Jerry Gulke: Where Does the Soybean Story Go from Here?

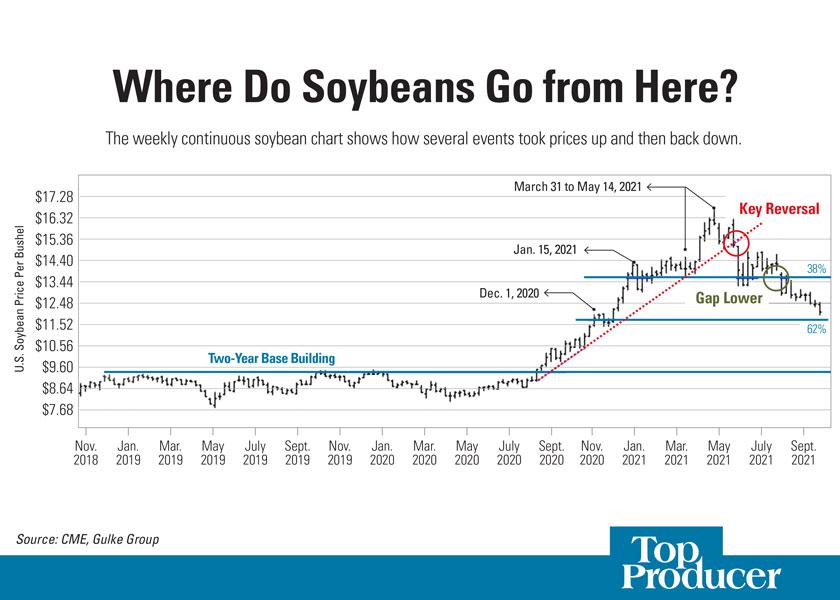

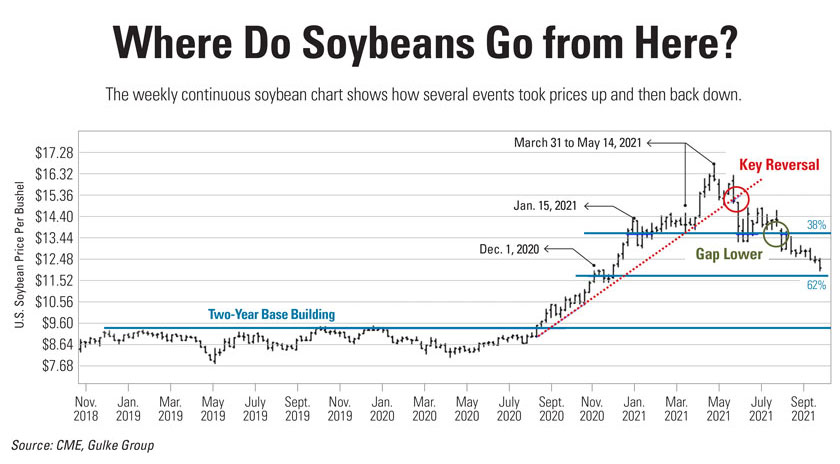

Every story has a beginning and an ending. The soybean story began in August 2020 after two years of a sideways base-building affair, trading below $10. The end of the bull story came after the following three key moves (see the chart below):

- We saw a pause around Dec. 1, 2020, when we didn’t know if the rally was still part of the sideways trend or if something had changed. In other words, was China’s buying for real? Were we were seeing a paradigm shift?

- On Jan. 15, the soybean rally again paused on the first anniversary of the phase-one agreement, reflecting on the progress thus far. Soybean prices held in a $1 trading range all through the Brazilian drought talk, as well as extensive speculation on U.S. acreage.

- The third price thrust began after the acreage shock of March 31. Early planting and the effort to buy more U.S. acres kept the rally through May 14. It ended there because price couldn’t really buy more acres. So, price had to curb demand such that production would suffice. We had already proven in 2008 and 2011 that $17 soybeans had slowed demand and would likely do so again.

PRICE MOVEMENT TRENDS

Daily sell signals occurred in early May followed by a weekly key reversal down during the June USDA report and the breaking of the longer-term uptrend. The weekly gap lower after the August USDA report put another nail in the coffin for soybeans, breaking a 38% retracement of the whole move from August 2020 to May 2021.

Soybeans proceed to break a 50% retracement level and capitulated toward a 62% retracement, marked by the Oct. 12 USDA report. Fundamentally, these market forces were at play:

- The Brazilian soybean crop kept getting bigger.

- China’s purchases paled in comparison to a year earlier.

- The market chatter was full of the “tight stocks” syndrome, which failed to materialize.

- USDA found more ending stocks than some thought, cumulating a near $5 drop in prices since May.

Markets go up and down in the process of price discovery. The question now is if soybeans will retrace the full 100% of the move from August 2020 or if they'll find support at the 61% retracement. Yes!

Soybeans could find support, and prices could very likely return to the beginning of the story near $10. It might be just a matter of time.

But won’t prices rally as the market paid $17 for beans in early 2021? Won’t it happen again?

I have faced these questions for decades. Instead of hoping for a second chance, learn the principles of price analysis/outlook, price discovery and demand curtailment. Soybeans have a lot of headwinds including the high cost of planting corn versus planting soybeans. We are now seemingly in need of another crop problem to resume a major bullish scenario.

Jerry Gulke dives into the topic further on Weekend Market Report:

Jerry Gulke farms in Illinois and has interests in North Dakota. He is president of Gulke Group, a market advisory firm. Disclaimer: There is substantial risk of loss in trading futures or options, and each investor and trader must consider whether this is a suitable investment. There is no guarantee the advice we give will result in profitable trades. Past performance is not indicative of future results.