Soybean Farmers Hopeful $461 Million Buried at Bottom of Mississippi River

Almost half a billion dollars is buried at the bottom of the Mississippi River, and the U.S. soybean industry is confident the vast sum is waiting at a depth of 50’. A massive effort is underway to dredge the lower Mississippi along its final 250-mile stretch, and the results could provide major financial benefits to American farmers.

At ports along the mouth of the Mississippi, most ships loading soybeans can presently carry a maximum of 2.4 million bushels, and any additional weight in the hold puts the vessels in danger of scraping the riverbed. However, a mere extra 5’ in depth allows a ship to squeeze in 2.9 million bushels, and gain greater carrying power, at a marginal increase in transport costs to the vessel. Translation: Digging the depth of the lower Mississippi from 45’ to 50’ could generate an extra $461 million annually for the U.S. soybean industry—independent of supply and demand, and strictly based on efficiency of transport.

Started in 2020, and scheduled for completion by 2022, the Mississippi River Ship Channel Dredging Project will cost roughly $270 million, and is expected to return $7.20 for every $1 spent in construction and maintenance, according to Corps of Engineers estimates. The project, says Mike Steenhoek, executive director of the Soy Transportation Coalition (STC), means basis benefits to growers, who could soon be selling a more economical bean. “This project is a big, big deal for the export strength of U.S. agriculture in the future, and it’s also very significant for farmers in the near-term,” Steenhoek explains. “Our researchers have broken basis improvements down by state and the savings are very real. The numbers show this project is going to mean better prices for farmers at their local elevators.”

Floats All Boats

The Mississippi River is an aquatic superhighway, and drains 40% of the continental U.S., including 32 states between the Rockies and Appalachians. At 2,350 miles long, water flow eventually discharges into the Gulf of Mexico at 593,000 cubic feet of water per second. Carried along in the prodigious flow of water is an ever-present sidecar of sediment, perpetually building along the river’s final run.

There are several areas on the lower Mississippi particularly subject to sediment buildup and those locations contribute to diminishment of the cargo-carrying capacity of ocean-going vessels. Simply, ships with too much cargo run the risk of striking the Mississippi’s bottom. As the river approaches the Gulf of Mexico, it splits into multiple lanes, and the channel providing a vital shipping connection to the Gulf is the Southwest Pass—an area highly subject to sediment accumulation. Despite the logistical supremacy of the lower Mississippi, the lack of depth in the Pass has become a major limiting factor in providing access to larger capacity ships. (The entire lower Mississippi River from Baton Rouge to the Gulf of Mexico, where all export terminals are located, is 256 miles. The Southwest Pass is the final 20-plus miles before the Mississippi River empties into the Gulf.)

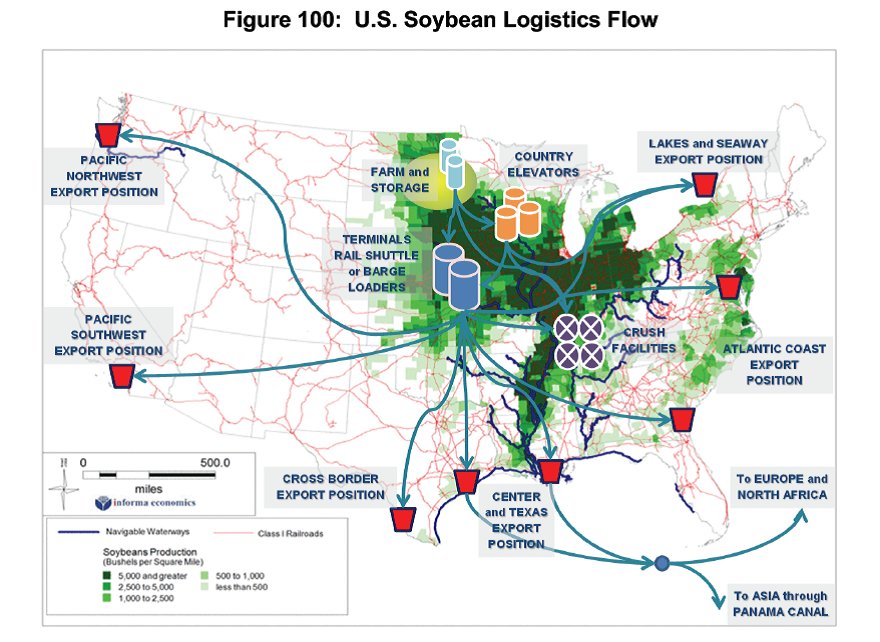

Without hyperbole, sediment buildup along the Southwest Pass carries national implications, because the lower Mississippi is the No. 1 port region of the U.S. in terms of freight volume. Energy, agriculture, plastics, resins, chemicals, and vastly more, the lower Mississippi River is a gateway of American commerce, providing maritime access to a pulsating network of waterways within the U.S. interior.

