Record On Tap: Brazil’s Soybean Acres Will Exceed 100 Million for the First Time

In September and October Brazilian farmers will start to plant corn, soybeans and other crops. Forecasts show, if weather cooperates, the 2022/23 Brazilian crop harvest could be the largest ever, according to CONAB, the country’s food supply and statistics agency.

For the upcoming crop season, CONAB forecasts Brazilian farmers will produce more than 300 million tons of soybeans, corn, cotton, rice, wheat and soybeans. That is 14% higher than last season, when Brazilian farmers harvested an estimated 271.4 million tons of grains — an all-time high.

The expected growth of the Brazilian crop is attributed to two factors, according to the University of Illinois’ Joana Colussi, Gary Schnitkey and Nick Paulson. They include:

- 2.5% jump in planted area

- 11% higher yields versus 2022

Although production costs are expected to be higher in the coming season, Brazilian farmers will benefit from high commodity prices, robust global demand and a favorable exchange rate.

Colussi, Schnitkey and Paulson recently analyzed the CONAB data in a farmdoc daily piece: New Record Grain Production on Horizon for Brazil

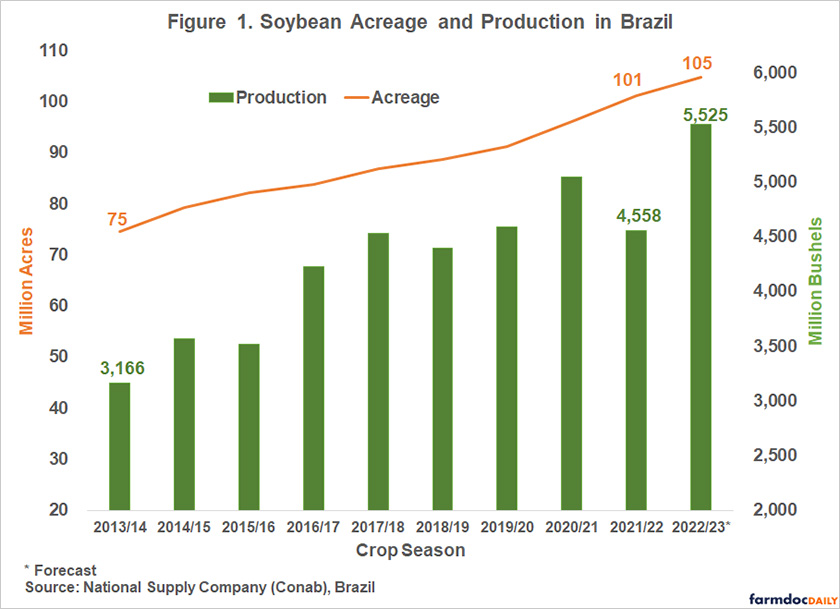

20% Increase for Soybean Crop

Soybeans account for almost half of the total grain produced in Brazil. The 2022-23 soybean crop is projected to be 5.525 million bushels (equivalent to 150 million tons), an increase of 21% over the previous harvest (see Figure 1).

Brazilian soybean acreage is expected to grow 3.5%, to 105 million acres, according to CONAB. It would be the first time the planted area will exceed 100 million acres. Most of the increase, Colussi, Schnitkey and Paulson say, is expected to be as a result of the conversion of pasture to accommodate soybean planting.

Average yields for the 2022/2023 season are expected to be 17% greater than last growing season, when severe drought affected southern states in Brazil.

“High prices and profits last season, coupled with the depreciation of the Brazilian currency relative to the dollar, have motivated farmers to increase their planted acreage,” the authors write. “The expected margins for soybeans remain positive, despite the rise in production costs, driven mainly by a spike in fertilizer prices.”

The net operating margin for soybeans in Mato Grosso, the largest soybean-producing state, should decrease from 59% last season to 23%, according to CONAB.

Brazilian soybean exports in 2022/23 are forecast at 92 million tons, a 22% increase from this season’s estimated shipments of 75 million tons.

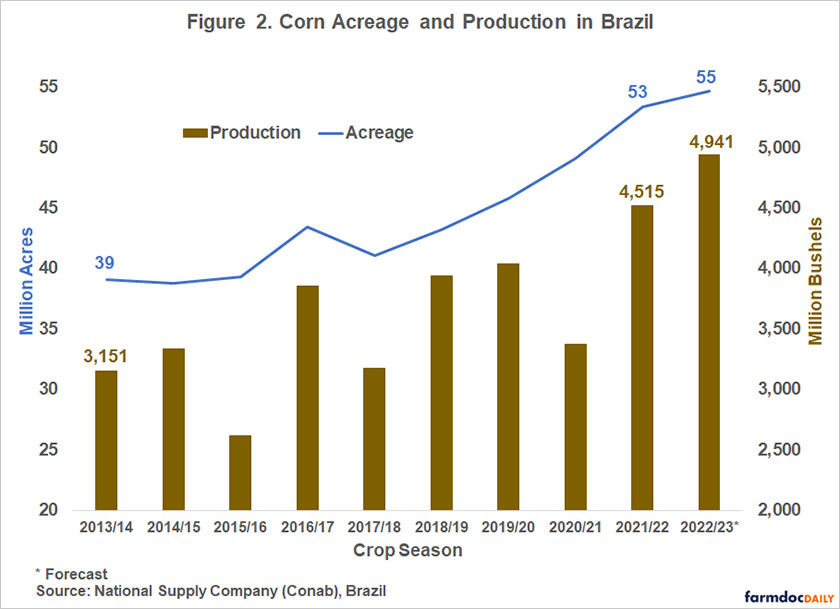

Corn Acres Jump 2.5.%, Yields Jump 6%

Brazilian total corn acreage is expected to grow 2.5%, to 55 million acres, according to CONAB. More than 70% of the corn produced in Brazil is from the second corn crop (known as the safrinha), planted right after the soybean harvest, typically in January and February. The 2022-23 corn crop is projected to be a record of 4.941 million bushels (equivalent to 125 million tons), an increase of 9.4% over the previous harvest (see Figure 2).

High domestic and global corn prices are the primary drivers for the expanded corn planting area. The net operating margin for corn in the 2022/23 crop season in Mato Grosso, the largest corn-producing state, should decrease from 9% last season to 7%, according to CONAB. The rise in the price of fertilizers is one of the main factors for the increase in production costs.

In the 2021/22 season, Brazil produced 4.515 million bushels of corn, a 32% increase compared to the previous harvest season affected by severe drought. Average yields for the 2022/23 season are expected to increase by 6% over the previous season.

The growth in the safrinha crop is an opportunity for Brazil to double its corn production in the coming years. Brazil is the world’s third-largest corn producer and exporter, behind the U.S. and China. In addition to having new agricultural frontiers to increase corn production, mainly used as animal feed, Brazil is expanding its ethanol production. Currently, 17 corn ethanol plants are in operation, including 10 in Mato Grosso and 5 in Goiás.

Brazilian corn exports in 2022/2023 are forecast at 44.5 million tons, a 19% increase from this season’s estimated shipments of 37.5 million tons.

Read More

New Record Grain Production on Horizon for Brazil

Despite Drought Brazil On Track to Harvest Record Safrinha Corn Crop