John Phipps: Are Politics and Policy to Blame for the Gain in Gas Prices

During Customer Support this week, Jay Brown in Ravenna, Ohio asked John Phipps the following:

“Love how you completely discounted the psychological influence on oil price speculation. Already forgot 2007-2008? We are absolutely in an oil price speculative situation just like bitcoin people are seeing big returns and fomo [fear of missing out] drives the market not fundamentals. This is absolutely 100% because of [Biden].”

This is an interesting idea. I tend discount speculative action in any commodity simply because they have to unwind those positions at some point. Any speculative position must have a counterpart on the other side of the trade for futures and options, so somebody is betting the opposite.

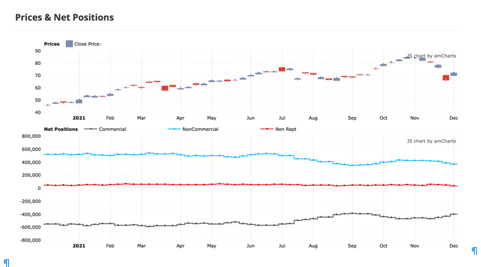

The Commitment of Traders report lump traders into three categories: commercial (people who use and sell real oil), non-commercial (speculators), and a very small group labeled non-reportable. Speculators have gradually lowered their collective long position during 2021. Long positions indicate belief prices will rise. It looks like there is no dramatic spike nor trend upward. The St Louis Fed has studied this belief and concluded the main drivers for oil are, in order of impact, supply, demand, oil inventory, and finally speculation. Oil is about fundamentals. The administration canceled the KXL in January, but there is little evidence of speculative action. Oddly enough oil prices have dropped significantly since August

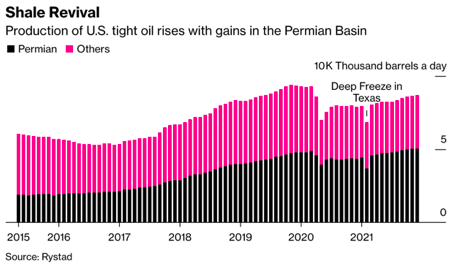

As I tried to show earlier, because we import and export almost the same amount of petroleum, the US is less sensitive to supply shocks like an oil embargo. In fact, higher oil prices have helped fracking to get going again. Nonetheless, oil prices aren’t set by our own supply and demand but globally. The much more serious energy shortage including transportation fuel in Europe is probably a stronger factor than the US production issues. Others around the world would benefit more from lower prices.

For the consumer, the lag between oil prices and gas prices can be irritating. One curious thing is complaints about fuel prices lead me to think it will speed electric vehicle adoption. It’s already happening but in an almost unseen way I’ll talk about soon.