Ag Economists Turn More Bullish On Soybean Prices, Corn Prices Are a Big Red Flag

Waning consumer demand for products like protein and other ag commodities continues to be a red flag for agricultural economists, according to the August Ag Economists’ Monthly Monitor. But even with signs of caution, they continue to be impressed with the staying power of the U.S. agricultural economy, as well as the U.S. economy as a whole.

The August survey is the third survey of the Ag Economists’ Monthly Monitor, a joint effort between the University of Missouri and Farm Journal. The first-of-its-kind survey collects insights from ag economists across the U.S. Nearly 60 economists are asked each month to provide their forecasts and views. They represent a wide geography with expertise in grains, livestock and policy.

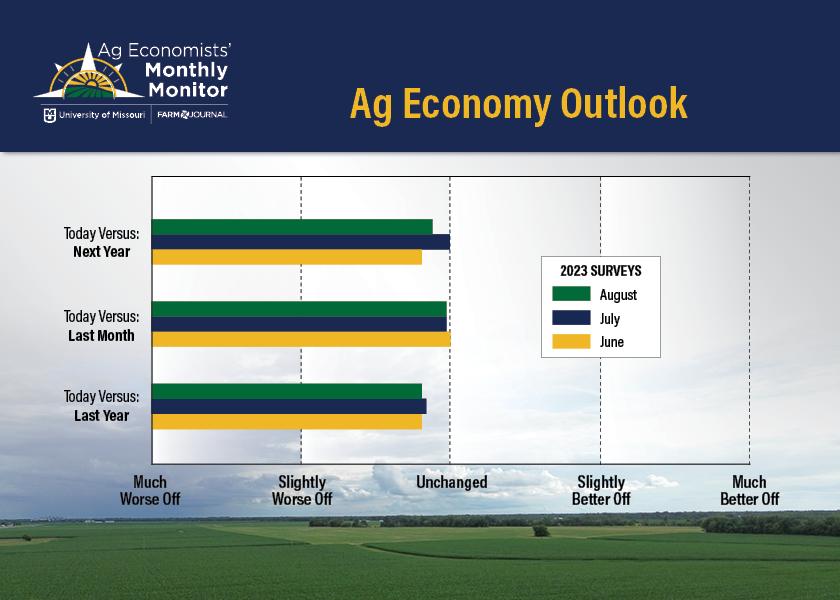

Scott Brown, interim director of the Rural and Farm Finance Policy Analysis Center who also helps author the Ag Economists’ Monthly Monitor, says the survey shows economists' views of the ag economy haven't changed much in the three months of conducting the survey. The August data show economists are:

- 5% less optimistic about the health of the ag economy a year from now relative to today

- 10% less optimistic when looking at the ag economy today versus 12 months ago

"I think the biggest thing to note is just how resilient we've been. And that shows in some of the answers we got back from the economists," says Brown. "Although there's been lots of concern about consumer demand and international demand for a lot of our commodities, the ag economy has been resilient."

The ag economists surveyed expect net farm income to hit $125 billion to $130 billion. According to Brown, that’s not the record $160.2 billion U.S. agriculture saw two years ago, but Brown points out that it’s still high.

“It just reminds me to say not as good as where we were a couple of years ago, but also maybe not as tough as some would have thought once we started to see these lower prices,” says Brown.

What Will Drive the Ag Economy Over the Next 12 Months?

The economists turned more bullish on livestock in the latest survey, while the outlook for corn prices produced more pessimism. But economists continue to be impressed with how farmers and ranchers have withstood higher costs on their operation.

"The financial strength on many farms is rather strong and many have taken advantage of relatively high prices for crops and cattle. Hogs and poultry are in somewhat worse shape now than last year. Looking ahead, I expect that lower crop prices and stable input prices will put a squeeze on high-cost crop producers. Consolidation across all of agriculture is something I expect to be a theme in the year ahead," says one ag economist in the anonymous survey.

"We're seeing an explosion of competitive production coming out of Brazil at the same time that geopolitical risks are increasing in a world facing mounting credit risks," was how one economist responded to the question.

"The current most-important factors are weather and input costs. In one year from now, it will be Brazilian production policy," says another economist.

