Infrastructure Woes To Watch: Potholes Plague Global Ag Trade

It seems like the world trade routes are riddled with more potholes than a Minnesota highway come springtime. Getting goods and materials from point A to point B has been anything but smooth sailing, and it continues to be a serious thorn in the side of the U.S. agricultural economy.

Recently, at Farm Journal’s Top Producer Summit, attendees were briefed on one of the larger logistical potholes to appear. Eric Snodgrass, Nutrien’s principal atmospheric scientist, pointed the finger at a particularly strong El Niño pattern leading to one of the driest years on record in Panama—home to the modern-day engineering wonder known as the Panama Canal.

Limited Capacity

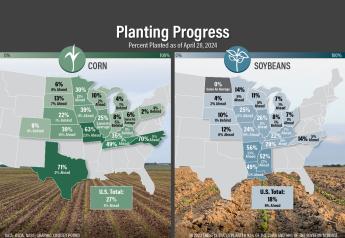

In 2023, USDA and the Panama Canal Authority reported 91% of U.S. sorghum exports, 29% of U.S. soybean exports and 18% of U.S. corn exports used the Panama Canal.

The persistent drought in Central America could profoundly effect those exports. The man-made Gatun Lake, which holds the water supply necessary for the Panama Canal to operate, was at its lowest level ever in January 2024. By early March, only 24 ships of any size were allowed to traverse through the canal daily, a reduction from the previous capacity of 35 ships to 40 ships.

Panama Canal Addresses Water Shortages

To add insult to injury, many larger vessels have had to reduce the amount of cargo carried to navigate shallower canal water levels. As the costs and the uncertainty of even getting a ship through the Panama Canal grew, prominent shipping companies responded by rerouting their vessels half a world away through the Suez Canal.

Plan B Nightmare

Turns out, the Suez Canal wasn’t a good plan either. Instead of Mother Nature disrupting trade, terrorists attacking commercial ships in the Red Sea have presented problems. Yemen’s Houthi rebels have been attacking ships in the region since November to force Israel to end its offensive in the Gaza Strip against Hamas. By mid-March, more than 40 vessels had been attacked, and three seafarers had been killed.

The effect on shipping in the Red Sea has been larger than the drought in Panama. In the first two months of 2024, Suez Canal transits dropped by 50% from the previous year. The only good way to currently go from the Port of New Orleans to a port in Tokyo is around the Cape of Good Hope. It’s also the longest way as the route: 15,637 nautical miles and 54 days on average. The Red Sea route shortens the trip to 14,401 nautical miles and 50 days. Using the Panama Canal, the same ship could leave the Port of New Orleans and travel 9,141 nautical miles to be in Tokyo in just 32 days.

Economic Implications

Since the pandemic, ocean freight shipping costs have increased 350%. A February report from the United Nations said consumers will feel the effect within a year.

Higher shipping costs and disrupted supply chains lead to one thing: inflation. If something doesn’t break for the better soon, then the ship may have already sailed on this year’s anticipated interest rate cuts by the Federal Reserve. At the very least, such action will likely be further down the road and less than anticipated.

Regardless if such chaos is the new normal, we need to spend less time blaming scapegoats and more time dealing with reality. If it is not a pandemic, climate change or terrorists at sea, then something equally disruptive is bound to occur.

Three Takeaways

First, politicians might want to spend less time fretting about the CO2 being released into the atmosphere from boats having to take the long way to and from China. Instead, working with other countries to find a better “plan B” for routing global goods and services would be more helpful. Expanding the Panama Canal “land bridge”—a rail line and highway that runs parallel to the canal—might be a good start. If freight is offloaded on one side of Panama and shipped to a port on the other side, it would still be faster.

Second, it is time to invest in the technology and infrastructure to get American goods to port quicker and more economically. In 2021, the American Society of Civil Engineers gave the condition of our country’s inland waterways a D+ rating. They cited infrastructure investment needs, especially along the Mississippi River. Meanwhile, U.S. roads ranked worse with a D rating.

Finally, it might be time for some good ole Teddy Roosevelt gunboat diplomacy. It is embarrassing the largest shipping companies with the largest ships in the world are running scared because of an unruly band of third-world terrorists. It is time to take control of the seas.

Another Pothole

Just when you thought it couldn’t get any harder—it just did. In breaking news, out of nowhere in Baltimore, Maryland a huge container ship lost power while exiting port and struck the Francis Scott Key Bridge causing it to collapse. Completely clearing the bridge wreckage will take months, thus limiting overall port traffic.

Will The Collapse Of The Baltimore Key Bridge Impact Agriculture?

In terms of its total effect, this latest incident is a much smaller pothole, but still significant. Baltimore is the ninth-busiest port in the national for international cargo. But for America’s heartland it will be felt as a bigger bump in the road as the port is closer to the Midwest than any other East Coast port. Additionally, it is a port that handles a significant amount imported light trucks, construction and agricultural equipment.

Buckle up. Food’s journey is never done until the product’s on someone’s plate.