2023 Crop Production Déjà Vu? USDA's Latest Report Shows Brazil's Crop Isn't A Disaster, Despite Crippling Drought Early On

Despite drought and weather concerns to finish 2023, South America is still sitting on a big crop. USDA's latest WASDE report released on Friday made minor revisions to the South American crop production estimates, and even raised the corn production estimate in Argentina.

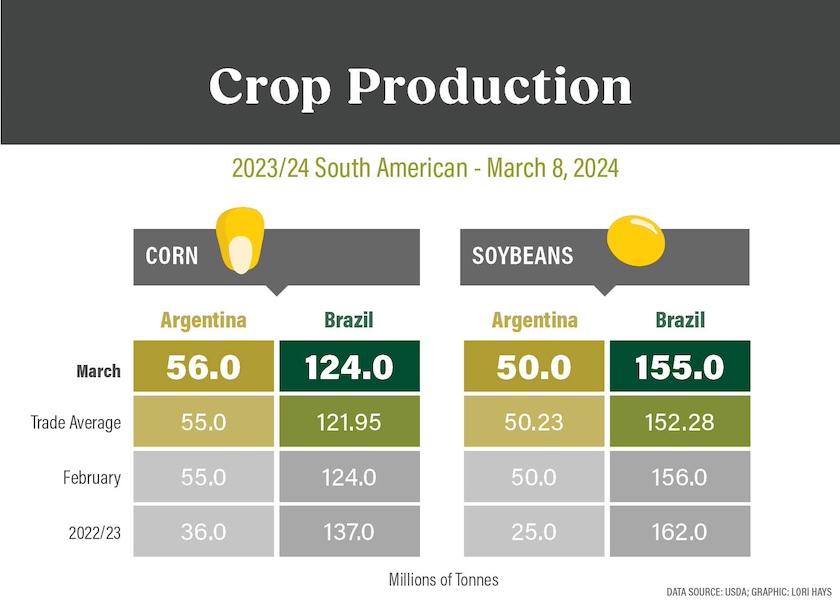

In the March WASDE report, USDA made the following revisions:

- Cut Brazil’s soybean production estimate by 1 million metric ton (mmt) to 155 mmt.

- No changes to the Brazilian corn crop estimate of 124 mmt.

- No changes to Argentina’s soybean production estimate of 50 mmt.

- Raised Argentina's corn crop estimate by 1 mmt to 56 mmt.

The biggest controversy was the fact USDA didn't make larger cuts to the Brazil soybean production estimate, as the 1 mmt drop was less than what the trade expected.

"As you look at this particular report, those were the only numbers that people were really watching," says Mike North of Ever.Ag "So, for them to not make a change, I think it was kind of upsetting the applecart in terms of expectations, but likely more to come."

North says boots on the ground estimates suggest there's more room for cuts, with North estimating another 4 mmt to 5 mmt could be trimmed from Brazil's soybean estimate.

"I think the question the market is still trying to answer is, what extra growth do we maybe have to add to Argentina? And then how do we balance an Argentine crop that's twice the size of last year against a less than record crop coming out of Brazil," says North.

Not every private firm thinks the crop in Brazil is getting smaller. StoneX Group released its recent survey from Brazil, raising its forecast for Brazil's 2023-2024 soybean crop by 1.5mmt to 151.5 mmt. That's still lower than USDA's current estimate for Brazil soybeans of 155 mmt.

"It's the old story with these grains now. They have the genetics. They just wait for the rains, and while they're waiting, the crops look terrible. When they get two inches of rain, all of a sudden, they've got a pretty good crop, and they've had decent rain since then," says Mark Gold of StoneX Group. "So, there's no reason to think that they're not going to wind up with a pretty good crop. Is it 155 [mmt] or 156 [mmt]? I don't think so. I think we're much closer to 150 mmt or 151 mmt than anything else. But we'll see where we go."

Brazil exported 6.610 mmt of soybeans during February, according to official government data. That was up 3.755 mmt (118%) from January and 1.593 mmt (31.8%) more than last year given the rapid soybean harvest.

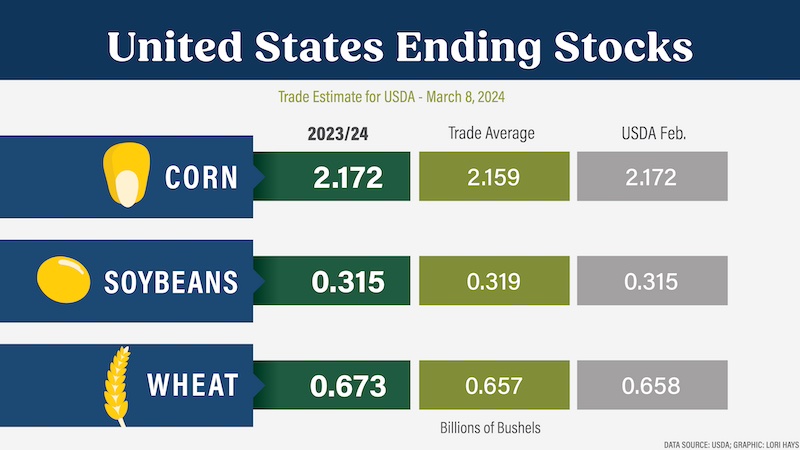

U.S. and World Ending Stocks

USDA made no change to the U.S. ending stocks figure, except for wheat. North says exports from the Black Sea region have been remarkable, especially from Ukraine.

"That becomes the one-two punch," North says. "Now you add in these extra bushels coming out of South America as they've gotten the good weather Mark alluded to, and you walk into another U.S. growing season. Balance sheets, globally, look really, really full and that ultimately sets the stage for this lower market that we've been in and really kind of justifies market action over these last couple of months, as we've really put to bed the South American story."

North says when you add the extra layer of additional Ukrainian volume, along with 5 mmt of wheat coming out of Russia in the next marketing year, it's another layer in the overall global grain supply glut story.

"There's going to be ample supplies of grain available in the world market," North says.

China Cancels Wheat Purchase, Yet Wheat Seems Unfazed

USDA pointed to poor exports in the latest WASDE report, but there's another piece of bad news for the wheat market this week. On Friday, USDA reported a SRW sales cancellation from China of 110,000 metric tons during the 2023/2024 marketing year, which marked the second straight day of cancellations.

"Isn't it interesting that we had two cancellations, one on Thursday and one on Friday, but the wheat market, as we sit right now, is looking at a key reversal and it made a contract low overnight," Gold says. "So, this market rejected bad news, if we see this higher close, and I believe the markets may have certainly seen the bottom in here."

He says now the key is what the funds do, as the funds still hold short positions.

"If we can just get the funds to pull the trigger and come cover some of these massive short positions, which they started to last week in the corn - they covered about 50,000 corn - but there's a lot more yet to come and that can lead us to some higher prices," Gold says.

What Spurs the Funds to Exit the Short Positions?

As Gold mentioned, the funds are extremely short. So, what will it take to get the funds to exit those positions? North says in today's day and age, when the geopolitical events continue to surprise the world, there are several things that could cause the funds to change and bring some bullish excitement back into the market.

"It could very well be some of this strong job growth that we continue to show, and some of the ultimate strength in the economy, which raises this inflation story some more and maybe starts bringing them back into the mix to use commodities as the inflation play," North says. "But I think the one bandwagon everybody is hoping on is weather."

North says the current drought map shows the U.S. remains dry.

"I think there's going to be some patience around that story, given the way the crop performed last year following a very hot and dry June," North says. "And so it's an unknown factor right now. But it's going to take something large, it's going to take something unknown, something like weather, to develop further and become a real threat."