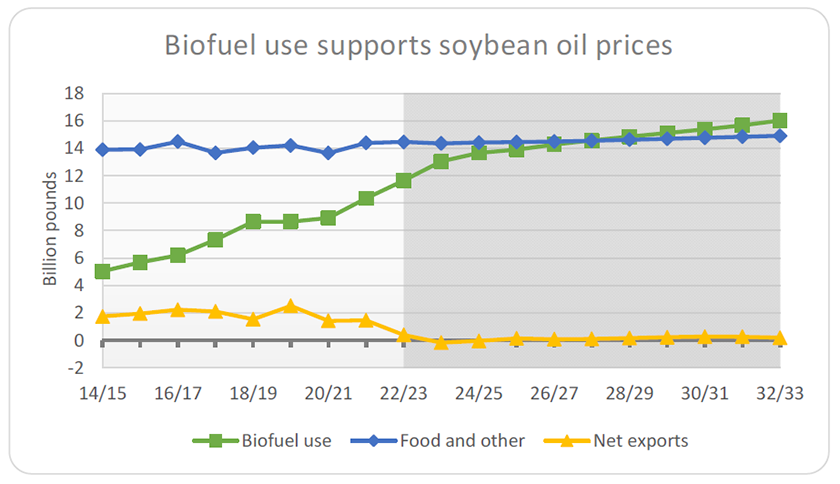

Demand for soybean oil has escalated due to the rapid expansion of the renewable diesel industry. Strength in demand for soybean oil supports soybean prices.

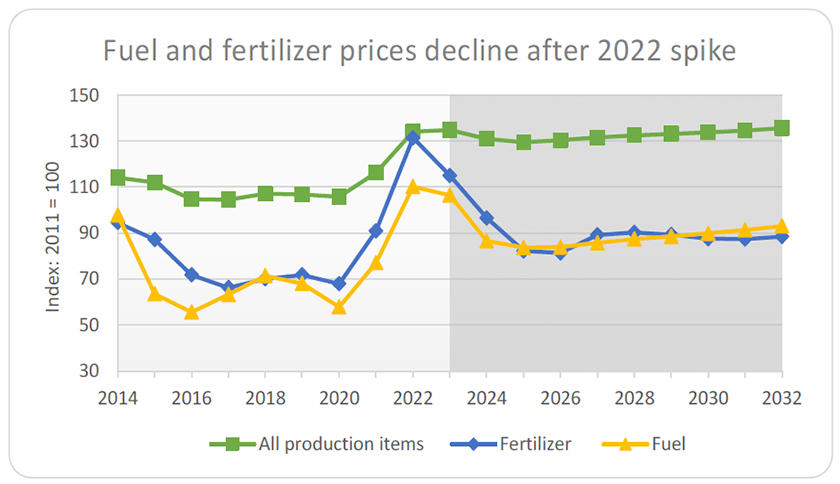

Prices for fertilizer and fuel spiked in 2022, but prices are expected to decline in 2024 and 2025. However, higher interest rates and labor costs will keep total farm production costs elevated.

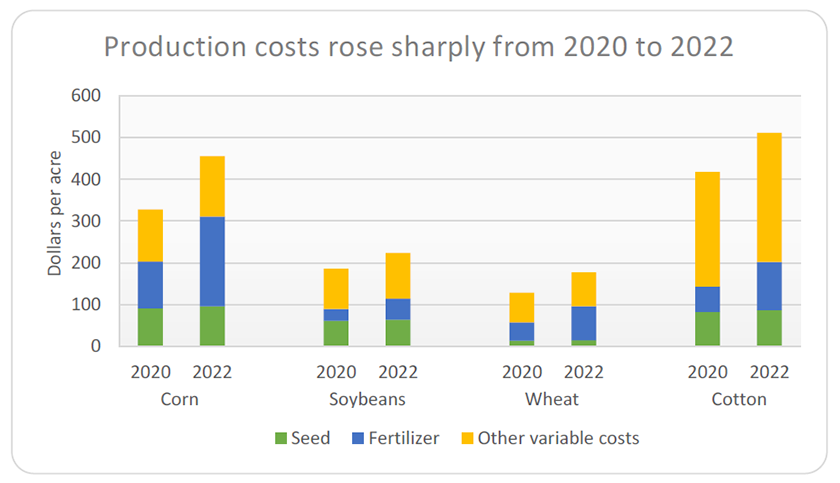

Higher fertilizer costs contributed to a 46% increase in corn variable production costs between 2020 and 2022. While fertilizer and fuel costs have dropped from recent peaks, expenses remain higher than prior years.

