Which Foreign Country Owns the Most Farmland in the U.S.? Hint: It's Not China

Controversy continues to grow across the U.S., and China is the primary target of the new rules. However, China doesn’t own the most farmland in the U.S., according to a new USDA report. It’s actually Canada, which accounts for 32%, or 14.2 million acres.

Rounding out the top five are the Netherlands at 12%, Italy at 6%, the United Kingdom at 6% and Germany at 5%. Together, citizens in those countries hold 13 million acres, or 29%, of the foreign-held acres in the U.S. China owns less than 1%, or 349,442 acres.

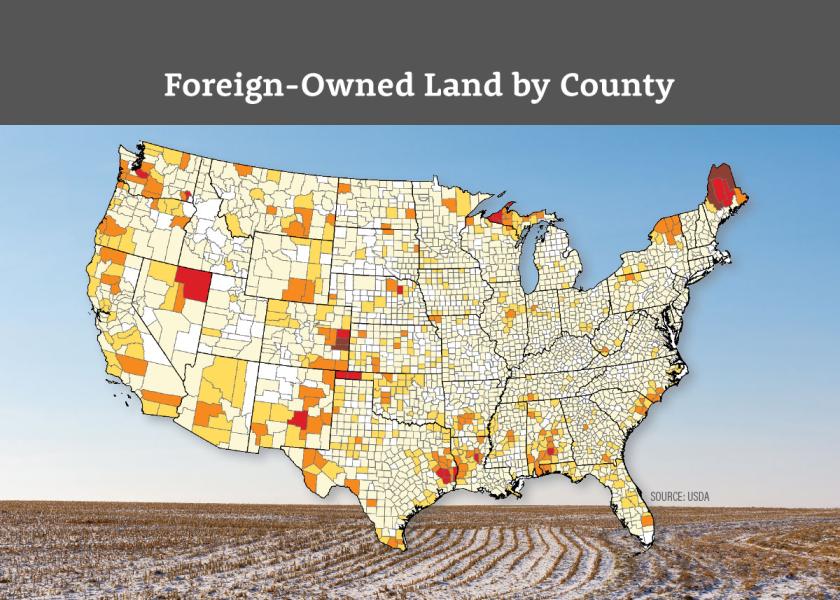

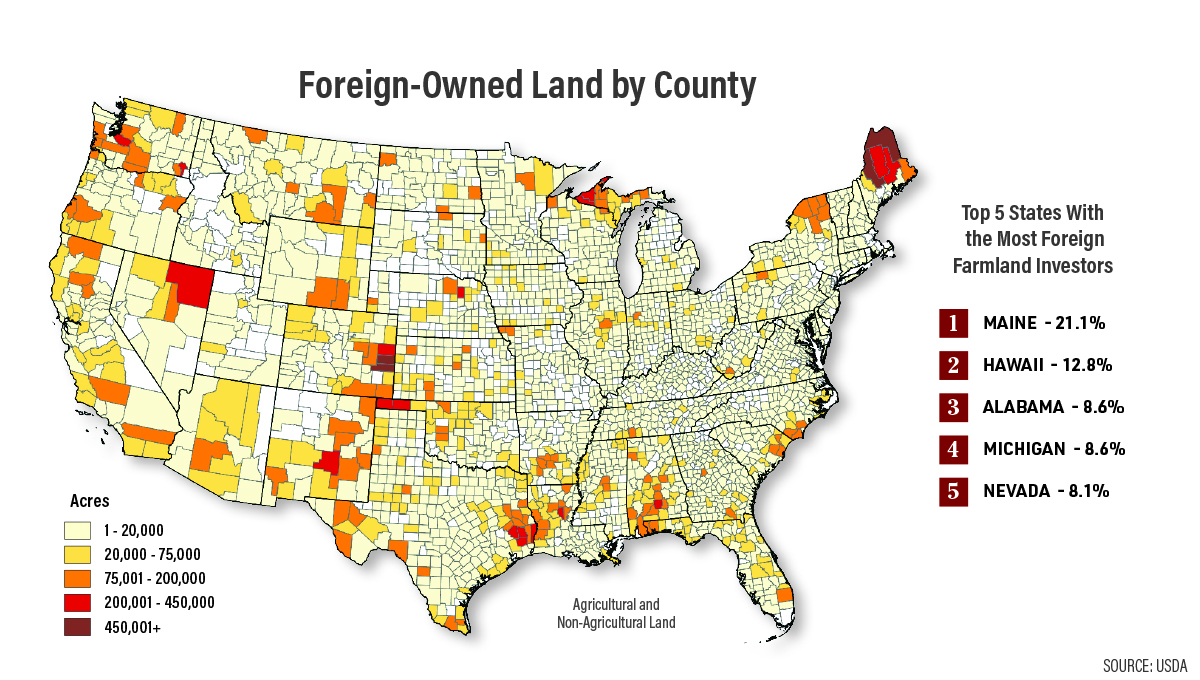

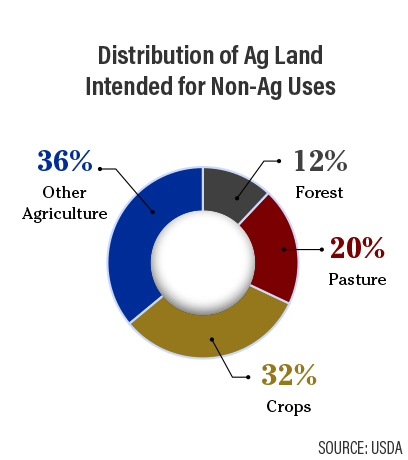

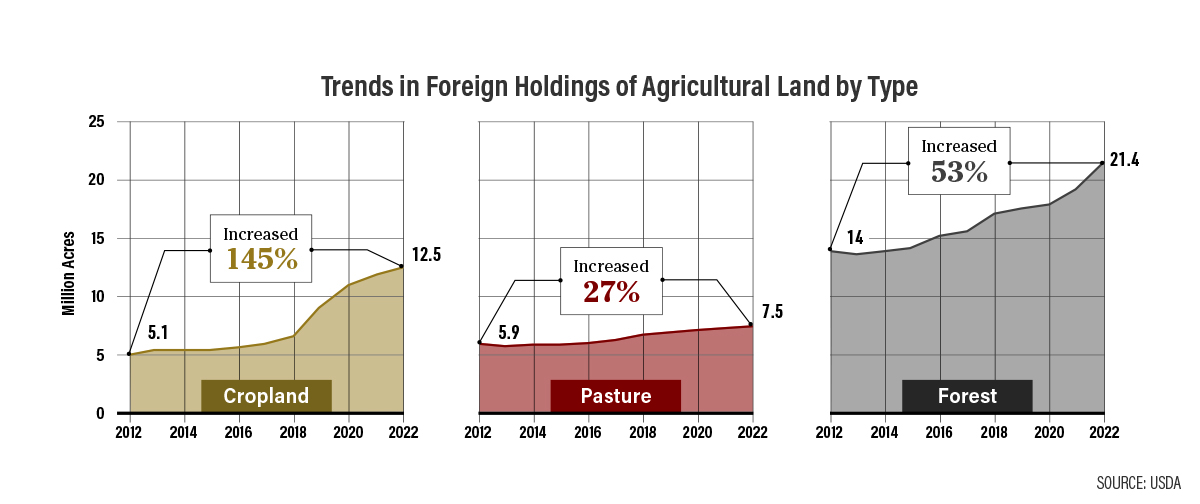

All told, 43.4 million acres of forest and farmland in the U.S., or 3.4% of all ag land, is foreign owned as of Dec. 31, 2022. Roughly 30 million of those acres are reported as foreign-owned, with the remainder primarily under a 10-year-or-longer lease. Of the 30 million, 66% is owner-operated, 14% has a tenant or sharecropper as the producer and 12% report a manager other than the owner or a tenant/sharecropper as producer. The remaining 7% are “NA.”

USDA says the two biggest Chinese-owned companies with land holdings in the U.S. are Brazos Highland and Murphy Brown LLC, which owns Smithfield Foods. Brazos Highland reported owning 102,345 acres, and Smithfield owns 97,975 acres.

The top five states with the largest Chinese holdings are:

- Texas at 162,167 acres

- North Carolina at 44,776 acres

- Missouri at 43,071 acres

- Utah at 32,447 acres

- Virginia at 14,382 acres

USDA reports those five states combined account for 85% of China’s farmland ownership. In Texas, USDA reports China has long-term leases associated with wind energy, and in North Carolina and Missouri, ownership is tied to Smithfield and producers who contract for pork production.

More States to Take Up Possible Bans in 2024

