Good Vs. Bad News: Ukrainian Grain Has Set Sail, But Unrest Could Limit a New Crop

For the first time since Russia invaded Ukraine, a ship with grain left Odesa on Aug. 1. The ship, the Razoni, was carrying 26,527 metric tons of corn, said the United Nations.

The vessel had been stuck in port since Feb. 18, before the start of the war. Its passage was part of the U.N.-backed deal between Russia and Ukraine signed in July to resume exports of Ukrainian grain through the Black Sea.

“There are still more questions than answers, but we did get a vessel out the door,” says Dan Basse, president of AgResource Company. “At least we know we have a corridor.”

Listen to Dan Basse discuss the situation in Ukraine with AgriTalk’s Chip Flory:

The shipment occurred a day after Oleksiy Vadatursky, the multi-millionaire owner of Nibulon, was killed, along with his wife, Raisa Vadaturska, during Russian shelling of Mykolaiv.

“He was the founder of Nibulon, which is the largest private grain company and exporter within Ukraine,” Basse says. “They were clients of ours, and I’d met him several times. It's such a sad day. The Russian rocket came into his bedroom in the dark of night. So, to believe he wasn’t targeted, I think would be a misnomer.”

More Vessels to Ship?

This current export agreement between Russia and Ukraine needs to be renewed every 120 days, Basse says. His estimates show there are around 55 vessels ready to ship out.

“If you move out just one vessel per day, it will take half of the current agreement just to get the stranded vessels out,” he says. “Plus, when you're only moving during the daytime and not at nighttime, the chances of getting a lot of grain out the door are not that great.”

To add to the complexity, Basse says grain companies are nervous about standard operation after the attack on Nibulon’s owner.

“We have a lot of other grain companies in Ukraine saying, ‘I don't want to put my people in harm's way.

Do I need to have my managers or operators sleeping in different hotels and other places? It's very complex,” Basse says. “There's lots of nerves and emotions; drama is high.”

Growing Crop Concerns

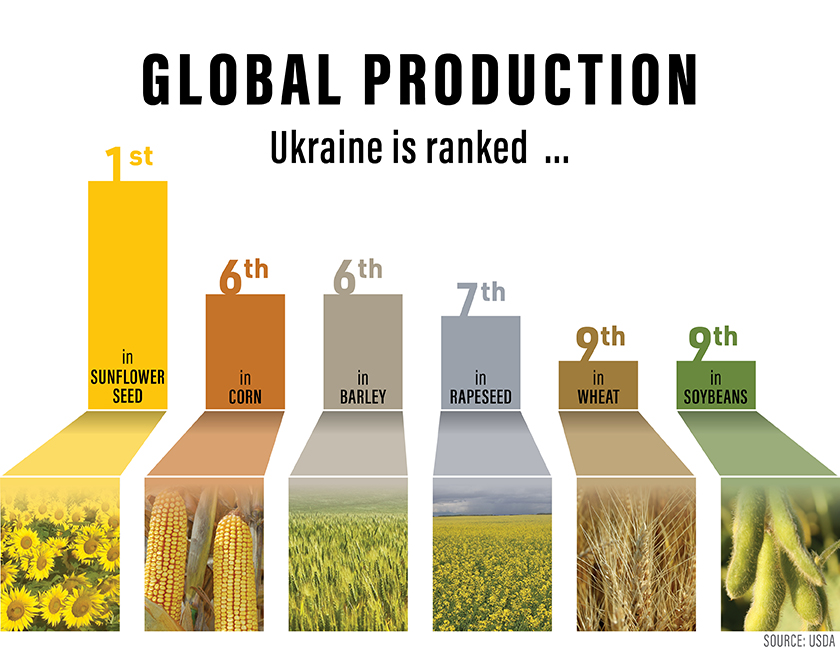

As the battle in Ukraine stretches on, just how many crops are planted, harvested and shipped remains a guess. In May, USDA forecast Ukrainian wheat production to fall 35% year-over-year with corn production down more than 50%.

“Normality is a long way down the road for Ukraine and agriculture in general,” Basse says. “The real problem we're having now is trying to understand what the Ukrainian farmer will do with new crop.”

The price of wheat coming off the combine, if you were harvesting today in central Ukraine, would be about $2.70 a bushel, he says. That is up from $2.20 per bushel a few weeks ago, but excessive transportation costs exist to get the grain to port or other locations.

“They will start a new planting season in wheat at the end of August and early September,” Basse adds. “Our discussion with farm clients there is they're not planning on planting any winter wheat. So, what does that mean for the world going forward? And if you don't have a crop going in the ground, by the end of September early part of October, it will create a shortage of world grain.”

Ukrainian Farmers Destroy Harvest Equipment to Keep Russians from Taking Crops

Upset to Global Agricultural Trade? Long-Term Impacts of the Russia-Ukraine Conflict

Is the World Really Running Out of Wheat?

Ukraine's Third Largest Exporting Terminal Destroyed By Russian Military

Ukrainian Farmers Dodge Landmines and Rockets as World's Farmers Offer Help