Farmers Seize Market Opportunities but Concerned about Rising Interest Rates

Barometer 080223

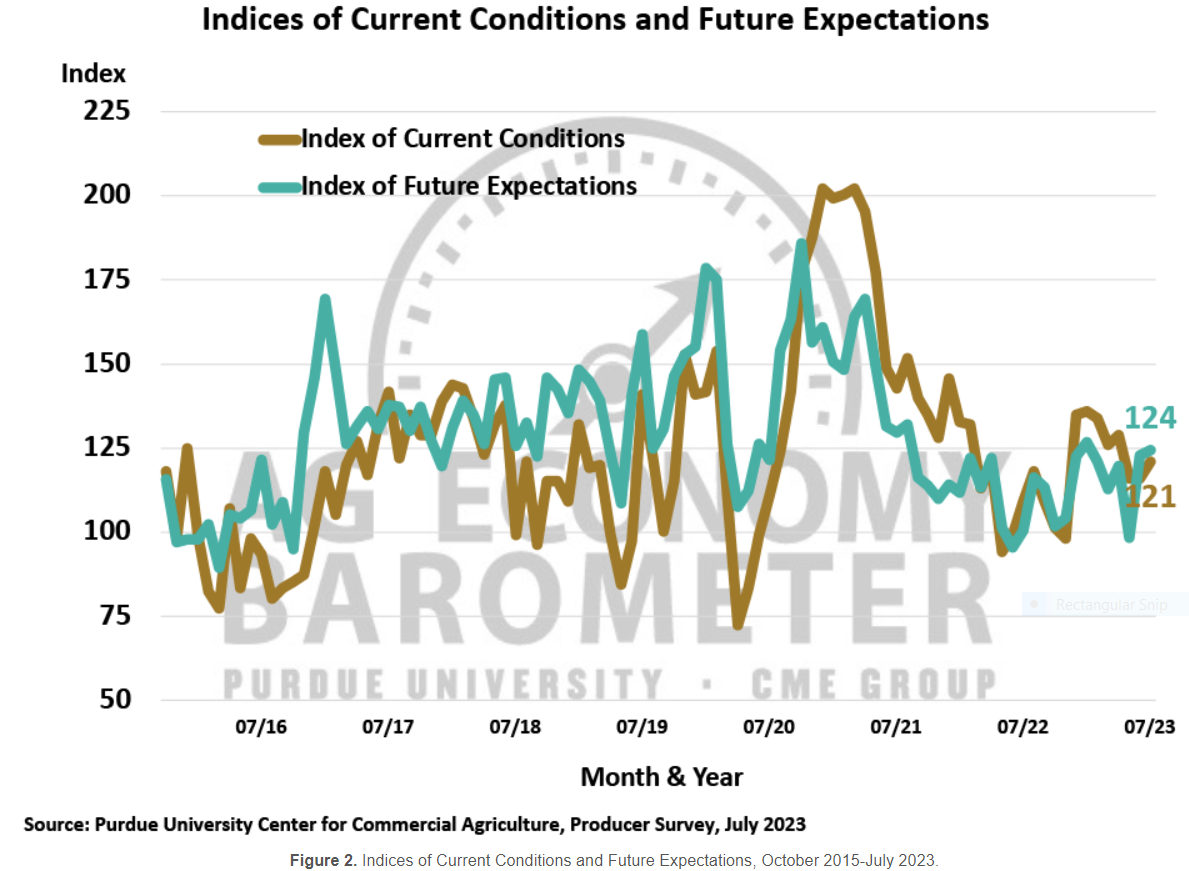

Farmer optimism inched slightly higher in July, according to the latest Ag Economy Barometer from Purdue University and the CME group, released August 1.

“It’s just a couple of points higher compared to June, but it’s up about 20 points compared to this same time last year,” says Jim Mintert, director, Center for Commercial Agriculture, Purdue University and co-creater of the barometer.

Looking back to May, however, Mintert says the percentage of producers rating their

