Thriving Against The Odds: Cattle Producers Share Insights On The Here And Now

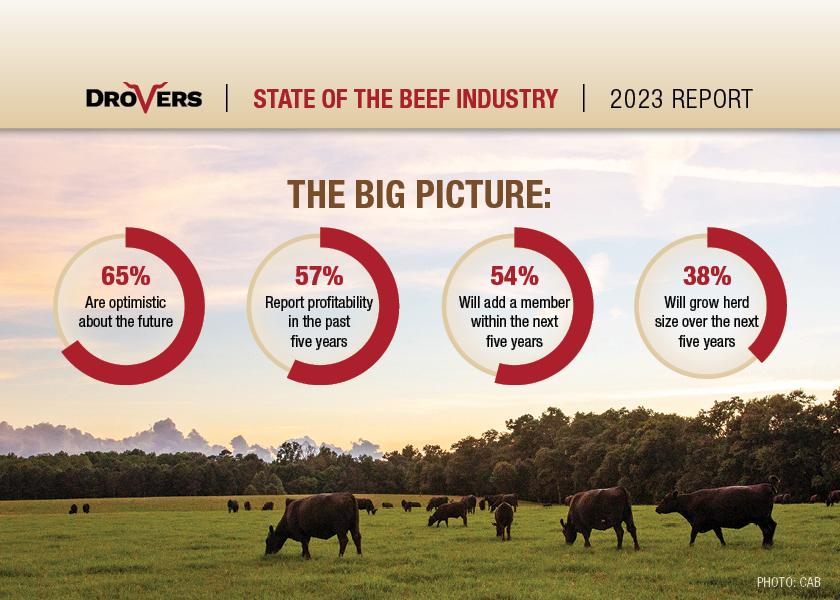

America’s beef producers are optimistic about the future, and the state of today’s beef industry is strong. Those are two highlights from Drovers State of the Industry producer survey conducted this spring.

Such producer sentiment was a little surprising due to the devastating and historic drought that gripped nearly all of cattle country last year. Yet, two-thirds of respondents call themselves optimistic about the future of the business, and 54% say they will add a family member to their operation within the next five years.

Those data points should be viewed as both the foundation of a strong industry and an indication of the resilience of Drovers readers. As part of our 150th anniversary celebration, Drovers sought to gauge producer attitudes, commitment and management practices.

