Do I Need A Trust?

Here’s what farmers should consider with this sometimes complex question

Most estate planning starts with a will. The legal document covers what to do with your assets and provides important direction on the care for minor children.

A will might be enough planning for simple situations. However, if you have a large estate, a second marriage, heirs with lifestyle concerns, children with special needs or charitable goals, you might want to consider a trust, says Kelly Jackson Hardy, CPA and principal with CLA.

“Whether you need a trust is about dollars, but it’s also about several other factors including control, asset protection, and family relationships,” she explains.

First, what is a trust? Simply, it is a set of instructions for managing a legal entity that owns property separate from the individual, says Shannon Ferrell, ag law professor at Oklahoma State University Extension.

“Think about a trust as a little miniature corporation,” he says. “You’ve created a separate legal entity that owns property by itself. So, when you put property into the trust, you don’t own it anymore, the trust does.”

TYPES OF TRUST

The basic categories of trusts are revocable living trusts, irrevocable living trusts and testamentary trusts. Hardy says you can also get into a slew of acronym trusts: CRAT, CRUT, IDGT, GRAT, SLAT, ILIT, etc.

“The basic trust is a revocable living trust,” she says. “Essentially during life, this trust operates as an extension of yourself. It can be changed and does not file a separate return. Upon death, it becomes irrevocable, and the assets are transferred per its terms.”

Most farmers, Hardy says, could benefit from a living trust for these two reasons:

- If all your assets are owned by the trust at death, there is no need to probate an estate. This not only saves you legal fees but prevents an inventory of your assets to be filed at the county for all your neighbors to view, she says.

- Administration of this type of trust is like a walking belt at the airport as opposed to walking up flights of stairs to get to the same place, she says. The trust moves the plan forward though administration and then moves the transfer of assets to the beneficiaries.

WEIGH THE BENEFITS

As you put your estate plan together, understand the purpose of each tool, says Connie Haden, founder and partner at The Law Firm of Haden & Colbert in Columbia, Mo.

“I see all the time people trying to jump around a trust, since they are more complicated and expensive than a will,” she says. “But they also provide you the most flexibility.”

In addition, once you set up a trust, she says, you title everything in your operation once. Then if you need to change your plan, you just change the single trust document.

“A trust can be very simple, or it can be very complex,” Ferrell adds. “Whether it’s simple or complex depends on how simple or complex your objectives are for what you want to achieve with the trust. In either case, your trust needs to be very carefully drafted.”

As you start or revisit your estate plan, Haden says you must stay focused on your big-picture goals.

“Rather than getting bogged down on if we should do a trust, come with an end goal in mind,” she says. “What is more important to me is for you to come in with a vision for what you want to have happen. Then we can talk about how to achieve that vision. Often it is a trust, but sometimes it is a different tool.”

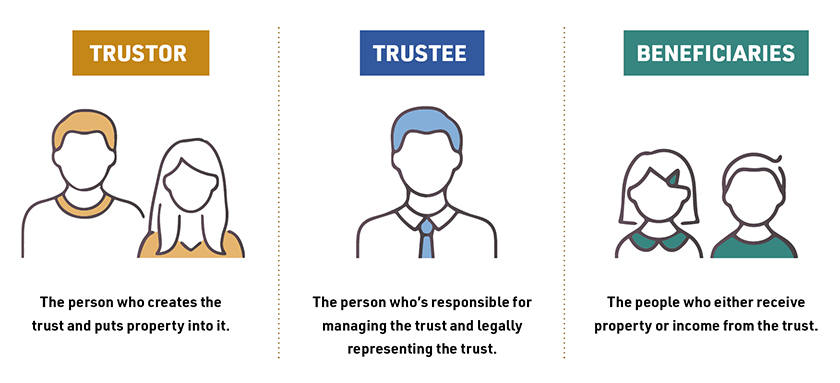

The Three Parties in a Trust

When you set up a trust, you identify three key parties, says Shannon Ferrell, ag law professor at Oklahoma State University Extension. While one person can hold all these roles simultaneously, you have to name people to each role:

- Trustor: The person who creates the trust and puts property into it.

- Trustee: The person who’s responsible for managing the trust and legally representing the trust.

- Beneficiaries: The people who either receive property or income from the trust.

Learn more about the transition options with trusts.

Sara Schafer, content manager for Farm Journal, knows asking good questions creates the most useful stories. She uses her Missouri farm roots to cover innovative operations, farmland trends, business topics and more.