USDA Makes Two Surprise Changes to Corn Yield and Demand In Its Latest Crop Production Report

In a surprise move for so late in the season, USDA raised its corn yield forecast by nearly 2 bu. per acre in the November Crop Production Report. With a larger crop currently being harvested across the U.S., it means estimated corn ending stocks is getting even bigger, but analysts say the increase wasn’t as big as it could have been since USDA also boosted demand.

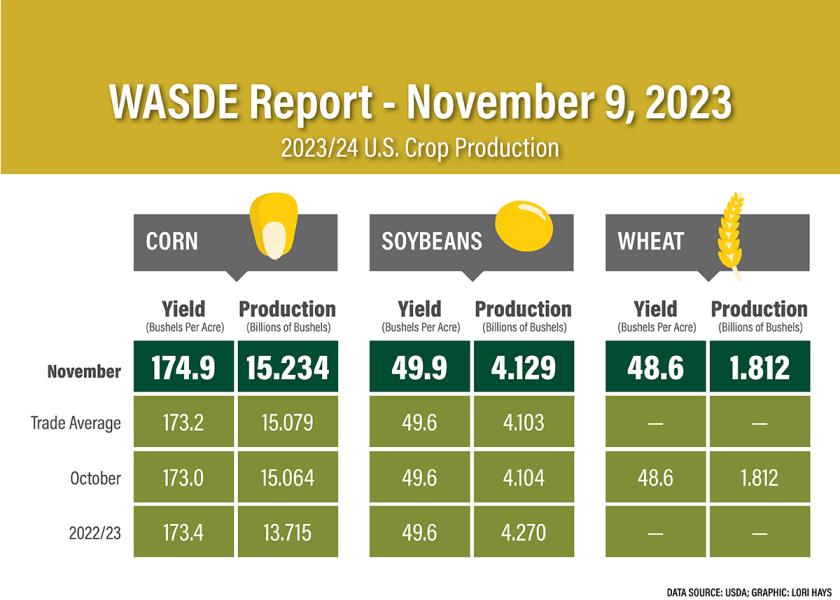

USDA-NASS made adjustments across the board, upping the yield forecast for corn, soybeans and cotton in the November report.

- Corn yield: 174.9 bu. per acre, up 1.9 bu. per acre from October

- Soybean yield: 49.9 bu. per acre, up 0.3 bu. per acre from October

- Cotton yield: 783 pounds per acre, up 16 pounds per acre from October

One of the biggest surprises in the November report was the large increase to corn yield, according to Matt Bennett of AgMarket.net.

“It's not typical to see that kind of increase,” says Bennett. “In the past, especially whenever they got in the field in August, you'd hardly ever see something like that. Now that they're in the field in September, I think that it's going to be a little bit more prevalent at times.”

He says the other surprise was the increase in demand, which Bennett thinks cushioned some of the possible impact from such a large increase to production.

