It's Starting: Why Recent Processing Plant, Farm Closures Signal Major Consolidation is Now Underway for Pork and Poultry

Farm Journal Report: Coping with Consolidation 8/12/23

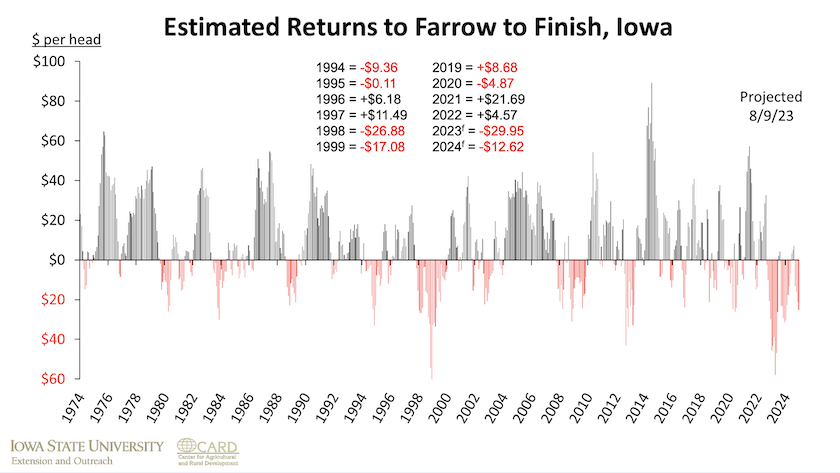

Talk to any farmer who used to raise pigs, and they’ll more than likely tell you it all changed in 1998. That’s the year that draws memories of agony and financial pain for many. Hog margins bled red, and it spurred mass consolidation.

The reality today is margins for hog producers could be worse than 1998, and it’s spurring what some think could be a similar situation to 1998: more consolidation in pork and poultry.

Tyson Foods’ decision to shutter four poultry processing plants yet this year and into early 2024, combined with Smithfield Foods closing 35 pig farms, are strong signals consolidation is already occurring, according to ag economists.

“It has been decades since the last time we've seen these kinds of signs of consolidation, and that just tells you where the industry is today,” says Scott Brown, an extension livestock economist with the University of Missouri.

Of the four Tyson poultry processing sites that will soon close, two are located in Missouri. Those two plants alone result in the loss of nearly 2,200 jobs. Smithfield’s pig farm closures will cause the loss of 92 jobs.

Not only are rural communities grappling with the possible effects and job vacancies the announcements will leave, but producers are also forced to find a new home for their birds, with some poultry and livestock producers possibly forced to exit the industry all together.

“With the Tyson announcement, I think some growers will likely have their contracts will be bought out, and they'll no longer be growing under contract for Tyson,” says Brown. “I think in other cases, and if you look at some of the information that's the Tyson’s put out there, it seems like some growers are going to have the opportunity to be growers for other plants that are nearby to their facilities.”

Crumbling Margins for Pork and Poultry Producers

Whether it’s poultry or pork, economists say the decisions are being driven by economics today.

“If you look at recent USDA data, it would suggest margins to broiler production have fallen 60% from July of 2022, to July of 2023,” says Brown.

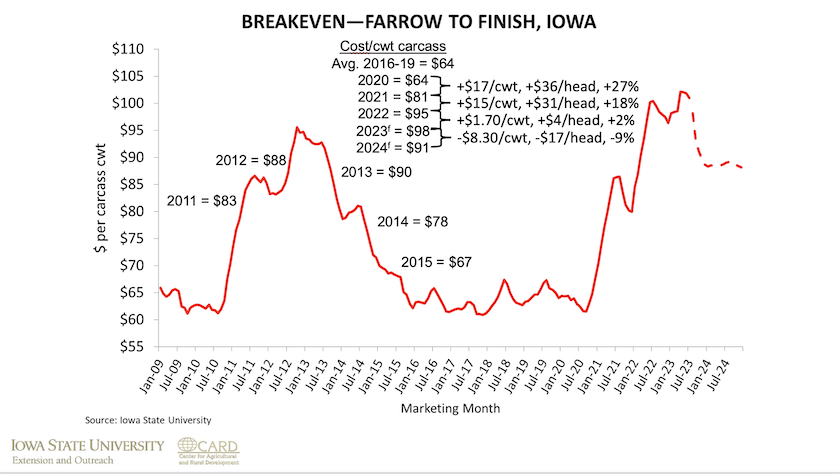

Pork producers are coping with similar economic headwinds, with pork margins crumbling as pork prices remain low and feed prices stay high.

Iowa State University’s Model for Profitability, which is shows farrow to finish operators in Iowa aren’t just losing money, forecasted 2023 margins look to be record-low.

“This is the worst annual year poor producers will ever have,” says Lee Shulz, an extension livestock economist with ISU who manages the Model for Profitability. “We always talked about 1998 as the worst year ever, but 2023, collectively, will be worse than in 1998.”

Iowa State’s data shows in 1998, the last time the industry saw mass consolidation, farrow to finish operators were losing $26.88 per head. This year, projections are those losses will hit $29.95 per head, more than $3 per head worse than 1998.

“And we're going to piggyback that with the next year, with at least what we're forecasting, is 2024 will be well below breakeven level,” Shulz says. “So, two consecutive years of large negative profits in pork production.”

The Expectation for Accelerated Consolidation

It’s pure economics that are producing such strong signals of consolidation, and possibly why announcements from major processing companies are already taking place. Economists warn that consolidation could not only continue, but only accelerate in the coming months.