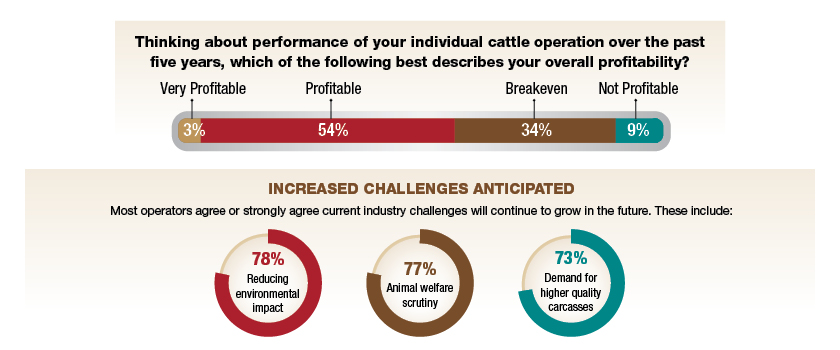

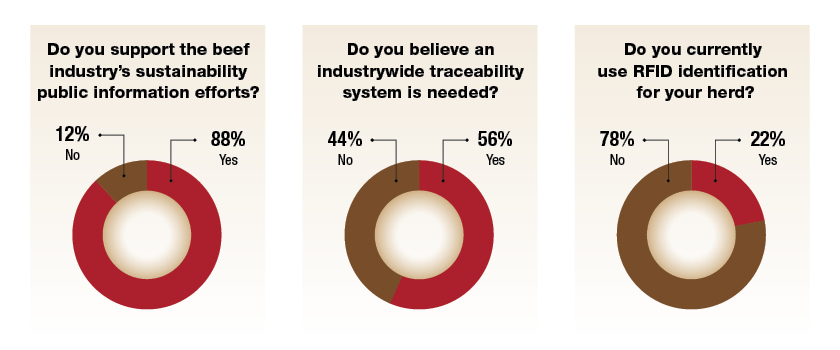

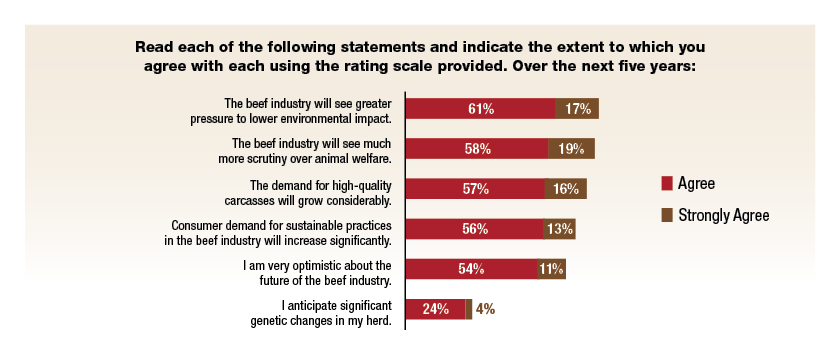

Overwhelmingly, 88% of Drovers survey respondents say they support the industry’s sustainability efforts, and most respondents agree or strongly agree current industry challenges will continue to grow in the future. They include: reducing environmental impact, 78%; animal welfare scrutiny, 77%; and demand for higher quality carcasses, 73%.

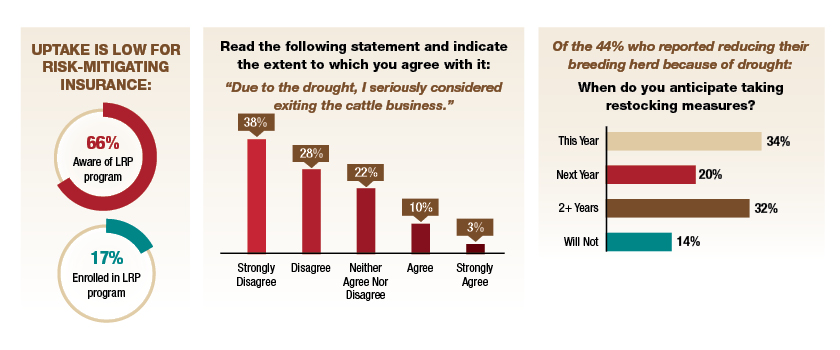

While it is encouraging to see widespread acknowledgment of key issues that might have significant impact on the industry in the long term, possibly the most important revelation from the Drovers survey was producer commitment. It speaks volumes about cattle producers who, having experienced the second historic drought in a decade, remain committed to their business and their lifestyle.

Despite the myriad stresses caused by the extended drought, just one-tenth of our respondents considered exiting the business, while 66% of respondents said hanging up their spurs was never a consideration.

At Drovers, we share your passion for agriculture and the beef industry. Our 150th anniversary State of the Industry report is designed to provide a benchmark of information to help you make successful decisions.

The discussion below highlights several items because of their potential influence on the industry. They’re addressed in no particular order; each one is independently important. But perhaps more significantly, these items ultimately overlap to influence producer decision-making going forward.