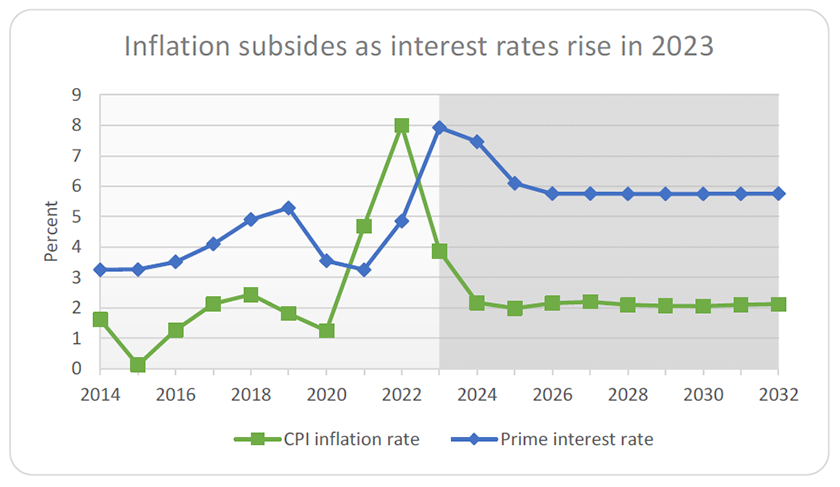

Inflation hit the highest level in decades in 2022. In response, the Federal Reserve increased interest rates. Both inflation and interest rates are expected to drop but stay above recent levels.

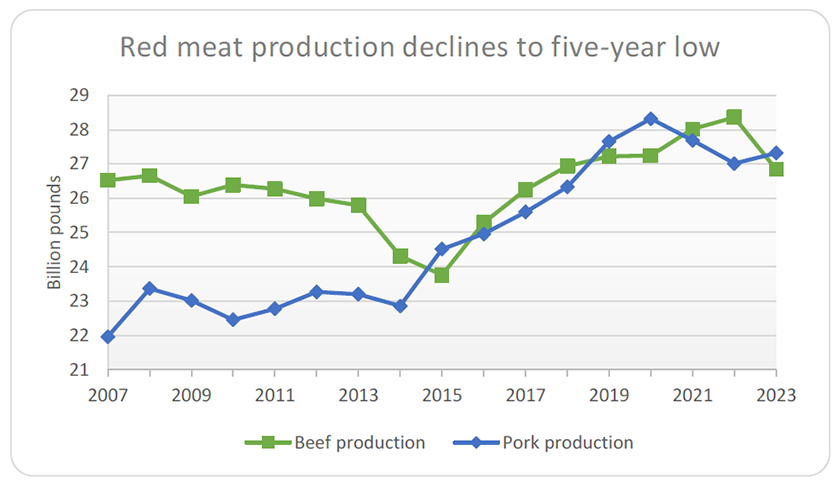

The largest decline in beef production since 2014 will outweigh modest growth in pork production, resulting in an overall decline in red meat production.

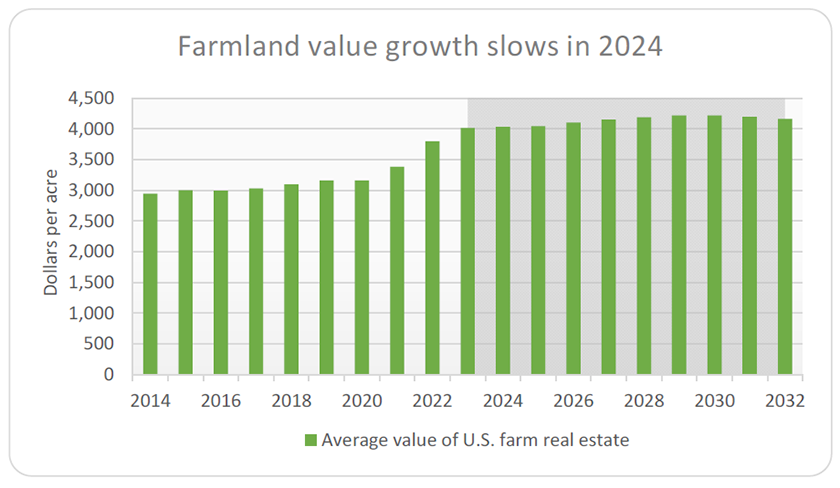

Farmland values have posted significant gains since 2020. Looking forward, prices are expected to plateau as farm income declines while interest rates increase.