“Packer owned hogs in the U.S. is up to 40% of the U.S. herd, and that's a number that's continued to increase,” says Shulz. “We could see increases in packer owned hogs, and if that continues, we’ll see consolidation with farms getting larger.”

Shulz says while last week’s announcements are a sign of consolidation, trouble started showing up in 2021 when Smithfield announced the closure of a 10,000 head a day pork processing facility in Virginia. Since then several more have closed, both in the U.S. and Canada.

“When you look at ongoing packing plant closures, both in the United States and Canada, it is a signal that we continue to see some contraction in the industry, as well as now we're seeing some farm closures that that are obviously impacting inventory levels,” says Shulz. “And this is really potentially the start of it, as you look out the next year to 18 months, as I mentioned, with those rather negative returns in the industry.”

Lack of Labor

As structural changes accelerate, economists say labor is another pain point today for both pork and poultry.

“Lack of labor availability is not a new issue, but I think it continues to be a problem for the for the poultry industry of, ‘Do I have enough labor to run that plant as efficiently as possible?’ And I think in many cases, the answer is ‘no,’” says Brown.

Purchasing Power and Negative Impact on Demand

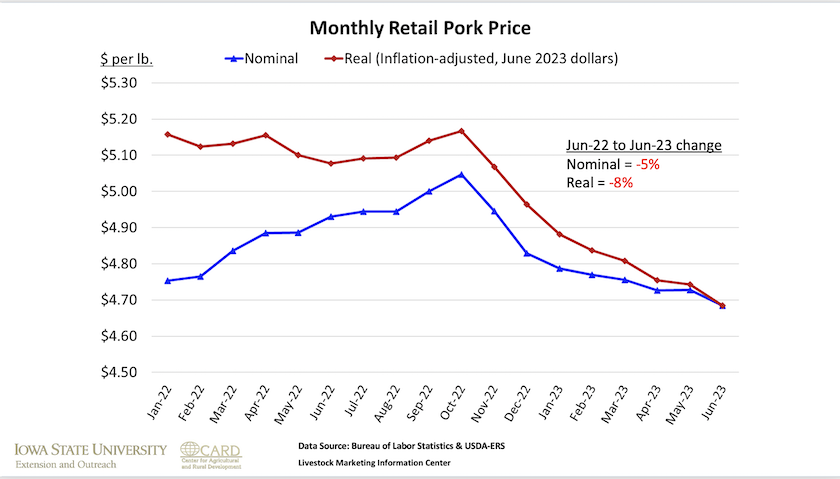

Labor availability is a major hurdle for processors, but so is the fact pork prices are low today.

“My data through June shows poor prices are down 5% compared to June of last year,” says Shulz. “But when we adjust for inflation, it's even worse. Pork Prices are down 8% compared to the same time last year when you adjust for inflation.”

Even on a national level, the Bureau of Labor Statistics numbers shows retail pork and poultry prices are also lower than a year ago, a sign of inflation impacts on shoppers.

“We've had at least a 10% pullback in most of those categories, and particularly the chicken and the pork complex,” says Glynn Tonsor, a livestock economist with Kansas State University. “Why is that? It's certainly not because costs of production have changed a lot. They're still elevated, but consumer buying power has been squeezed.”

Tonsor tracks meat demand in a Monthly Meat Demand Monitor. He says the Monitor shows consumers still want to buy protein, they’re just not able to buy as much right now.

“The Meat Demand Monitor project, that's Beef and Pork Checkoff funded here at K-State, continues to show strong interest in keeping meat protein in your diet. So that isn't the narrative here. Rather, I think it is an issue with purchasing power,” Tonsor explains.

Shulz says consumer demand is driven by consumer incomes, prices of other protein substitutes, as well as taste and preference. Today, he says it’s the consumer income piece that’s faltering, which may be a product of the Covid-19 pandemic and the amount of money that poured into the U.S. economy.

“We really inflated consumer incomes during the pandemic,” says Shulz. “We pumped a ton of money into the economy, money supply increased roughly 40% in two years, consumers had a lot of money to spend and they spent it on protein, including pork, and they had a lot less things to spend it on during the pandemic.”

Now that incomes have tightened with no more pandemic related relief and assistance being sent out to Americans, as well as inflation and higher interest rates pinching their pockets, it’s impacting how much protein consumers can afford to buy.

“It's not just pork, but when we look at pork, this is the third consecutive quarter that we've seen pork demand below year ago levels,” says Shulz. “And so while 2022 will really stood out as a very strong pork demand year, and really helped offset a lot of the higher costs we had, we're starting to see that that pork demand decline.”

Tyson Foods’ CEO told Yahoo Financial during an interview last week, that this current period is one of the most challenging macro environments he’s ever seen in his four decade-long career.

Tyson Foods (TSN) stock slips after reporting an earnings miss, underperforming with

In an exclusive interview, Tyson Foods CEO Donnie King told Yahoo Finance that there has never been "a more challenging time" in his 40 years in the business. "The macro environment is challenging, and it'll continue to be challenging for a bit," King added.

What makes today more challenging than even during the COVID pandemic? Shulz says it’s actually tied back to the pandemic.

“You can think about this as just a really long tail on to that because you got to think about all the outside forces that are impacting pork producers,” says Shulz. “You have higher interest rates still inflation well above, you know, the 2% that the federal reserve benchmarks, you have employment issues, consumer incomes are obviously being impacted health of the general economy questions on if we will enter a recession, fiscal policy, monetary policy, they're all impacting producers’ profits.”