"Agriculture is benefitting from somewhat lower input prices, but weather is creating challenges in production. During the next 12 months production costs should continue to moderate, but prices are also moderating so that the net change is slightly positive. A new farm bill needs to be completed to create more certainty and reduce revenue risk," is another response from the anonymous survey.

Corn vs. Soybeans Price Projections

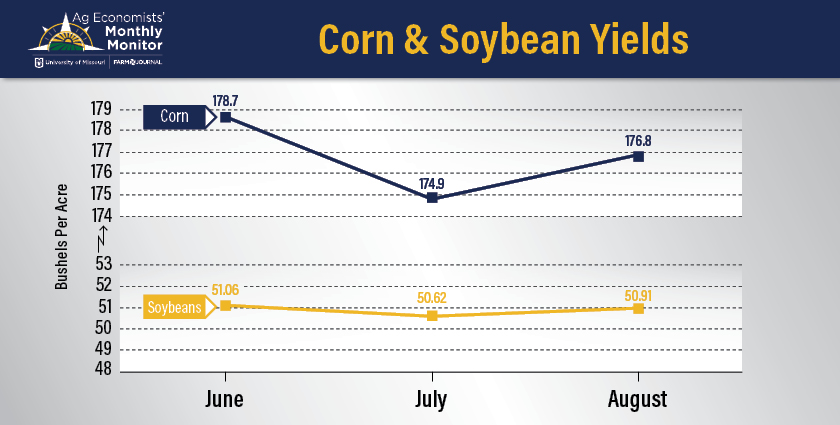

Ag economists are more optimistic about soybean pries than they are corn prices, and one of the main reasons is demand. According to the latest Monthly Monitor, economists indicate soybean prices will trend higher not just this year but also for the 2024/25 crop. For corn, the survey shows the opposite with the expectation for corn prices to fall.

"On the crops side, the one to be optimistic about is soybeans," says Brown. "According to the latest Ag Economists’ Monthly Monitor, economists say soybean demand is certainly stronger than we might see in a commodity like corn, as biofuels and renewable diesel will all continue to maybe drive some crushed demand as we look ahead."

Brown says, as a result, economists are also more optimistic on soybean prices moving forward compared to corn. Part of the concerns are due to an expectation for yields to increase, but the other is the negative outlook for demand.

“On the corn side, a little less optimism. I would say weak demand exports, in particular, seem to be a lot of what we have answered back from the survey. And the expected corn prices in the next 18 months ahead over the last three surveys certainly show a downward trend in what folks expect on the corn side," says Brown.

Economists say the biggest impacts on crop prices will come from:

- Demand domestically (including for feed grains) and abroad (particularly in China)

- War in the Black Sea if shipments from Russia are curtailed

- El Nino presence and weather in major crop production areas of the world

- Strong competition in the international corn export market and U.S. export levels

- U.S. crop acreage stable, better yields pushing down prices

Projecting the Positives Pieces for the Ag Economy

With so much concern about international competition and domestic demand, economists also pointed out some positives in the ag economy, including farmland values and the U.S. economy.

- "The land value market has a lot of supportive fundamentals under it and will withstand a couple years of negative farm income. As a result, farm balance sheets will stay rather healthy and those that have available working capital and cash will be positioned well," says one economist.

- "At least so far, the U.S. economy has proven more resilient in 2023 than many had anticipated," was another response in the monthly survey.

- "Lower fertilizer costs and a relatively stable U.S. economy," says another economist.

- "I see strong international markets for pork and beef as the most positive aspect regarding the outlook of U.S. agriculture," one economist says.

More Bullishness on Beef

Continued consolidation in livestock is a major concern for economists. The survey was completed on the heels of Tyson Foods and Smithfield announcing plant and farm closures for both pork and poultry. However, economists think consolidation in cattle will also be a major theme in 2024, and it could have an impact on major meat processers.

The survey shows ag economists think cattle prices could climb even higher over the next year.

"Not only have cattle prices been moving higher, but our economists have been upping their estimates of cattle prices to the tune of about $10 [per head] over the last couple of months," says Brown. "So a lot more optimism. I think that just has a lot to do with the short supplies of cattle that we're beginning to see in the marketplace."

Brown says economists are still concerned about the lack of profitability currently projected for pork producers, but they are turning more optimistic on prices.

