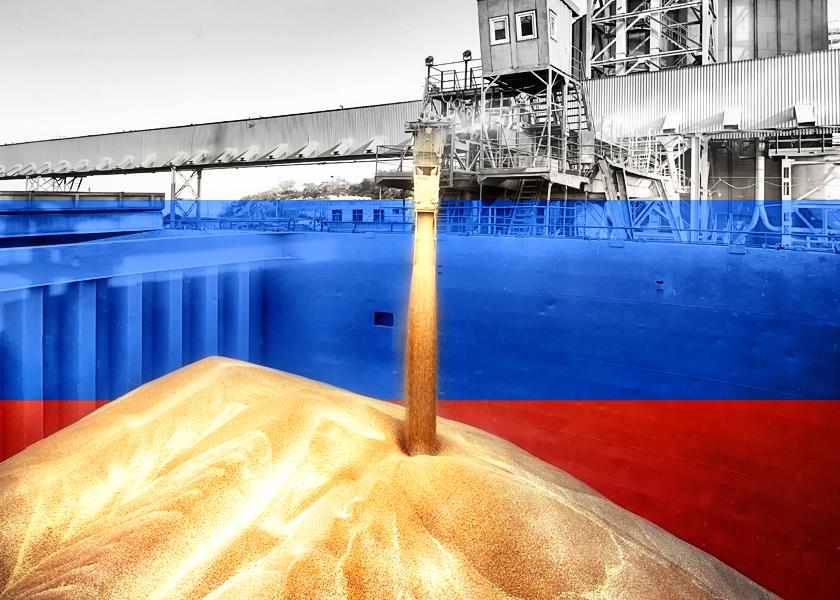

Is Russia Taking a Page Out of China's Playbook By Working to Take Control of Its Grain Industry?

Three major grain companies have announced plans to stop exporting Russian grain as of July 1, as analysts say the move is spurred by Russia’s plans to control its domestic grain industry. Russia claims the decision will not affect the volume of domestic grain shipments out of the country, but analysts argue the decision will put Russian grain farmers at a disadvantage.

Cargill, Viterra and Louis Dreyfus Company all recently made announcements. Each company says it will stop exporting Russian grain at the beginning of the 2023-2024 marketing year, which starts July 1.

“The cessation of its export activities on the Russian market will not affect the volume of domestic grain shipments abroad. The company’s [Cargill’s] grain export assets will continue to operate regardless of who manages them,” the Russian ag ministry told Reuters.

Louis Dreyfus Company made the announcement last week, and said that it is withdrawing from Russia "as grain export challenges continue to increase in the country.”

Increased Challenges for Farming in Ukraine

Dan Basse of AgResource Company was meeting with Russian, Ukrainian and Baltic traders when the news about Louis Dreyfus was released last week.

“We all talked about the risks and the opportunities of the markets, and the Ukrainians are struggling mightily, as you can imagine. They can't find fertilizer, seed supplies are several years old, the price of diesel is now up to $34 a gallon. Imagine farming with that,” Basse says.

Long-Term Challenges for Russia

He says based on his conversations, as well as AgResource data, he thinks the Ukrainian crop export program will be well below last year. But it's not just farmers in Ukraine that could be negatively impacted by the war. He thinks Russia will face growing challenges longer-term with not just exports, but crop production.

“If you think about what the Russians just did, in taking care of the control of the grain industry, that's fine in terms of buying from the farmer and elevating it on a boat, but it's the Russian farmer that will be the big loser,” says Basse. “We still believe they’ll be able to get some technology from Syngenta and maybe Bayer and some others on the seed side. But longer term, I think there's going to be a drag in production out of the Black Sea in general, including Russia and Ukraine.”

Basse thinks down the road, the changing scenario for grain production in the Black Sea region could be a “bullish tailwind.”

“What we don't know about today, though, is will President Putin actually allow the grain corridor to continue after the middle of May, now that he gave us a 60-day extension? The Russian grain traders were more pessimistic on this one. We’ll see how that all comes forward, but that would be really important as we head into the end of April and middle of May," he says.

The Murky Future of the Black Sea Grain Initiative

Just last week, Russia’s Foreign Minister put the onus of the Black Sea Grain Initiative's future on the West. Russia claims the West’s sanctions on Russian food and fertilizer exports are creating insurance and payment hindrances. Russian leaders say if those sanctions aren’t removed, then Ukraine will have to use land and river routes to export grain in the future instead of traveling across the Black Sea.

As more grain companies announce plans to exit Russia and halt grain exports, Chip Nellinger of Blue Reef Agri-Marketing says Russia’s efforts to control its grain export program is a similar move to China.

“It seems like Russia has taken a page out of the Chinese playbook as far as the transparency goes, and rightfully so,” says Nellinger. “They've always played it close to the vest. It's hard to get actual numbers out of there. Are they going to export? Are they going to ban exports? Are they going to create some sort of domestic stockpile? They're playing that game, and we don't know for sure what the end result will be.”