Bill Biederman: A Dichotomy of Possibilities

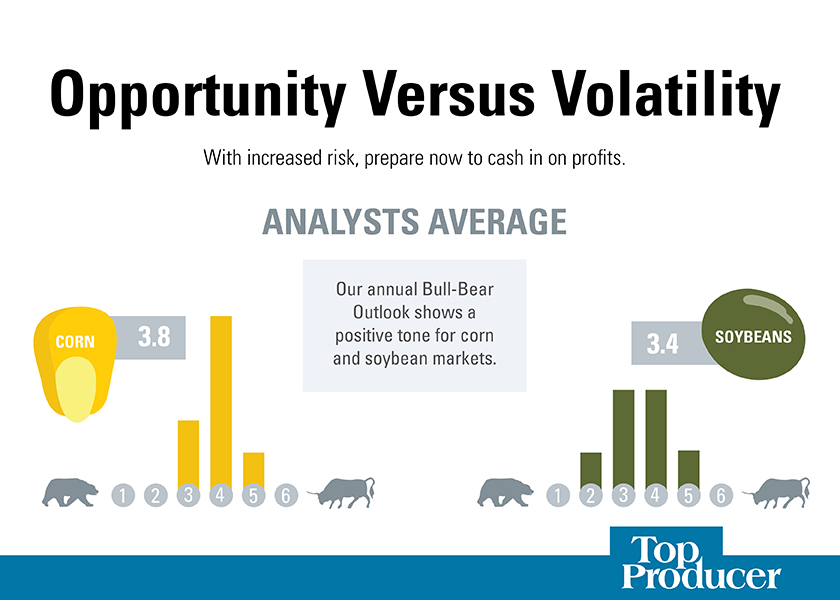

Could 2022 offer the same profitable opportunities as 2021? The outlook for corn and soybeans is optimistic thanks to strong demand and potential production shortfalls in South America. Yet headwinds are present. We asked eight analysts to provide their best estimates on price direction and market strategies you can put to use in 2022.

Bill Biederman, AgMarket.Net

The price outlooks for corn and soybeans are initially about as different as a drought and a flood. Driven by inflation, supply chain issues, labor problems and those pesky tariffs that are still in place, U.S. fertilizer prices exploded. As a result, farmers are looking for specialty crops, rotation adjustments or will simply live on the soil bank and plant corn anyway.

If U.S. acres shift like they did the last time fertilizer prices exploded (2007-08), corn stocks could fall to 509 million bushels, which would be 700 million bushels shy of required pipeline needs. Soybean stocks could swell to 873 million bushels and would rival the record of 909 million bushels in 2018.

This exercise suggests acres cannot shift much, or end users of corn will go broke and soybean processors will swim in beans. For that reason, we believe the influences of supply-and-demand economics will push the corn:soybean ratio toward the equilibrium needed to bring balance toward acres.

If South American production is strong this year, we will likely see soybean prices decline while corn prices might not decline much at all. If South American production declines more than 10 million metric tons in soybeans, the need for U.S. soybean acres could maintain a foundation of strength under soybean prices, and corn will have to move to a price that will compete for ground. We cannot lose more than 3 million acres of corn.

The Bottom Line: Operating profit or loss drives all things at home. The only way we know how to navigate a year where the outlook has such a dichotomy of possibilities is to know your outcome if prices go up — or if they go down. Then hunker down and focus on production.

Read More

Brian Basting: Market Tools That Turn Uncertainty Into Opportunity

Disclaimer: This material has been prepared by a sales or trading employee or agent of these analysts and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions and agree that you are not, and will not, rely solely on this communication in making trading decisions. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that these analysts believe are reliable. Such information is not guaranteed to be accurate or complete, and it should not be relied upon as such. Trading advice reflects good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice provided will result in profitable trades.