Foreign-held farmland has become a hot button topic on Capitol Hill. Farm Journal Washington correspondent Jim Wiesemeyer thinks it will continue to gain momentum in 2024 as a political ploy used by candidates.

“It’s an emotional issue, and it’s not a simple issue either,” Wiesemeyer says. “I was recently in Missouri, and some commodity leaders worry about the negative consequences of going too far. No one’s saying China should not be watched relative to buying farmland near airports, national security is involved in that case, but more than a few farmers are looking at the potential downsides for pork producers who contract with Smithfield and the number of acres they own.”

One of those unintended consequences is playing out in Arkansas.

“I’m announcing Syngenta, a Chinese state-owned agrichemical company, must give up its landing holdings in Arkansas,” says Gov. Sarah Huckabee Sanders, referencing a 160-acre research site owned by Northrup King Seed, a Syngenta subsidiary.

Eric Boeck, president of Syngenta Seeds North America, told Farm Journal editor Clinton Griffiths: “EPA and USDA many times require us to do work and permitting right in the same state as we’re going to sell products. One of the first things we have to make sure we figure out is how we work with the local community to make sure we’re still getting products tested in their backyard, so we have the ability to sell those products.”

Syngenta argues if they sell that particular farm, Arkansas farmers will be at a disadvantage because research can’t be done in the same weather and soil conditions.

“We’re heavy in the soybean market in Arkansas, some of those maturity zones, we have a very significant market share and savings,” Boeck says. “We want to make sure we’re protecting those farmers’ abilities to be able to use our products.”

Wiesemeyer says the bigger issue for U.S. farmland might be solar panels, with farmers in states like Missouri reporting companies have offered to pay more than $1,000 per acre cash rent to put solar panels on their farm. At such a high price, he says it’s eating up acres of farmland, with the potential to grow even more in 2024.