Winter Weather: Find Out What's in Store for Agriculture

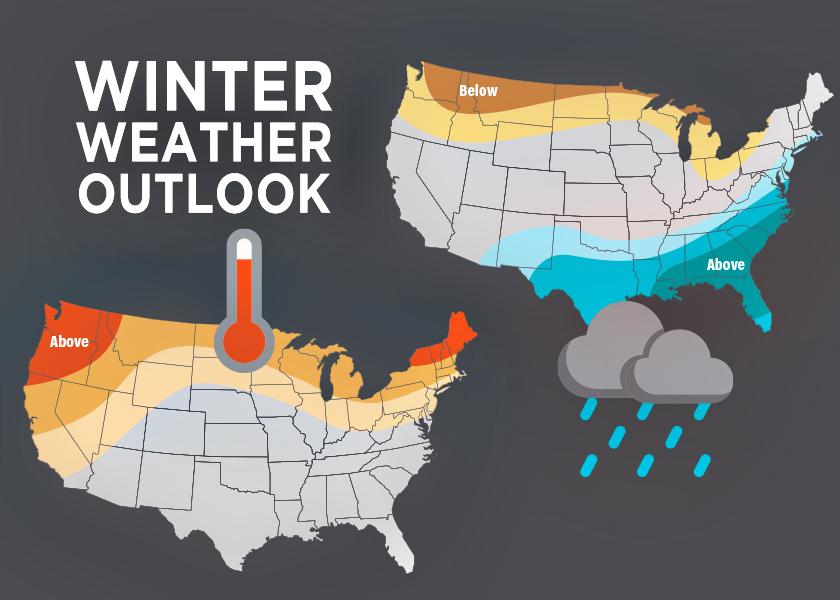

The upcoming winter is shaping up to look a bit different than the past several years. The shift to a different weather pattern, El Nino, is in the works – resulting in a very strong subtropical jet stream and a weakened polar jet stream.

Brad Rippey, USDA meteorologist, shares the predictable changes to North American weather those involved in the agriculture industry should be on the lookout for.

Northern Weather Will Be Drier

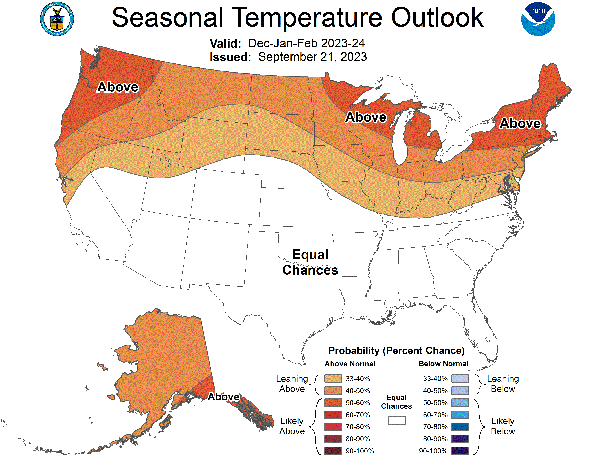

One of the common changes Rippey shares is unusually mild weather across the northern tier of the U.S. The mild weather is a result of the weak polar jet stream and affects areas stretching all the way from the Pacific Northwest to New England.

“That of course has implications for winter crops,” Rippey says. You don’t get as much establishment of a snow cover, but at the same time, you don’t have a whole lot of cold weather to deal with and there’s less concern for winter kill. So, it’s kind of a tradeoff there.”

Along with the milder temperatures, northern states are also predicted to see drier conditions this winter.

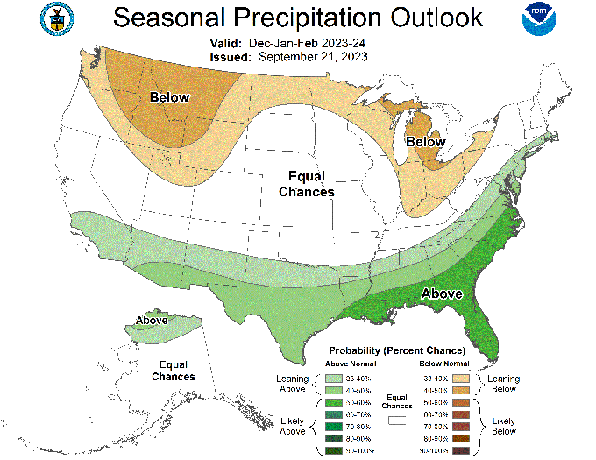

An outlook published by NOAA in late September shows between a 33 to 50% chance of below average precipitation for a portion of the northern U.S between November and March. The areas NOAA expects the largest impact are the Pacific Northwest and Great Lakes region.

The dry, warm conditions have the potential to make this planting season an early one.

“It all depends on how the snow falls, but generally speaking, soil temperatures will likely not be as cold as they were in the spring of 2023,” Rippey says. “Given the mild, dry forecast, there may be a fairly quick planting season in the north for spring 2024.”

The Story for Southern States is Much Different

“The enhanced subtropical jet stream tends to bring stronger storms across the southern tier of the United States,” Rippey says. “Sometimes that affects Southern California but it’s more likely along the Gulf Coast and southern Atlantic coast.”

NOAA’s predication maps show the highest probability of above average rainfall – 50 to 60% – for states along the Gulf and southern Atlantic coasts.

The increased precipitation in those areas is something Rippey says could help with low water levels from the summer’s drought.

“As we get deeper into autumn and the heart of winter, the odds most definitely increase we will see wetter conditions in places like Arkansas, Louisiana and Mississippi where we’ve got not only low water levels impacting navigation, but also the saltwater intrusion from the Gulf,” he says. “It may take a while but eventually as the winter proceeds, we should see relief especially in the southern part of the basin.”

The Wild Card to Watch For

A less clear aspect for this winter’s forecast could be due to elevated oceanic temperatures, which have the potential to keep global temperatures high through the winter and into 2024.

The high oceanic temperatures produce blocking high pressure systems, which Rippey says can be blamed for Canada’s wildfire season and recent heat waves and fires in Europe.

“If some of the oceanic temperatures continue to induce weird blocking patterns, that can lead to extremes like heat, cold, droughts and floods that’s generally independent from El Nino,” he says.

Effects on South American Production

El Nino has different implications for growers in South America.

Key production agriculture areas such as southern Brazil and Argentina are just moving into their spring growing season and the El Nino weather patterns are expected to create more favorable conditions for their crops than La Nina.

“From a crop production standpoint, I would expect improving conditions in some of the areas that have been impacted by drought over the last few years,” Rippey says. “As you move northward into the Amazon basin, El Nino can trigger drought. That’s a concern from an ecological standpoint and that drought often extends into places like Mexico and the Caribbean for as long as El Nino persists.”