Survey Results

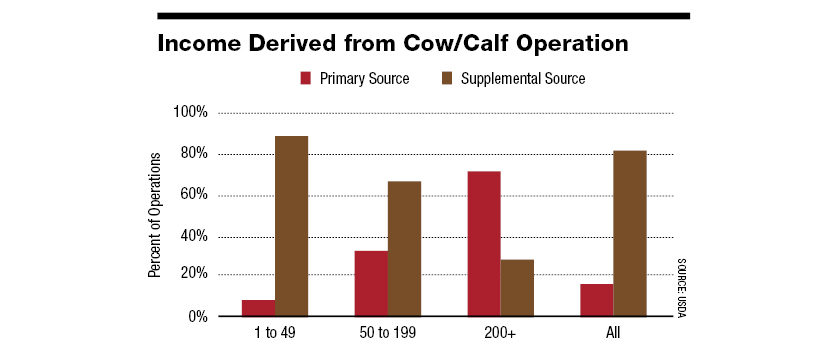

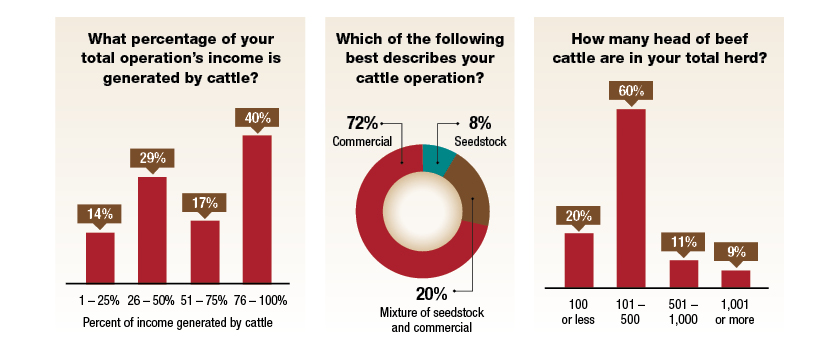

It’s important to note at the outset, the survey results are largely representative of producers fully committed to the business. For example, roughly half of the respondents in the survey generate 75% or more of their income selling weaned calves. Moreover, 40% of respondents indicate cattle to be the primary/sole income source for the operation. At first blush, that might seem low and even contradictory with the previous statement; however, that number well exceeds the national average.

USDA’s National Animal Health Monitoring System Beef 2017 survey provides an extensive and comprehensive overview of management practices within the cow/calf sector. Most significant here, the survey categorizes income for respective operations (primary versus secondary). While bigger operations are more likely to designate cattle as a primary source of income, only 15.8% of all operations in the U.S. categorize it as such.

Additionally, the responses regarding preconditioning practices further underscore respondents’ commitment to the business. More than 80% indicated they precondition the calf crop prior to marketing. Based on a subjective view of the industry, that number far exceeds industry norms. In other words, survey respondents are actively seeking all opportunities to leverage both their genetic investment and management skills to maximize revenue for the operation.

Weather

No discussion about farming and ranching can occur without some mention of weather. During the past 10 years, cow/calf producers have endured two major rounds of drought and subsequent selloff of the cowherd. The outcome being the smallest beef cow inventory going into 2023 since the early 1960s.

What happens next? Just one-third of operations that downsized in recent years due to drought intend to restock this year. In other words, survey respondents are carefully evaluating their options and seemingly aren’t in any rush to restock anytime soon. Rebuilding the cowherd will take time, implying this cycle will likely be of longer duration versus the previous inventory lows in 2014. That assessment was confirmed by USDA’s July 1 cattle inventory report; producers are neither keeping back cows nor retaining additional heifers to grow the cowherd.

That’s not surprising. Producers need time to replenish pastures, ponds and hay inventories. To that end, the percentage of range and pasture rated as poor or very poor is on pace with the five-year average. That reality can be viewed both ways: it’s no worse versus previous years, but it’s no better either.

Profitability/Success

Survey results reveal a bullish outlook on the business. First, nearly two-thirds of respondents indicate they’re optimistic about the future. And second, despite market challenges in recent years (especially through COVID-19), less than 10% indicate their business operated at a loss during the previous five years. And given 2023’s market strength to date, it’s likely if the survey were taken today, such optimism likely would be even higher.