Soybeans annually rank as the #1 agriculture commodity export departing from the mouth of the Mississippi, with corn as a close #2. (Further, the Gulf is the also the top export launching point for soybeans and corn.) Fairly stated, any change in export logistics on the lower Mississippi—for the good or the bad—can have a major impact on U.S. grain farmers.

Identifying the sediment buildup issue was easy, but finding enough greenbacks to fund a permanent remedy was a far tougher knot. In 2016, Congress passed an updated version of the Water Resources Development Act, and made key cost-share changes. Prior to 2016, financial responsibility for a capital improvement was split in half, a 50-50 federal/non-federal deal. However, after 2016, the new law moved the numbers to 75% federal and 25% non-federal, opening the door for the State of Louisiana to aggressively tackle sediment problems.

However, the Midwest didn’t let the South carry all the water. The Soy Transportation Coalition entered the picture in 2018, and commissioned research to find precise answers about how sediment removal would affect ag commodity exports, according to Steenhoek. “This project is not just a Louisiana thing, but also key for Illinois, Ohio, Iowa and many other states. We all stand to benefit, and that’s why the United Soybean Board provided $2 million to help assist with the cost. It’s a great collaboration among Louisiana stakeholders, the Corps of Engineers, and soybean farmers.”

In May 2018, commissioned by STC, Informa Economics (IEG) completed a report, titled Impact on Crops and Product Export Flows of Dredging the Lower Mississippi River to 50 Feet—and the results hold extreme relevance for soybean farmers. Plainly stated, the report indicates a rising tide indeed floats all boats.

Steenhoek posed the following question to IEG researchers: If the soybean transportation chain is improved due to a deepening of the river, to what extent will local basis improve for farmers? “We quantified and found a total of $461 million in basis improvement,” says Steenhoek, “and we broke that number down state by state.”

A Better Price

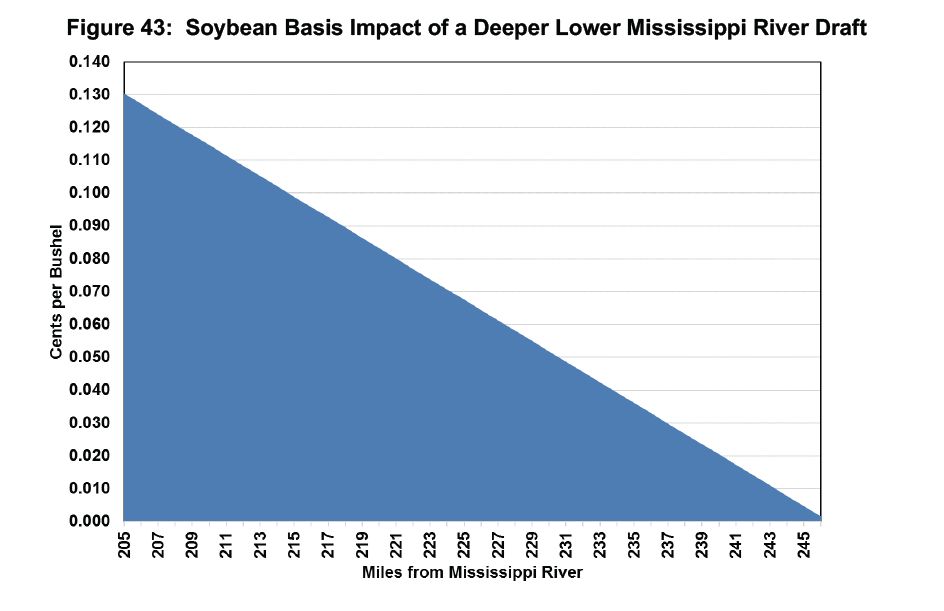

Answering Steenhoek’s question, the IEG report predicts an annual improvement in basis of 13 cents per bushel within 205 miles of the Mississippi River, and then a steady decline to zero at 246 miles. Illinois growers, with $77,083,490 in potential increase, are positioned as the project’s top beneficiaries. “Illinois is projected at No. 1 because it has the advantage of the Mississippi, Ohio, and Illinois rivers all playing a part,” Steenhoek says.

Other states with substantial gains on the table include Iowa ($71,482,588), Minnesota ($49,372,039), Indiana ($42,158,994), Missouri ($34,866,744), and Ohio ($34,291,415).

“Eventually, this means farmers will get a better price at local elevators,” Steenhoek says. “I want farmers to understand how this could improve basis in their neighborhoods, whether they’re close to Davenport, Cincinnati, Louisville, or a lot of other cities. The price farmers receive at the barge loading facility is massively influenced by how efficient the transportation system is subsequent to that delivery.”

On the flip, the IEG report also forecasts trouble, stating: “Soybean crushing facilities located within the draw area of 247 miles will be the big loser. The improvement in the export delivery system effectively allows China to compete better with the domestic users. The decrease in volume crushed will also decrease the production of soybean meal.”

5’ = 500,000 Bu.

Once the 256-mile dredge is completed from the Gulf to Baton Rouge, the river depth will increase from 45’ to 50’, and the 5’ differential should mark a gargantuan change in the calculus of soybean economics.

Each year, roughly 500 to 600 ships enter the Mississippi River’s mouth and stop at U.S. ports to purchase soybeans. The vast majority are Panamax vessels, often described as workhorses of global commerce, and were once the largest ship capable of passing through the original locks of the Panama Canal. A Panamax takes over a day to load its seven hatches (300,000-400,000 bushels per hatch), usually carrying a maximum load of 2.4 million bushels of soybeans. However, the extra 5’ will boost the maximum load to 2.9 million bushels, equating to a 100,000 bushels for each added foot of depth.

Most Panamax vessels are China-bound, an approximate 30-day journey when returning through the Panama Canal. (Some ships take the opposite route, across the Atlantic Ocean, around the Cape of Good Hope, and through the Indian Ocean.) “An additional 500,000 bushels is not a marginal improvement,” Steenhoek emphasizes, “and that’s what we see for near-term gain with Panamax vessels. However, in the future we’ll be loading even larger ships that can accommodate even more bushels per vessel. But using even bigger ships assumes that the point of destination can also accommodate the huge load.”

Perpetual Investment

The pressing need for deeper waters at U.S. ports is also heavily related to competition—particularly in South America. From the IEG report: “The US farmers’ infrastructure advantage over other countries is disappearing however. Multinationals have entered the Brazilian grain and soybean handling system, investing heavily on grain and soybean collection infrastructure including barge equipment, barge loading elevators, rail network capabilities and export elevators. For example, across northern Brazil, the result is a recorded load out increase from 1.6 million metric tons in 2002 to 15.4 million in 2015, with potential exceeding 60 million.”

Steenhoek emphasizes the need for perpetual investment in the U.S. transport framework: “Great nations and great industries continue to invest in themselves. Look at our competitor’s improvements in Brazil to store and transport. Yes, they’re behind us in quality of infrastructure, but they’re sure making progress. We can’t control what happens in South America, but we can sure make improvements here.”

Hose and Hydrant

And what will the Corps do with all the sediment pulled from the bottom of the river? The dirt will be used as an environmental antidote. Louisiana has long struggled with shoreline erosion, but river sediment removal will help build resiliency for the Pelican State coastline, including an increase in wildlife habitat. “This is project that is a winner from so many angles, and returns over $7 for each dollar spent in the $270 million cost,” notes Steenhoek. “It makes sense on all fronts.

In conclusion, Steenhoek uses a bare-bones metaphor of a hose and hydrant to highlight the significance of the Dredging Project for U.S. farmers. “What sometimes gets ignored in agriculture is the connectivity between supply and demand. That’s why this project is such a big deal: It allows us to accommodate strong demand, and positions us for farmer success. If our infrastructure can’t fully connect supply and demand, then we’re attaching a garden hose to a fire hydrant.”

On Sept. 11, 2020, the Corps removed the first scoopfuls of dirt for the Mississippi River Ship Channel Dredging Project and the effort is slated for the finish line in late 2022. “The projections are real,” Steenhoek adds. “The added transport efficiency could mean an additional $461 million every year in revenue for soybean growers.”

For more stories from Chris Bennett (cbennett@farmjournal.com), see:

While America Slept, China Stole the Farm

Where's the Beef: Con Artist Turns Texas Cattle Industry Into $100M Playground

The Arrowhead whisperer: Stunning Indian Artifact Collection Found on Farmland

Fleecing the Farm: How a Fake Crop Fueled a Bizarre $25 Million Ag Scam

Truth, Lies, and Wild Pigs: Missouri Hunter Prosecuted on Presumption of Guilt?

US Farming Loses the King of Combines

Ghost in the House: A Forgotten American Farming Tragedy

Rat Hunting with the Dogs of War, Farming's Greatest Show on Legs

Misfit Tractors a Money Saver for Arkansas Farmer

Predator Tractor Unleashed on Farmland by Ag's True Maverick

Government Cameras Hidden on Private Property? Welcome to Open Fields

Farmland Detective Finds Youngest Civil War Soldier’s Grave?

Descent Into Hell: Farmer Escapes Corn Tomb Death

Evil Grain: The Wild Tale of History’s Biggest Crop Insurance Scam

Grizzly Hell: USDA Worker Survives Epic Bear Attack

A Skeptical Farmer's Monster Message on Profitability

Farmer Refuses to Roll, Rips Lid Off IRS Behavior

Killing Hogzilla: Hunting a Monster Wild Pig

Shattered Taboo: Death of a Farm and Resurrection of a Farmer

Frozen Dinosaur: Farmer Finds Huge Alligator Snapping Turtle Under Ice

Breaking Bad: Chasing the Wildest Con Artist in Farming History

In the Blood: Hunting Deer Antlers with a Legendary Shed Whisperer

Corn Maverick: Cracking the Mystery of 60-Inch Rows