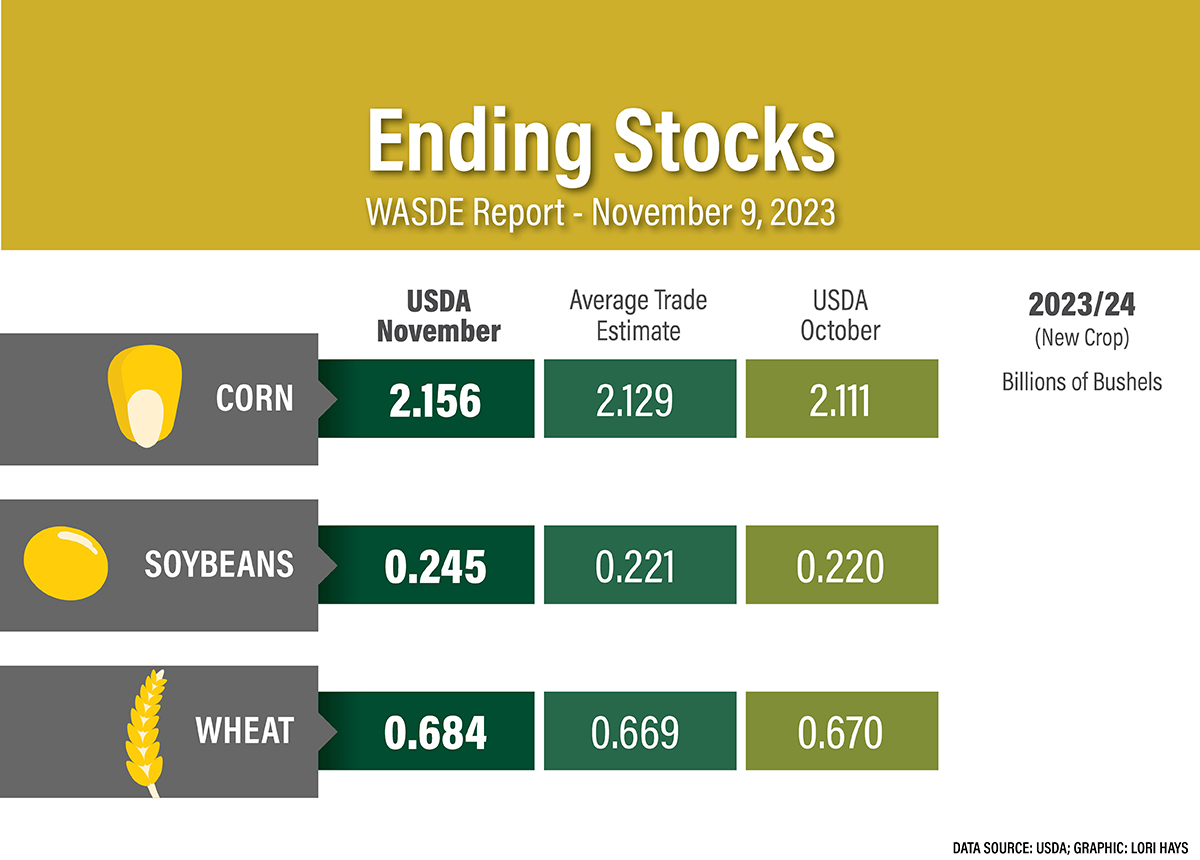

“As soon as I saw the 174.9 yield in corn, because that's the number that catches your eye first and what you're looking for, I thought we'd be down 20 cents in corn,” he says. “And then you see that carryout only goes from 2.111 billion bushels to 2.156 billion bushels, you realize it’s not as bad as it could have been.”

November 2023 Corn Yield Bushels and Percent Change from the Previous Year pic.twitter.com/GSD16pJV1R — Jim McCormick (@jpmccormick3) November 9, 2023

USDA’s November report increased total corn demand by 125 million bushels, which included a 50-million-bushel revision to feed usage, and an increase of 25 million bushels to ethanol demand.

“That's pretty interesting, though, to see them take yield up 2 bushels [per acre] and then see carryout grow by 45 million bushels. Quite frankly, I would have never said those two things would go hand-in-hand, especially with some of the demand concerns that are still lingering."

November 2023 Corn Yield United States pic.twitter.com/FkS8d8lxlO — Jim McCormick (@jpmccormick3) November 9, 2023

Bennett says even though the increase in demand helped offset the bigger crop, the 2.156 billion bushels ending stock estimate is a nearly 50% increase in just a year. He says producers need to keep in mind that if Mother Nature brings favorable weather during the growing season next year, it’s possible that corn ending stocks could climb into the 3-billion-bushel range.

The Story in Soybeans

The November report was less of a story for soybeans. While USDA made a slight increase to yield, there wasn’t much change on the demand side of the balance sheet. However, with the increase in yield, it did increase the soybean ending stocks estimate to 245 million bushels.

November 2023 Soybean Yield pic.twitter.com/duoNBcj9dZ — Jim McCormick (@jpmccormick3) November 9, 2023

“Revising the 220 [million bushels] carry to 245 is still extremely tight, but bottom line is when you see the export sales that were posted this morning, they were massive. We’re talking 1.7 million tons to China and unknown destinations, which is likely China. And so China's back, and I think it’s because they’re a little bit nervous about what's going on in South America.”

Bennett says while the 2023 U.S. crop production story isn’t over, and there’s still a chance USDA could also raise its soybean yield forecast in the January report, the market is currently focused on South American weather.

“Without the weather influence from South America, I'd be pretty bearish. I don't like being bearish, but I just would be when you’re looking at world stocks of 115 million metric tonnes. That's just a lot of beans. But, let's say you take 10 million metric ton or even 20 million metric tons out of production with Brazil, if they stay in this just ridiculous weather pattern that they're in, there's no question that the bean market could be quite dynamic moving forward,” says Bennett.

He says AgMarket.net is encouraging producers to lock in a worst-case scenario for prices, while leaving the upside open on a few bushels. That way if a rally takes place, producers can take advantage of it.

“Because if this weather straightens out as a lot of times it does for Brazil, then there's no question that downside could be pretty wild as well,” he adds.