Carbon’s Next Chapter On The Farm

A yet-to-be-realized provision in the Inflation Reduction Act could be the key for farmers to engage in measuring the carbon intensity (CI) of their grain.

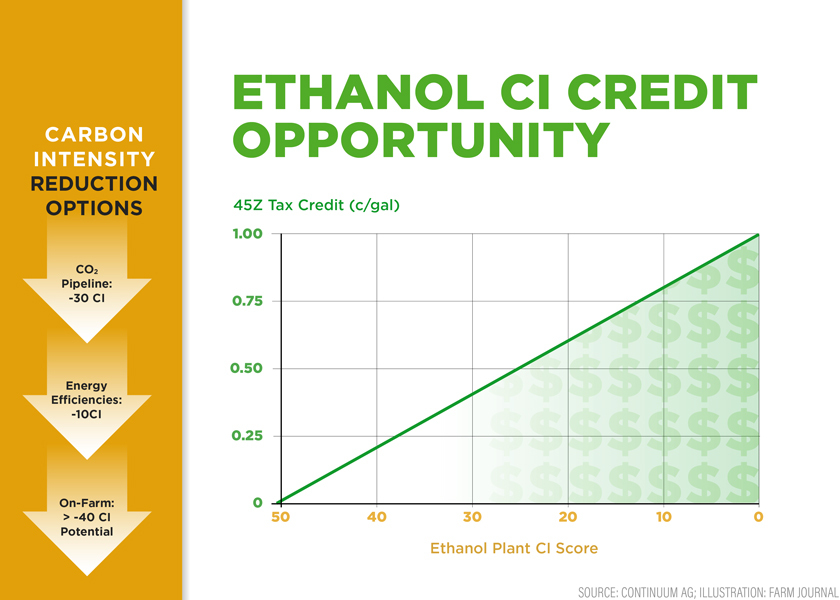

The Section 45Z tax credit provides biofuel producers (ethanol, biodiesel and sustainable aviation fuel) with an incentive to produce low-emission fuels. What makes this different than carbon offset programs is it could provide a business model in which the farmers’ carbon data is associated with their crop at the point of sale, rather than maintain the trend of carbon being an asset on its own.

Iowa farmer Mitchell Hora says his low-carbon intensity grain could be worth more than $400 per acre in 45Z tax credits.

That’s the good news. Here’s the catch — the Internal Revenue Service (IRS) has yet to issue its own regulation, which is the holdup for ethanol companies before giving a clear answer on the value to farmers.

“[Expectations for compensation] will vary by farm,” says Paul Scheetz, ADM director of Climate Smart Ag Origination. “Our goal is to make the process simple, so farmers understand how they can receive – and increase – incentives as they lead in meeting the vast and growing demand for lower CI products.”

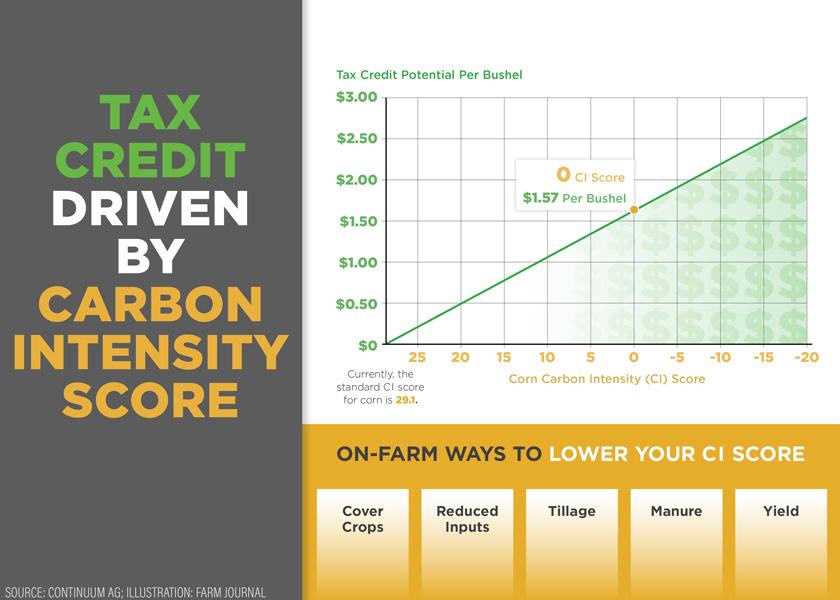

Grain will be assessed with a CI score, which has a set of parameters determined by the Department of Energy. Currently, the standard CI score for corn is 29.1. The Inflation Reduction Act sets a weighted average below 25.

“The value potential here is pretty good — 5.4 cents per CI point below the industry standard,” says Paul Neiffer, a farm CPA. “If you raise 200 bu. corn with a CI score of 0, that’s $1.57 per bushel and an extra $314 in value. Now, the ethanol plant isn’t expected to share 100%, but it could be 25% to 30%. There's definitely potential here for material value to the farmer. I don't think this is pie in the sky.”

Hora says his farm’s current CI score for corn is -4.4.

“What excites me the most about this is it really opens the potential for farmers to be price makers and not price takers,” Hora says. “With their production practices, including the long-term practitioners who were excluded from offset market participation, they can sell a digital asset associated with a physical product, their grain.”

Neiffer and Hora discuss the topic more on The Farm CPA Podcast

With his regenerative ag software business, Continuum Ag, Hora is ready to help farmers assess their carbon score upon providing the following data:

- Yield

- Fuel usage/energy usage

- Fertilizer

- Tillage

- Cover crop (yes/no—doesn’t matter which one or what rate)

- Manure

- Herbicide and insecticide (fungicide isn’t currently counted)

While, the current parameters don’t specifically ask for planting date or planted populations, Hora says farmers should have it any way.

Neiffer agrees this opportunity could be transformational for every farmer.

“This is based on what farmers are actually doing. If a farmer has done good practices, they are getting rewarded for it,” he says. “This isn’t a program where a farmer has to make a change and then wait five to 10 years for a bonus payment.”

Unlike the previous program, the structure of how these tax credits will be issued provides the ethanol plants with an opportunity to sell excess credits on the secondary market.

Here’s another catch, section 45Z is only good for three years: Jan. 1, 2025, to Dec. 31, 2027.

“First, the IRS needs to publish their regulations, which will help us really calculate the values,” Neiffer says. “We could get that from the agency as late as December 2024.”

Neiffer shared more on AgriTalk:

For now, Hora encourages farmers to get their data in order, and work with folks who can help them start to measure their CI score.