July Rains Helped

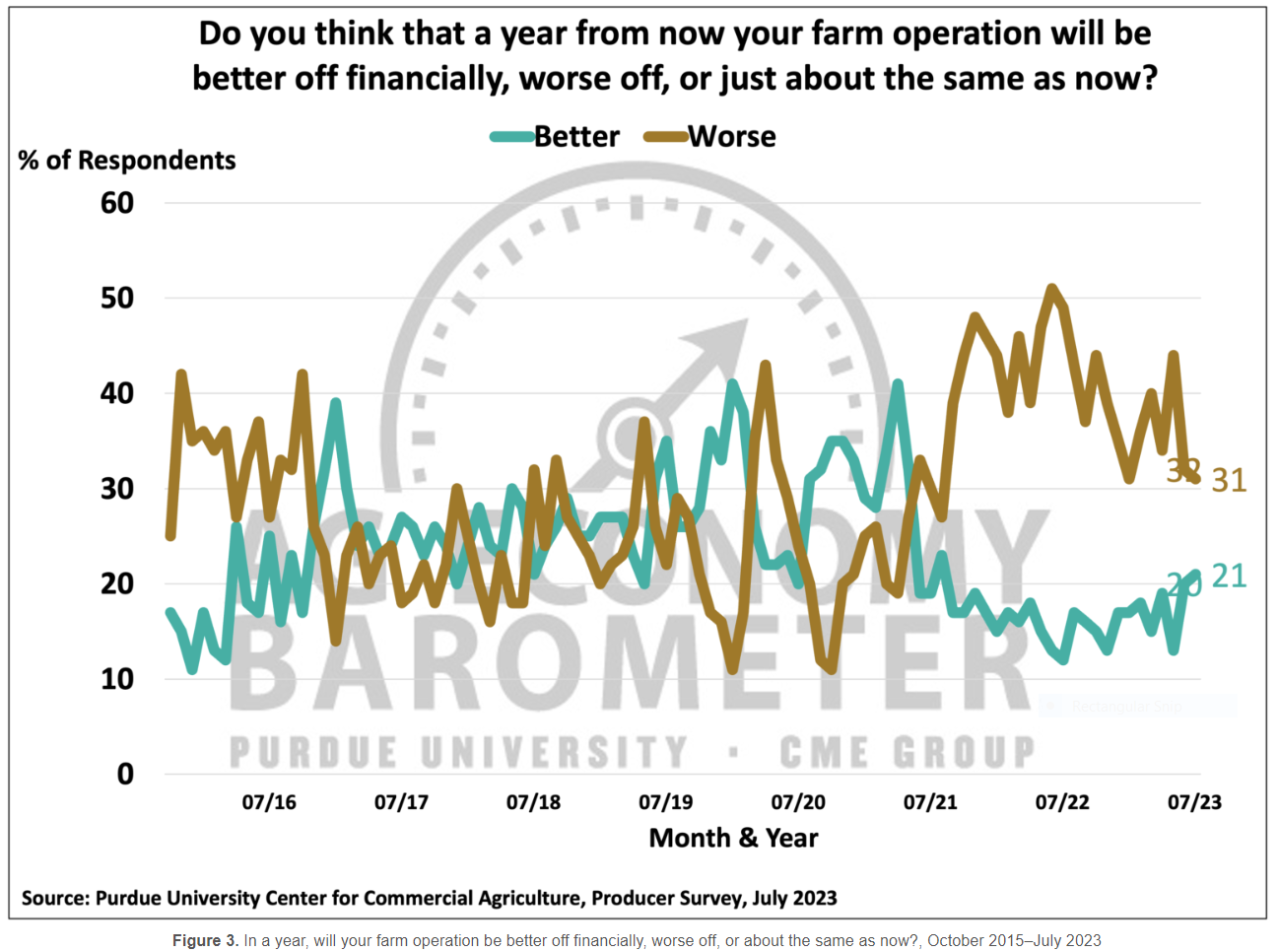

Part of what’s at play in Chip Flory’s opinion is farmers are feeling better about their personal yield prospects, given some rains in July, and are seizing market opportunities.

“I think that's probably got a lot to do with this and just the simple fact that these markets have given some opportunities,” says Flory, a market analyst and host of AgriTalk. “It sounds to me that more and more producers have taken advantage of the markets that were given to them and increased their new crop markets.”

Farmers managed to navigate the market volatility last month, Mintert adds. “That was one of the things that led me to be a little bit surprised. I thought perhaps we'd see some negative things show up, just relative to the fact that these markets have been so volatile as that can create some stress,” he told Flory. "But it was really an interesting survey in terms of people felt a little bit better about their farm's financial performance. They feel little bit better about making large capital investments. So really some cautious improvement there.”

Concerns About Interest Rates Mount

Mintert says the rising interest rates are increasingly a concern for farmers. The concern was most apparent when farmers were asked about making large capital investments replied that now is a bad time to make that decision.

Last summer, between 14% and 18% of the people in the survey told Mintert and his team that rising interest rates were a primary reason for it being a bad time to make large investments. That sentiment has only grown. Now, almost 40% of farmers surveyed chose rising interest rates as the biggest reason why they thought it was a bad time to be make large investments.

“And we have two thirds of farmers – 65% of people in the survey this month – who expect interest rates to go up over the course of the next year,” Mintert says.

Land Cash Rental Rates Outlook

One thing most farmers surveyed don’t expect to go up are land rental rates. Nearly one-fourth of corn/soybean producers expect farmland cash rental rates to rise in 2024 compared to 2023. Seven out of 10 producers look for no change in 2024’s rental rates.

The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from July 10-14, 2023.

Listen to the full discussion between Flory and Mintert here: