Jerry Gulke: Is Curbing Demand the Only Choice?

Slow planting, inflation, next week’s USDA reports and more are impacting the markets. Jerry Gulke shares his outlook.

July corn prices were down 28¢ and December corn prices were down 29¢, for the week ending May 6. July soybean prices were down 60¢ and November soybean prices were down 34¢. However, wheat prices were up 40¢ to 60¢.

Slow Planting Progress

Even though little corn or soybeans have been planted so far, we're finally going to get some good planting weather.

Once it warms up, we're going to go at planting with a vengeance, and I think the market understood that. We'll get a lot of crops in the ground before what appears to be another round of cooler weather and rain.

Will Farmers Switch Crops?

Currently ag market commentators are seemingly fixated on whether or not there will be 1 million or more acres shifted from one commodity to another due to spring planting delays, price incentives or the mere extreme costs to put in one crop (corn) versus another (soybeans).

My spreadsheet shows a clear winner of corn over soybeans.

Agronomists will tell me I can still achieve 92% of my “yield potential” on corn planted in May. Yield potential is higher than an APH, which suggests if everything is perfect going forward what I plant the last half of May could still achieve APH. Using that still favors corn so that has been my last-minute plan, to move acres to corn (weather permitting).

Technical analysis also favors corn as November soybeans put in their top on Feb. 24 — the day of the Russian invasion Ukraine. Soybeans have tried unsuccessfully to move higher whereas December corn futures did indeed increase in value.

We will see another U.S.-sized soybean crop in January to February in the southern hemisphere, weather permitting, that may have to contend with less Chinese demand than expected.

So, under a global-demand-reduction situation, soybeans likely have more downside risk than the current market has been admitting. President Biden is trying to legislate planting more double-crop beans on wheat for next year in a move to add supplies. What might be done next is soy oil resumes its parabolic move again?

Thus my “potential” acreage decision, which the market won’t know about until June 30, unless it smells something sooner.

Inflation: Demand Destruction?

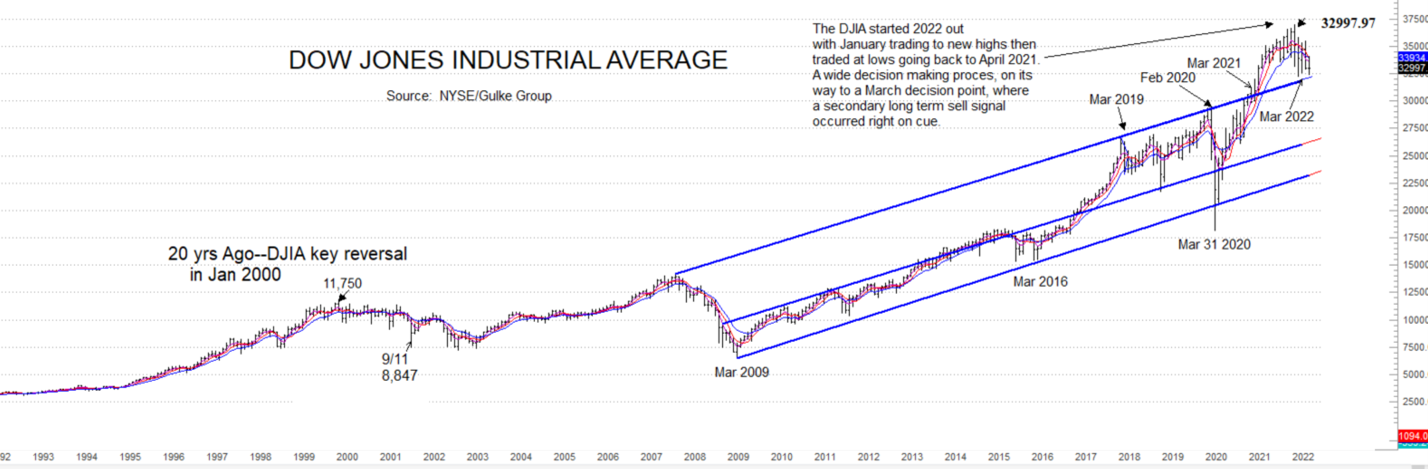

Regarding demand reduction or demand destruction, the decision that rests it seems in the U.S. with Fed Chairman Jerome Powell. It is not a matter of if but when and how demand is reduced, while hoping for a soft landing of the economy is or will be accomplished without a recession or worse yet deflation. Having lived through the great inflation of the 1970s and the recession aftermath, I recall very well what finally had to happen—an interest rate increase shock.

How all this plays out here in the U.S. will be behind the curve of what already is the task in Europe, Asia and China, of course. There is a correlation, in theory perhaps, between GDP growth or contraction and calorie intake. We can rightly assume poorer nations increase calories (food) when income increases. But is the opposite true?

Certainly, the massive $4.5 trillion in expenditures has a tendency to cloud consumer spending in the U.S. It also means the Fed can’t lower interest rates unless there is a loftier level from which to lower them.

Thus, the real action should have been a ¾% hike in rates to exhibit the determination to get inflation under control rather than feather the systems to where it is more uncontrollable. From what I can tell the laws of economics and supply and control have not been repealed by this administration just yet. It took a decade and a half of free money to get us to this place, and it won’t be fixed all that quick. Now we have trillions (not billions) to work through the system, causing a false sense of progress, and worse yet, miscalculations.

One can debate all day what it takes to curb inflation. But demand that exceeds what we can produce is simply inflationary. We can have a whole debate about how the government can try to make supply-side reforms that would produce more as we have witnessed in the past, but why debate it because the current administration is quite the opposite of the Reagan administration that pursued those reforms after the last inflationary shock of the 1970s.

That leaves the Fed only one alternative: To try to fix inflation by curbing demand. Given the situation globally and the war’s direct effect on food prices, as well as energy, along with our current reluctance to reverse our U.S. attitude regarding fossil fuel, there is only one choice.

The question then is do we really want or expect higher and higher ag prices when all it may do is to force administrations globally to do odd things? When politicians have their backs against the wall, they will take irrational short-term actions. Basic premise is there are more non-ag votes than ag votes.

Read more: Jerry Gulke: Are We Facing Inflation Déjà Vu Again?

May 12 USDA Reports

USDA will release its monthly Crop Production and World Agricultural Supply and Demand Estimates (WASDE) reports on Thursday, May 12.

The general thinking right now is the reports will be somewhat friendly. The thinking is USDA will increase exports because the U.S. will have to get a share of what’s not available out of Ukraine, Russia or South America.

I look at these markets and say: What is everybody expecting? What don't I want to see?

I don't want to see the government raise the ending carryout of grain.

May can be a real market mover and can set significant market direction. Sometimes we get a black swan event. We have to be really cautious going into the May report.

Check the latest market prices in AgWeb's Commodity Markets Center.

Get in Touch with Jerry

Do you have questions for Jerry? Contact him at info@gulkegroup.com or 312-896-2090 or GulkeGroup.com

Jerry Gulke farms in Illinois and North Dakota. He is president of Gulke Group Advisory Services. Disclaimer: There is substantial risk of loss in trading futures or options, and each investor and trader must consider whether this is a suitable investment. There is no guarantee the advice we give will result in profitable trades. Past performance is not indicative of future results.