USDA Makes Cuts to U.S. Yields in August Report, Analysts Say There Is One Big Caveat

USDA’s first farmer survey-based yield estimate offered few surprises, but analysts say the yield estimate might already be out of date due to recent rains. USDA also made more cuts to demand as the export picture remains sluggish.

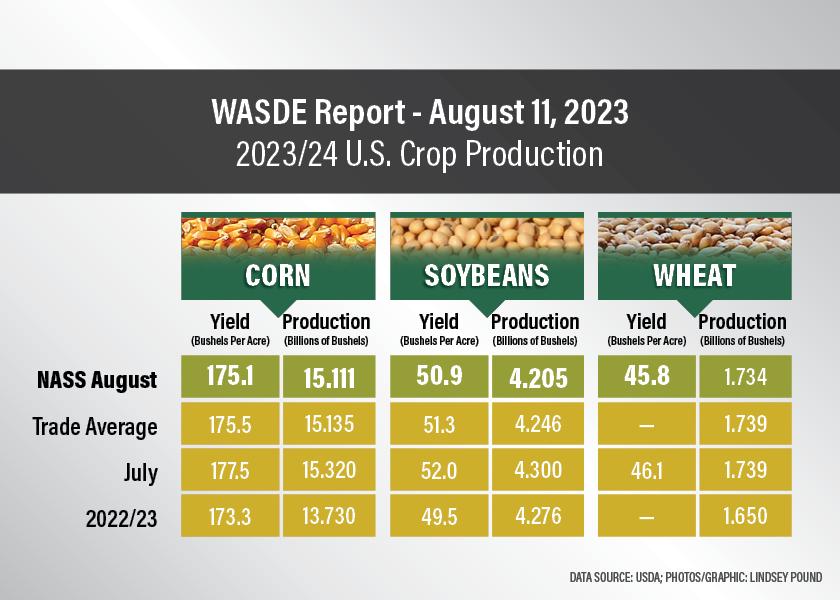

According to USDA’s August Crop Production report, USDA-NASS made cuts to the national yield estimate.

- Corn yield: 175.1 bu. per acre vs. 177 bu. per acre in July

- Soybean yield: 50.9 bu. per acre vs. 52 bu. per acre in July

- Wheat yield: 45.8 bu. per acre vs. 46.1 bu. per acre in July

The Yield Debate and Timing of the August Survey

The method used to estimate yield changes in August each year if different from how yields are calculated earlier in the growing season. Up until this month, the World Board handled the yield estimates and produced those via a model they use every year. This month, NASS takes the reins, conducting a farmer survey which asks farmers for crop estimates based on August 1.

Analysts say the only problem with that is one of the biggest rain events of the year fell after August 1 this year.

"The stuff prior to August is more of like a formula based approach," says Joe Vaclavik of Standard Grain. "They have formulas that are based on a number of different things. This is mostly operator survey, so to go back to the date thing, I mean, that rain event in early August was probably the biggest rain event of the whole summer. That happened last weekend, after August 1. So, I don't know what degree of that, if any, is reflected in these numbers."

Vaclavik says if the rain event was excluded in the August report by USDA-NASS, then he thinks the yield numbers are already old news.

Up until the big rain event, many fields were in desperate need of a rain. While some areas are still waiting, Matt Bennett of AgMarket.net says those rains made a big difference in areas, especially for soybeans.

"As of August 1, you've got to assume the USDA had the room to go ahead and make an a yield adjustment lower," says Bennett. "We just had a massive rain event this past weekend over a pretty good chunk of the Corn Belt, which would lead me to believe that if the bean yields especially are as of August 1, they're probably going to be discounted somewhat, which you could say that it was a friendly report from a yield standpoint on both corn and beans. But at the same time, whenever you're looking at yield, whenever you're looking to carry out, it was all within the range of trade guesses."

Read More: Corn and Soybeans Fade USDA Cuts to Yields and Ending Stocks: Timing of Surveys May be the Answer

Bennett says the markets initially were higher after the report, but he thinks once traders digested more of the numbers, it was clear demand is still a problem and that the yield data may already be out of date due to the rains that hit after the first of August.

"I think it's pretty clear after the report was released, you had a little bit of a bump in the market prices, and then all of a sudden, we kind of traded back towards unchanged. And I believe that that's a true indication that the trades taking a look and saying, 'You know what, yeah, maybe yields are down a little bit as far as the print for this report, but it's as of August 1,' so I think people have discounted it."

