Corn and Soybean Prices Tank After USDA Report Makes Surprising Revisions to Yield

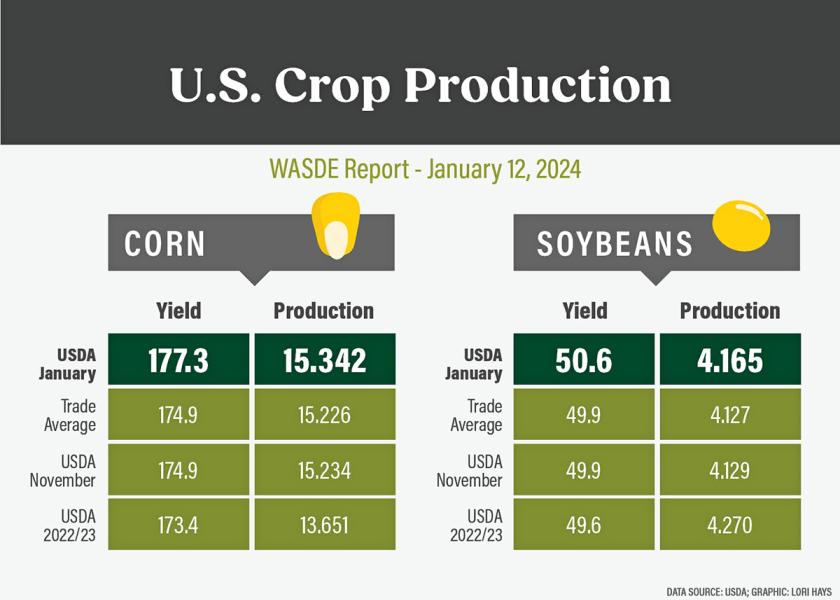

USDA’s final look at crop production for 2023 caught the commodity markets by surprise. The agency increased the final yield estimates for both corn and soybeans, and as a result, prices plummeted on Friday.

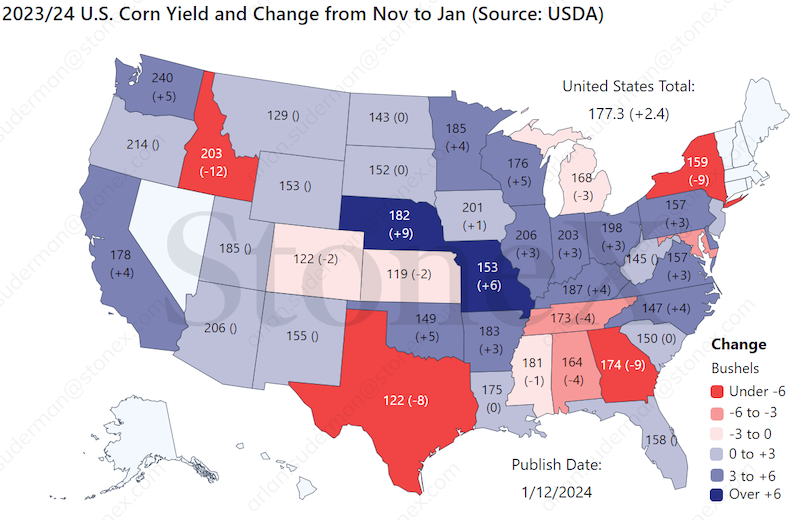

The big news in the report was the revisions to yield. USDA raised the national corn yield to 177. 3 bu. per acre in the January report, which is a new national record yield. It’s also a big jump from November, when USDA had the national yield penciled at 174.9 bu. per acre.

USDA also cut harvested acreage, but with the big increase in production, USDA pegs the 2023 corn production figure of 15.34 billion bushels.

The increases to yield and production were larger than what the trade expected, which caused corn prices to sink.

“We got a lot of criticism for our estimate all summer long being too high. And we ended up too low,” says Arlan Suderman of StoneX Group. “This crop, I’m just really impressed with, not just the genetics of it, but farmers with their technology, the seed placement, just the management of it. They are getting better and better at withstanding the stresses and it just makes you wonder how good this crop might have been had we not had the stresses we had.”

USDA also increased demand, which helped offset a portion of the increased yield. USDA increased feed use by 25 million bushels. The agency also increased ethanol use by 50 million bushels.

“Those revisions were pretty much in line with what the trade expected,” says Jim McCormmick of AgMarket.net. “And I guess it's a good thing because without those upward revisions of demand, this carryout would have really exploded to the upside. And I think the market could've had an even worse negative reaction than it's currently having.”

Surprise in Soybeans

USDA also surprised traders with the increase in the soybean yield estimate. USDA raised it’s soybean yield forecast for the 2023 crop to 50.6 bu per acre, which was up from the 49.9 bu. per acre forecast in November. Soybean production is now pegged at 4.16 billion bushels.

Suderman says these yield increases are something farmers should note, especially with the current debate on how much of an impact weather will have on Brazil’s crop that’s currently in the ground.