"As we've done the last couple of months, prices have recovered and economists' outlooks have gotten a little brighter, even though we're talking about some fairly low prices. Dairy is the one that still sticks out as the worst, and our survey basically shows not a lot of change for prices with a projected $20 (per cwt) for the all milk price forecast for the next 18 months or so. If the costs stay where they are today, it makes that a pretty tough industry to participate in.”

What factors could impact livestock prices over the next six months? The main theme continues to be tighter cattle supplies and demand.

- "Beef cattle supplies will continue to tighten, and beef production will continue falling. Beef demand remains remarkably resilient," says one ag economist.

- "Factors impacting livestock prices include U.S. herd liquidation, global meat availability and domestic demand," says another economist in the anonymous survey.

- "Consumer demand will impact livestock prices the most in the next six months," the survey reveals.

"We asked folks a lot about what they see as important in the livestock markets as we look ahead, and we did see that consolidation word come up, especially in cattle markets," says Brown "So although we're talking about record cattle prices, and maybe at some point record profitability, although not today, I think there's a lot of concern about what this does for the industry long-term.

"I think packers are going to be in an awful difficult spot here for a period of time," Brown adds. "Feedyards could also be in a tough spot. It's tough to keep yards full with the lack of supplies of feeder cattle. So the idea is that these industries are going to continue to adjust. And I think 2021 and 2022 were just such phenomenal demand years that they almost masked what were some very high costs faced by all of the segments of the livestock industry."

Consolidation Concerns

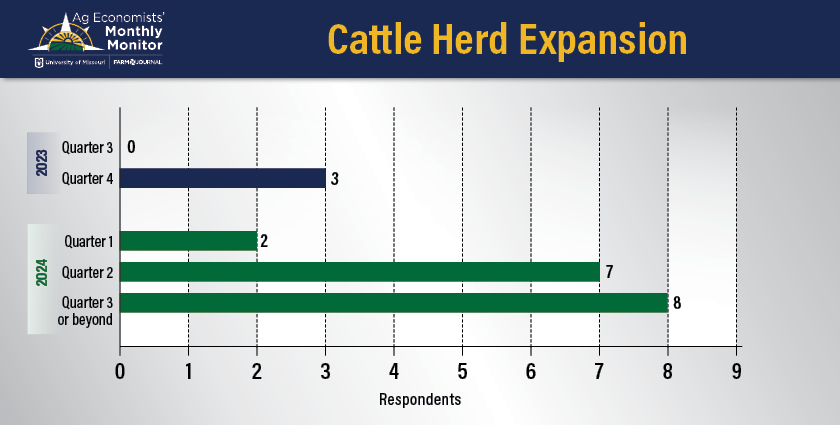

Ag economists think cattle prices could push even higher, a trend that could continue for at least another year. The August survey also asked economists when they think cattle herd expansion will start to take place. The majority think cattle contraction will continue for at least another year.

A smaller percentage think it could happen in the second quarter of 2024.

"It will probably be late 2025 or 2026 before we see significant increases in beef production. So if demand at all stays with us, we can be talking about these kinds of lofty prices for several months down the road," says Brown. "I kind of wonder when we talk about changing structure whether or not the cow-calf industry will look different. So maybe bigger operations, perhaps some of the smaller beef cow operations will have retired. And we won't see those back. So I’m curious to watch consolidation, what's been probably the slowest segment of agriculture to consolidate over time."

The survey also asked economists to explain the reasoning behind their herd expansion forecasts. Consolidation was also a major theme as economists explored what the current state of the cattle industry could mean for the future of agriculture.

- "I do think consolidation of all parts of the beef industry is coming. I think this will be a time when some of our well-established 100-cow operations will think about exiting," says one economist.

- "We will see prices that significantly surpass 2014-2015. Processing plants will consolidate due to fewer cattle available to process. Producers will be slower to expand than in 2014-2015 because of continued drought and higher borrowing costs. I expect the high prices to last longer than in 2014-15," says another economist.

- "Further reductions in slaughter will put continued pressure on beef processors while boosting prices for cattle producers," one economist says in the anonymous survey.

- "The impact of the smallest beef cow herd in 60 years will likely put pressure on processing and retail margins, may give a more competitive advantage to competing proteins, and could result in a smaller industry going forward," one economist says.