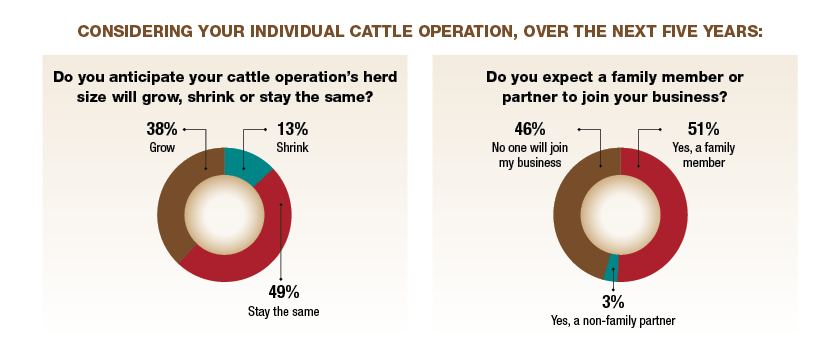

The combination of respondents’ optimism and profitability leads to a third aspect of significance: plans to expand the operation. In terms of growth, 54% indicate plans to add an additional person to the operation while 38% expect to expand their herd in the next five years. In other words, as alluded to above, growth and expansion are in the cards; it’s likely to be drawn out and take time.

Herd Expansion and Family Integration

Perhaps the most indicative question of long-term commitment and optimism about the business revolves around plans to add a family member. Regardless of profitability, roughly half of all respondents indicate they plan to add an additional family member in the next five years.

Complexity

Ultimately, the beef industry’s success will be underpinned by how well it navigates the respective priorities of consumers and the inevitable shifts in the marketplace over time. The survey asked about four different aspects related to consumer pressure and expectations for change in the future: environmental impact, animal welfare, sustainable practices and desire of high-quality beef, respectively. In every instance, a majority of producers either agreed or strongly agreed each of those items will be increasingly important in the years to come.

The survey report summarizes it succinctly: “Operators foresee acceleration of challenges they face today, mostly related to consumer attitudes and activist efforts that are largely outside their control. Most beef producers expect increased pressure to be sustainable, care for the environment and elevate animal welfare while producing higher quality carcasses.”

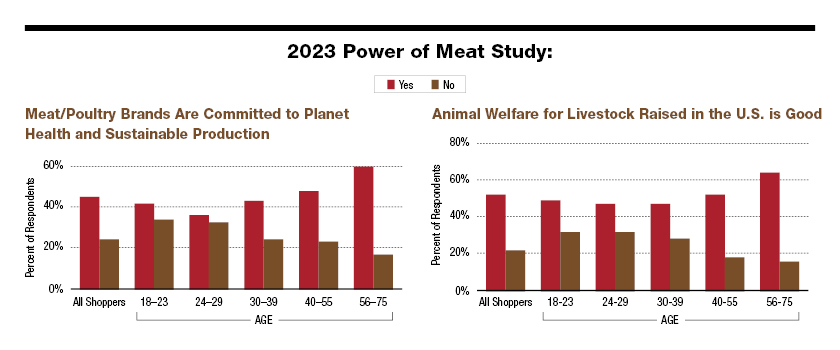

That’s especially true as millennials (many of whom consider themselves to be Flexitarians) obtain wealth and increasingly become the most influential consumer cohort for the beef industry, and the importance of being responsive to their concerns is best illustrated by 2023’s Power of Meat study.

The marketplace will become more complex in the years to come. Accordingly, in response to those pressures, producers will need to be increasingly cognizant of the importance of eating quality coupled with planet health and animal welfare.

Conclusion

Going back to the beginning, as noted previously, survey respondents are actively seeking opportunities to leverage their skills and capabilities to maximize revenue for their operations. Furthermore, they also envision even more complexity coming to the marketplace. And given their current state of mind regarding the business (growth and optimism), it’s fair to say Drovers' respondents are highly likely to eagerly anticipate that complexity as yet another venue of opportunity.