“The same genetics we plant here we plant in South America as well, essentially, so we need to look at South America in that same light,” Suderman says. “This crop really did well, especially in eastern Midwest. We saw some really good yields from corn and soybeans this year. And some of that may have been some of the benefits from the smoke coming from the Canadian fires. That's one of the theories now that was sulfur and some other positive effects were coming from that smoke.”

Cuts to Brazil

After drought impacted Brazil’s crop for much of the growing season, USDA cut its soybean forecast in Brazil to 157 million metric tons. That’s down from the 161 million metric tons forecast in the last report. USDA also trimmed its corn estimate for Brazil by 2 million metric tons.

“Traders were looking for bigger cuts,” McCormick says. “The rhetoric I think was even for bigger cuts and what the average straight guess was. So yeah, it was definitely a little bit disappointing. But time will tell where we're at. Some of the modeling I've seen for the weather is that we are going to turn a little bit warmer and drier here in the middle part of January, and with this latest crop that has been planted, that could cause some problems to that crop and still shrink it. And of course, we still haven't started planting safrinha corn crops. So the size of that crop is yet to be determined.”

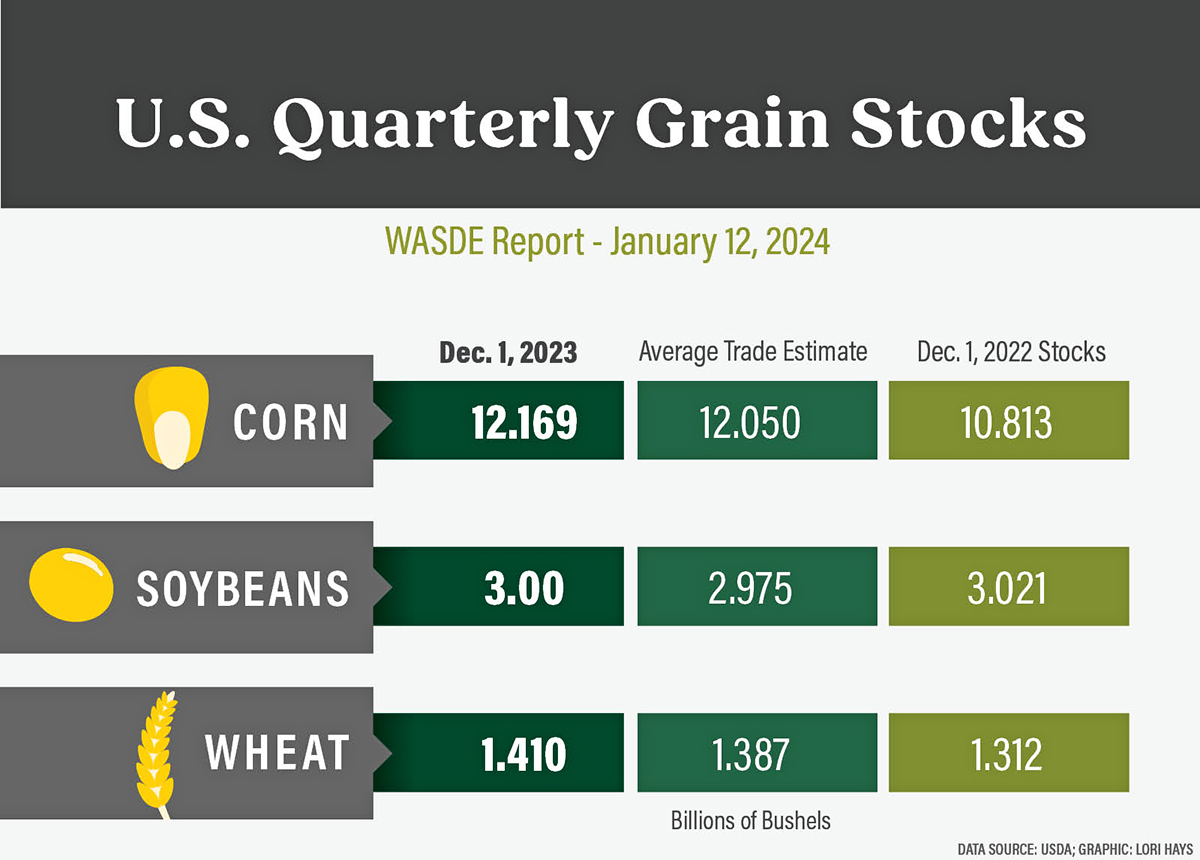

Quarterly Grain Stocks

USDA's revisions to the 2023 crop production numbers pushed the quarterly grain stock estimates higher and above trade expectations.

Corn stocks are forecast up 13% to 12.2 billion bushels. Soybeans were adjusted down 1% from December to 3 billion bushels.

Wheat supplies on December 1 were forecast to be up 8% from a year ago at 1.41 billion bushels.