Flashback to Previous El Niño Trends

The ink was barely dry on last month’s column on the effects of El Niño on South American weather before a 70¢ weather rally ensued.

Media hype was that it was too soon to be concerned about weather in South America, but price is discovered in the futures markets and looks ahead to discount what-if scenarios. Since late planted or replanted soybeans affect the safrinha corn crop in Brazil (75% of the total) what effect might occur under El Niño?

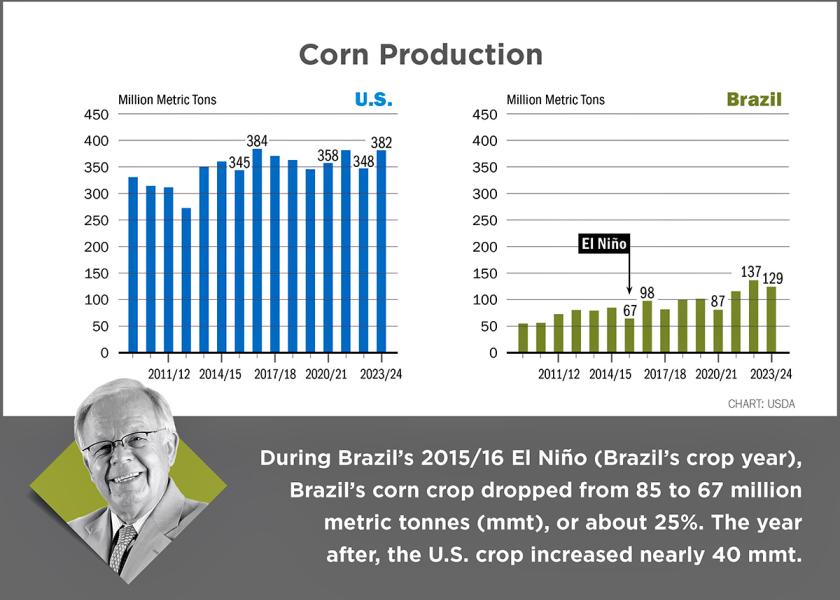

The only reference we have is the history of past El Niño years. Circumstances change of course, but the most recent decent reference is the El Niño of 2015 for South America. Brazil’s corn crop dropped from 85 to 67 million metric tonnes (mmt), or about 25%. Admittedly, an 85 mmt is small in comparison to the 137 mmt produced last year, but a comparative percentage analysis would suggest a drop of 34 mmt from “potential” is possible. Is it probable? Perhaps not. But market psychology being what it is, end users give it thought, and the market can trade it. Is it enough to change prices greatly?

