Breaking Down the Biggest Surprises in USDA's June WASDE Report

Sluggish exports continues to be the main theme in the grains markets. USDA made what one analyst says is a surprisingly large cut to soybean exports in its June WASDE report, but with possibly more cuts to corn demand on the way, the bigger story moving forward may be soft corn demand.

USDA’s WASDE report typically isn’t a big market mover. So early in the growing season and ahead of the big June Acreage Report, USDA tends to leave new crop corn and soybean yield forecasts untouched. USDA continued that trend this year, instead making changes to ending stocks.

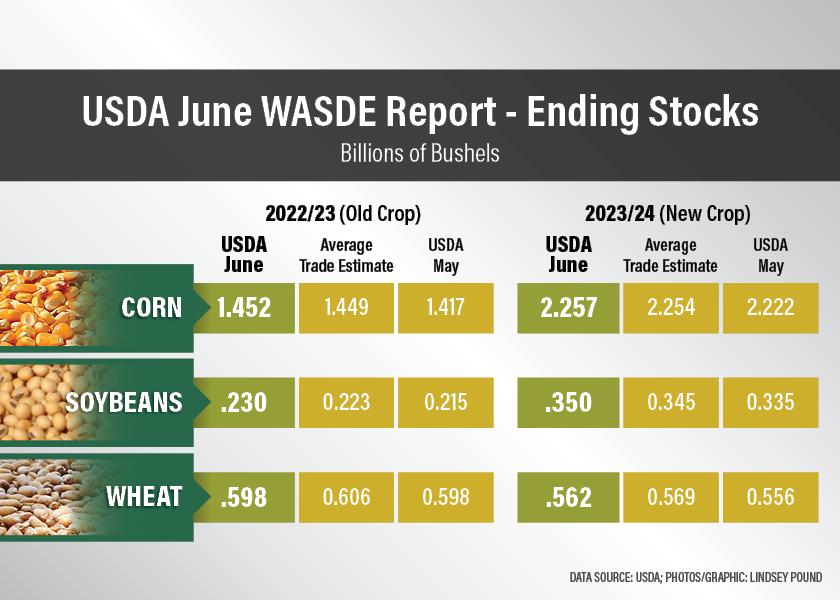

For ‘22/’23 ending stocks, USDA made the following adjustments:

• Increased old corn ending stocks to 1.452 billion, up. 35 million bushels from May.

• Soybeans were adjusted 15 million bushels higher to 230 million.

Wheat ending stocks for old crop were unchanged by USDA. The forecast still sits at 598 million bushels.

For ‘23/’24 ending stocks, USDA revised corn, soybeans and wheat higher:

• Corn: 2.257 billion bushels, up 35 million bushels

• Soybeans: up 15 million bushels to 350 million bushels

• Wheat: Up 6 million bushels to 562 million bushels

Suderman Says Biggest Surprise is Soybeans

Arlan Suderman of StoneX Group calling the report fairly neutral for wheat, as expected for corn and a little bearish for soybeans.

“Probably the biggest surprise to me was that they cut soybean exports by 15 million bushels. I think that's justified, I just didn't expect USDA to do it this early in the ballgame,” says Suderman. “Shipments have been there, but slowing because export sales have really been flat.”

USDA cut its soybean export forecast, but Suderman notes on Friday morning, USDA confirmed an export sale of 197,000 metric tons to unknown destinations.

“So, what does that mean? How do we translate that? But overall, I think we're going to struggle with the big Brazilian crop,” says Suderman.

USDA cites increased competition from South America as a continued headwind for U.S. exports, which also prompted the agency to raise both old crop and new crop ending stocks forecast for corn and soybeans on Friday.

• USDA increased Brazil’s current corn production estimate by 2 million metric tons.

• Brazil soybeans increased by 1 million metric tons.

• USDA reduced forecast for Argentina’s corn and soybeans by 2 million metric tons.

Soy Oil Demand Trumps Bearish News

Suderman says the adjustments to South America’s crop didn’t come as surprise, but the revisions also didn’t seem to phase the markets. Instead, Suderman thinks it was soybean oil that was the big driver for the increase in soybean prices on Friday.

“The focus has been on soy oil demand,” says Suderman. “That's been giving soybeans a boost with the chart starting to put in a bottom. We saw some end-user buying come in that started to turn the charts and more momentum kind of came in fund short covering, but no big fundamental news. They're given us the big gains in soy oil, but that is helping boost soybeans right now.”

Sluggish Corn Demand

Moving forward, Suderman thinks corn demand may be the biggest story to watch.

“USDA had a 50 million bushel cut in corn, and I think they've got more cutting there they may do. They may also cut ethanol. I think that the big story right now is the soft demand for corn,” he adds.

Watching Weather

Now that USDA issued its June WASDE revisions, the trade and market watchers will start debating possible changes to acreage in the June Acreage report, which is set to be released later this month. Suderman says traders are also watching weather, especially with drought concerns across the Midwest.

“Weather does matter, but it tends to matter more in July,” says Suderman. “Right now, we're starting to get into that time when we start to set the maximum ear size, so it's crucial that we get rain soon. We're right at that pivotal time right now.”

NOAA officially declared the arrival of El Nino this week. Suderman says it’s a pattern they’ve been watching, especially in mid-June.

“Over the next few days is when we expect to see the pattern start to change. If the rains disappoint, then we're going to leave some corn under stress. I'm not in the 2012 camp by any means. The conditions are totally different than what they were then. But I do think we can end up pulling the yield below USDA at 181.5 bu. per acre, if these rains disappoint.”

Suderman doesn’t know if a reduction in yield will be enough to offset the softer demand, as he still thinks USDA is too optimistic on feed usage and exports this year.

USDA Adjusts U.S. Wheat Production Estimate

While there weren’t changes made to U.S. corn and soybean production, USDA did raise total U.S. wheat production forecast by 6 million bushels to 1.66 billion bushels. The yield forecast was adjusted slightly higher, to 44.9 bushels per acre. USDA saying higher hard red winter wheat production is expected to more than offset reductions in soft red winter and white winter wheat.