Could Drought Cause Brazil to Lose its Top Spot as the Largest Corn Exporter in the World? Economists Weigh In

Agricultural economists have little doubt about Brazil remaining the world’s top exporter of soybeans for 2023/24; however, the corn export outlook is a bit murky with potential production problems for the safrinha corn crop casting doubt on Brazil holding on to the top spot in corn.

Dry weather toward the beginning of the growing season didn’t dampen Brazil’s soybean exports. New numbers show Brazil's soybean exports for the first four week of January reached a new record of 2.6 million tons.

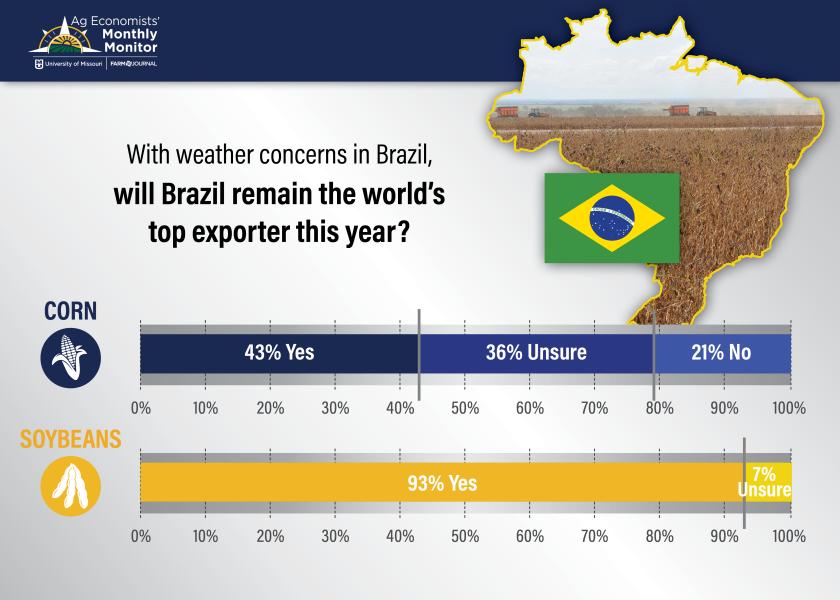

According to the January Ag Economists’ Monthly Monitor, it’s a trend that could continue, despite projections for lower production. The survey of nearly 70 ag economists from across the country found 93% of ag economists say Brazil will remain the world’s largest exporter of soybeans this year.

“On the soybean side, that was a clear indication that Brazil would continue to be the lead exporter of soybeans,” says Bill Lapp, founder and president of Advanced Economic Solution and a respondent in the January Monthly Monitor. “They're increasing their acreage, there's a rebound there, so even with poor weather, there's going to be a recovery in their production. Corn is more iffy, and it will depend on the final, second crop there, the suffering of crop and how that ends up.”

The January Ag Economists’ Monthly Monitor revealed economists’ views were more mixed on corn. Forty-three percent of economists think Brazil will remain the world’s top exporter of corn, and 21% disagree. University of Missouri ag economist Ben Brown says it’s Brazil’s title to lose, and it all hinges on timing.

"I think weather is playing into that uncertainty, maybe more on the corn side: What's the crop in Brazil look like at the end of the day? And some stronger corn exports out of the United States maybe made that not quite as easy of an answer as it’s been for soybeans,” Brown says.

While the planting season has just started for the safrinha corn crop, it's the bigger production generator in Brazil. Farmers in Brazil plant corn year round, but the safrinha crop accounts for 70% to 75% of the country's production each year.

Krista Swanson, lead economist for National Corn Growers Association (NCGA) points out it’s still early, as Brazilian farmers are just now beginning to plant the safrinha corn crop in Brazil.

“I think that all eyes are on what actually happens with that safrinha corn crop,” Swanson says. “Weather dictates how many acres get planted, I think as we also look at where prices are right now, do those farmers have an economic incentive right now to even plant corn as a second crop? I know some of some of those farmers, last year, were selling that second crop at a loss. And so if you're that farmer making that decision, you've got a lot to weigh. You're potentially getting it planted later than normal, and then you know that the price isn't there to really drive those additional acres.”

Swanson says that’s why the market is watching the situation closely, to see how weather impacts planting and if farmers plant as many second crop acres as intended.

Related Stories:

Why Ag Economists Think Net Farm Income Could Fall to Lowest Level in 3 Years