Variability of Production

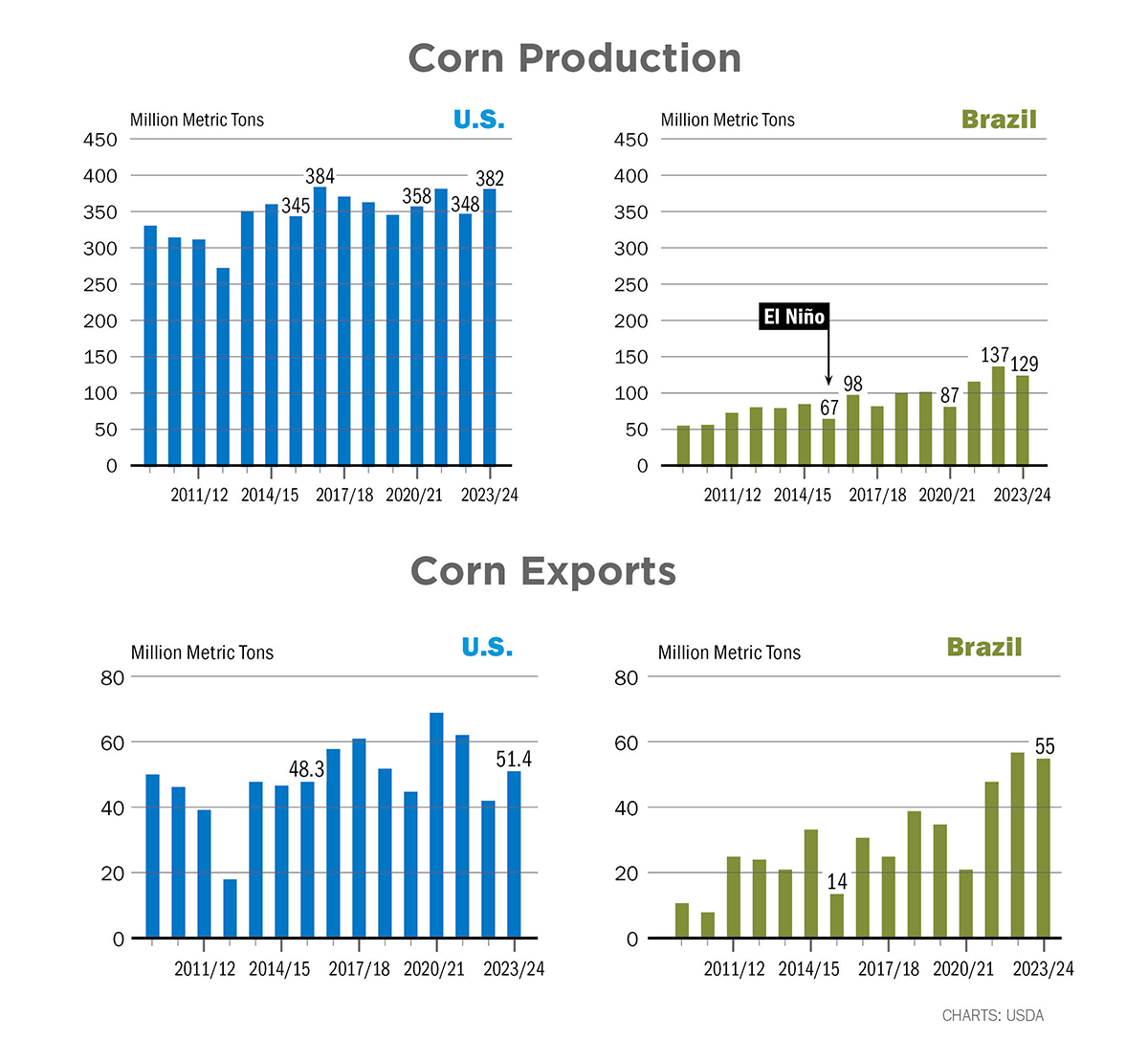

I wrote last spring of the potential outlook for corn to print near $4.50. It came about four months ago on news that is now old news. Everyone knew 60 days ago of the 2.2-billion bushel carryover for U.S. corn, but corn has not made new postharvest lows. Is a 34 mmt drop in Brazil corn enough to change market psychology? Brazil’s crop in 2020/21 was just 87 mmt, so you bet it is possible whether through acreage reduction, weather or some of both. Even a small percentage of a big number is still a big number. Ideas are now permutating through the media of a “3” in front of prices in order to get rid of the excess. A 15 mmt reduction is 600 million bushels. A 600-million bushel reduction in Brazil has occurred before as recently as 2020/21.

Honorable mention of the El Niño effect on other major producers is warranted. During Brazil’s 2015/16 El Niño (Brazil’s crop year), European Union (EU) corn production dropped 17 mmt. The year after, the U.S. crop increased nearly 40 mmt.

The production figures point out the variability of respective production. Every country produces corn, some not enough while some produce in excess and have exportable supplies. It is when one of the major exporters has a production shortfall, like Brazil or the U.S., that prices are affected. If there is too much in the world, price seeks market clearing levels to get rid of it. If not enough, price seeks a level where someone can’t use it.

Our price discovery system is efficient. Education seems lacking, but odds are we will all get one (education) one way or the other as the laws of supply and demand have not been repealed. A black-swan event could be in the making.