Richard Brock: Watch These Market Fundamentals

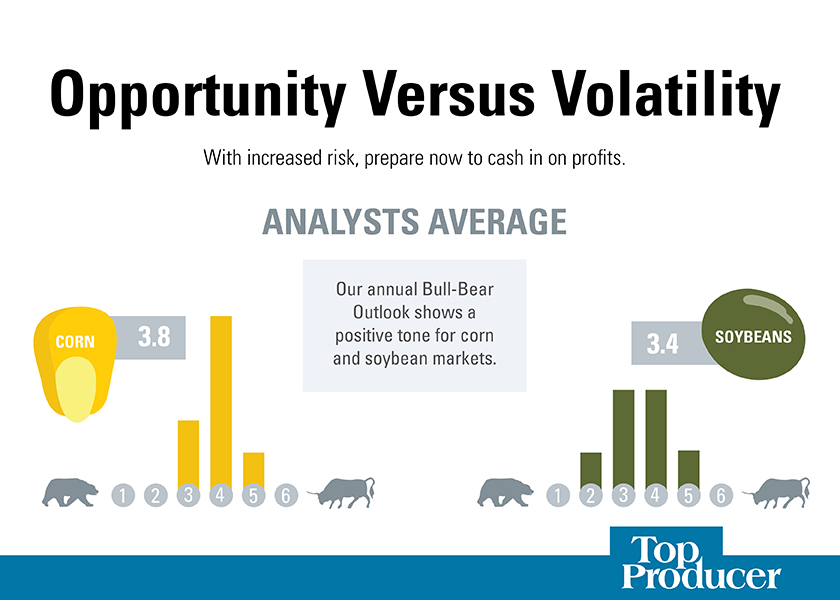

Could 2022 offer the same profitable opportunities as 2021? The outlook for corn and soybeans is optimistic thanks to strong demand and potential production shortfalls in South America. Yet headwinds are present. We asked eight analysts to provide their best estimates on price direction and market strategies you can put to use in 2022.

Richard Brock, Brock & Associates

On the bullish side, ethanol production is increasing and ethanol plants are profitable. Also on the positive side is the advancement of renewable diesel. California is requiring cleaner fuel, which has pushed up the demand for both ethanol and renewable diesel.

A negative factor would be a sharp jump in global production. As of mid-January, there was concern over Brazilian soybean production due to dry weather. That has helped support the market. My estimate is that will not last. Supply-driven bullish news is normally short lived.

Two other key fundamentals include China’s purchasing programs, which are strong but lagging the amount of corn and soybeans purchased last year from the U.S. We believe they will be long-term buyers but not like they were 12 months ago.

Another key fundamental is the price of fertilizer and other inputs for this year’s crop. Nitrogen prices have more than doubled. A concern? Yes, but let’s not forget a large share of Midwestern producers applied the majority of their anhydrous last fall. Once nitrogen is down, the acres go to corn.

It all comes down to what fundamental changes mean to the stocks-to-use ratios. As of early January, the ratios for both corn and soybeans were over 10%. History shows a 10% ratio in soybeans creates average prices of $10 per bushel. In corn, a 10% ratio equals $4.70 per bushel. Thus, corn and soybean prices are near the top of the price range.

Read More

Naomi Blohm: Corn and Soybean Market Factors to Watch

Bill Biederman: A Dichotomy of Possibilities

Brian Basting: Market Tools That Turn Uncertainty Into Opportunity

Disclaimer: This material has been prepared by a sales or trading employee or agent of these analysts and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions and agree that you are not, and will not, rely solely on this communication in making trading decisions. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that these analysts believe are reliable. Such information is not guaranteed to be accurate or complete, and it should not be relied upon as such. Trading advice reflects good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice provided will result in profitable trades.