Fertilizer Free Fall: The Gamble of Locking In Prices

The decision of when to lock in input prices is always a gamble, and in 2023, those who opted to wait might feel like they won the lottery. Fertilizer and herbicide prices have been in a bit of a free fall since spring, a dramatic change from the price shock farmers faced in fall 2022.

According to Ohio State University’s Barry Ward, if farmers locked in their input prices prior to spring, they’ll more than likely harvest their most expensive crop ever this fall. If they waited to buy fertilizer until April or May, the 2022 crop holds that record.

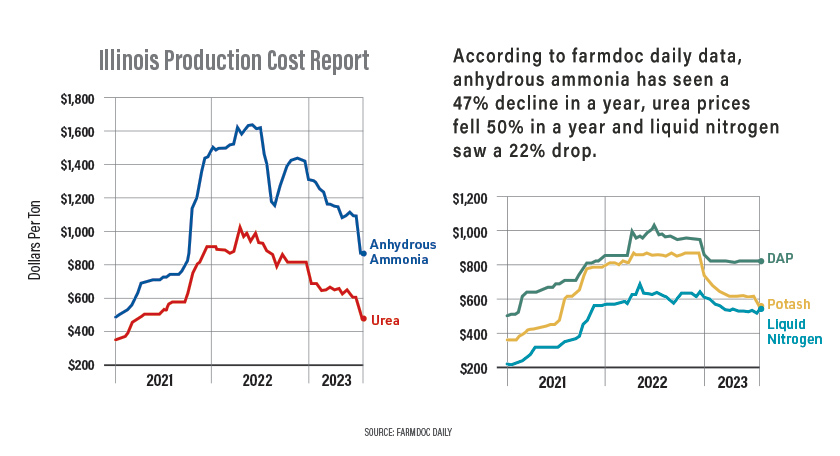

“We look at nitrogen prices, some of the big ones like ammonia and the UAN products, and those prices are 30% to 50% lower than last year,” Ward says.

The data shows anhydrous ammonia dropped 50% year over year, and 30% of that drop happened since March. Phosphorus fertilizer products are 20% below last year.

Most Affordable Prices Since 2004

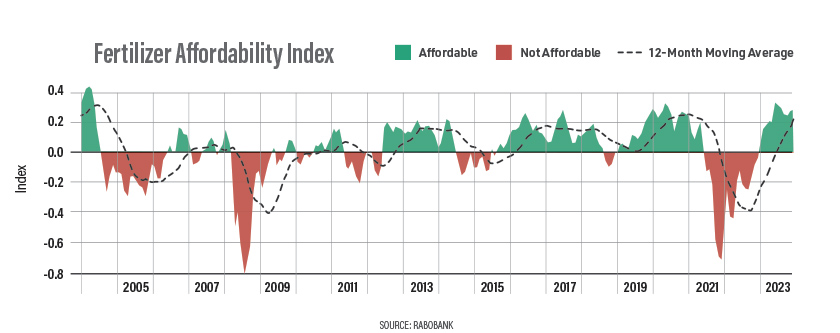

The price shift was sudden and something Rabobank’s Sam Taylor has also been tracking.

“If you look at the affordability index, it has gone from being atrocious last year to actually one of the best it’s been in decades,” Taylor says.

Rabo’s Affordability Index tracks the wholesale price of a breadbasket of fertilizers, including nitrogen, phosphorus and potassium (NPK). The index compares those prices to current commodity prices. Taylor says the index shows fertilizer prices went from the least affordable since 2008 in 2022 to this year where prices are the most affordable since 2004.

What’s Weighing on Prices Today?

Ward says the sharp decline for key fertilizer products is partially driven by falling crop prices.

“As [crop prices] move, fertilizer prices tend to follow. It’s not always a perfect correlation, though,” Ward adds.

Lower commodity prices can cause some farmers to second guess the amount of fertilizer they buy. But the other major driver? The price of natural gas.

“We saw that really fall out in both North America and Europe throughout the winter,” Ward adds. “A milder winter was part of the driver. So, those lower natural gas prices were a key feature and a key factor in not only nitrogen prices, but also helping to soften some of our phosphorus fertilizer prices.”

High fertilizer prices also caused some demand destruction in 2022, with farmers scaling back on what inputs they decided to buy, he says. The higher prices also enticed fertilizer producers to ramp up production.

“We had bottlenecks creating some of that upward price pressure in 2022. Some of that did ease a little bit as we entered into 2023 and China started to allow a little bit more product to move,” Ward says.

The Reintroduction of a 2022 Wildcard

With ample supplies of herbicides and fertilizer, the question now is: Will input prices stay relatively low through fall?

“It’s tricky because there are a lot of fundamentals at play, some we really can’t sort out, such as the whole Black Sea region and nitrogen and phosphorus fertilizer coming out of Russia,” Ward explains. “That’s an issue that was better, and now it’s likely going to be worse.”

North America doesn’t receive a lot of product directly from Russia, he adds, but as it flows elsewhere, it impacts overall global supplies, which in turn influences prices.

Farmdoc daily points out much of the rise in fertilizer prices during the first half of 2022 was due to trade disruptions stemming from the Russia-Ukraine conflict. Sanctions were placed on exports from Russia and Belarus, which prompted other global producers to implement export restrictions to protect supply.

The Dilemma for Fall

With uncertainty injected back into the fertilizer market today, growers are weighing what to do with fertilizer purchases this fall.

“There is supply, there is inventory,” Taylor says. “Unless something goes cataclysmic in the world, farmers shouldn’t see a huge price correction.”

According to farmdoc daily’s August fertilizer report, there’s still upside risk.

“These market expectations for corn and natural gas prices and current price levels for fertilizer products seem consistent with conditions during late-summer and fall of 2021, prior to the turmoil introduced by the Russia-Ukraine conflict in February 2022. Thus, it might be prudent to consider pricing at least a portion of 2024 fertilizer needs given the ongoing risks in the market,” says the early August report.

Ward has a strong message for growers: If you’re looking to lock in fertilizer prices, get some crop sales on the books as other costs on the farm are projected to climb.

“With fertilizer being a little bit lower than crop chem, there’s still this issue of escalating cash rents across the Midwest, which are going to put pressure on growers,” Ward says.