Dampening Effect of Demand

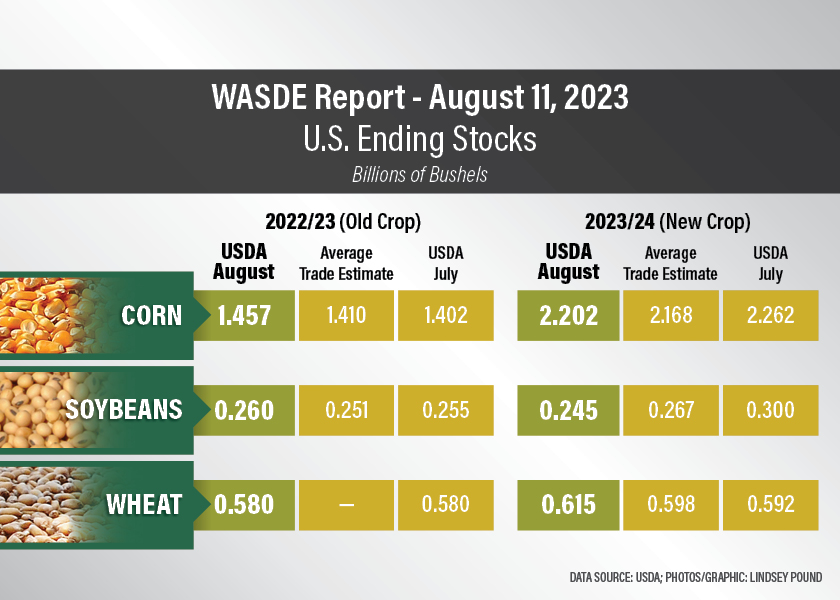

USDA's WASDE report also made more cuts to demand. Highlights include:

- Old crop corn exports cut by 25 million bushels

- New crop corn exports slashed by 50 million bushels

- Wheat exports lowered by 25 million bushels

- Soybean exports trimmed by 25 million bushels

"You could call the yield numbers surprising to some degree," says Joe Vaclavik of Standard Grain. "The numbers were slightly lower than what the trade had expected, but not super bullish versus expectations. I do think USDA did what they typically do. When they cut supply, they also cut demand. So we ended up with carryout numbers, especially in the case of corn that were actually larger than expected, soybean carryout number was lighter than expected, but USDA did again what they normally do, they cut demand as they cut supply, which I think is warranted given the pace of things like new crop export sales."

Vaclavik says the caution he has with exports is it's still early in the year, but he thinks they were justified.

"The export picture could absolutely change. It's super, super early," says Vaclavik.

According to his statistics, new crop sales are 26% below last year. USDA's report on Friday shows new crop exports will be up 26% versus a year ago.

"So, if you're going to argue anything, you've got to argue that they're still overstating exports," says Vaclavik. "And the same can be said for soybeans, sales are off 42% versus last year, USDA says we're going to be off 8%. All that being said, the fact that the cuts to exports are probably justified, it can change really quickly. I mean, the deficit in corn could be made up through like two or three flash sales to China of the right quantities. So it's very, very early yet remember. We're talking about a marketing year that hasn't even started yet. So while it looks bad now, it could absolutely improve. And that's part of the market's function with these lower prices is to stimulate some demand."

Bennett calling the cuts to demand no big surprise, considering these estimates were from the beginning of the month.

"As of August 1, our thought process was especially really in the case of corn or soybeans that you had room to take a little bit of demand out and in the first place that we would go to do that would be exports, mostly because of the way that the new crop book looks," says Bennett. "I mean, as of this point, we're certainly running pretty far behind. We're catching up, though, the last couple of weeks have been a welcome surprise, kind of seeing some of these new crop sales actually show up, which is really been nice to see. But I was not surprised whatsoever that exports would come down to 50 million out of corn. I think you could take a little bit more yet."

Bennett points out Brazil's large crop offers ample supplies, and he thinks if prices do trend lower, it could possibly attract more demand.

"I also think you've got to keep an eye on that Black Sea region, whether you're talking corn or wheat," says Bennett. "I mean, there's no question that you've still got the supply there, most of the time that we see a bomb, you see the markets take off on a little bit of a jump, then they get sold pretty quickly. And the reason is, because people know that the supply is there. It's just that we're disrupting the world flow."

Bennett thinks the situation in Russia is something to watch, especially if Ukraine retaliates and impacts exports out of Russia.

Countdown to Pro Farmer Crop Tour is On

As the yield debate in the U.S. continues, the Pro Farmer Crop Tour is set to ground truth yield estimates, uncovering yield estimates and the crop potential in the field. The tour kicks off Monday, August 21 in Ohio and South Dakota. Pro Farmer says the goal of the tour is to get a strong objective view of corn yield potential across the Corn Belt during the third full week of August.

While scouts will search fields during the day, nightly meetings give farmers the unique opportunity to hear those results first-hand. Below is a schedule of the nightly meetings, and you can attend by registering here: Click here to register.

2023 In-Person Crop Tour Meetings

WESTERN TOUR

Grand Island, Neb.

Monday, Aug. 21

Riverside Golf Club | 2820 Riverside Drive | Grand Island, NE 68801

Nebraska City, Neb.

Tuesday, Aug. 22

Lied Lodge and Conference Center | 2700 Sylvan Road | Nebraska City, NE 68410

Spencer, Iowa

Wednesday, Aug. 23

Clay County Fair and Events Center | 800 West 18th Street | Spencer, IA 51301

EASTERN TOUR

Noblesville, Ind.

Monday, Aug. 21

Embassy Suites Noblesville | 13700 Conference Center Drive S. | Noblesville, IN 46060

Bloomington, Ill.

Tuesday, Aug. 22

DoubleTree by Hilton | 10 Brickyard Drive | Bloomington, IL 61701

Iowa City, Iowa

Wednesday, Aug. 23

Hyatt Regency Coralville | 300 East 9th Street | Coralville, IA 52241

FINALE

Thursday, Aug. 24

Rochester, Minn.

Mayo Civic Center | 30 Civic Center Drive SE | Rochester, MN 55902