Angie Setzer: Establish Profitability for Your Farm

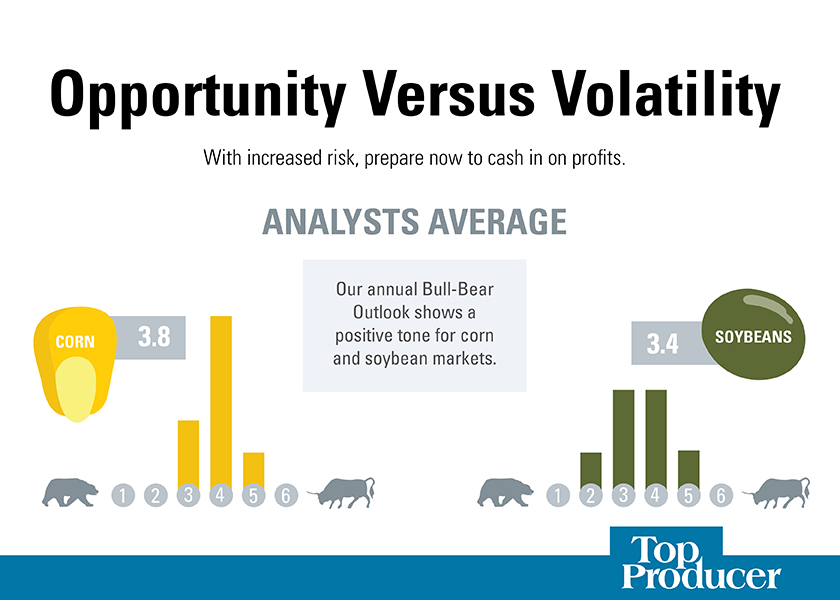

Could 2022 offer the same profitable opportunities as 2021? The outlook for corn and soybeans is optimistic thanks to strong demand and potential production shortfalls in South America. Yet headwinds are present. We asked eight analysts to provide their best estimates on price direction and market strategies you can put to use in 2022.

Angie Setzer, Consus ROI

I’m watching Chinese demand and South American production for corn and soybeans. Those two factors will play a significant role in market moves as we work into the summer and beyond.

We will continue to see talk of inflation playing a role in 2022 as we did in 2021, but the comparisons likely end there. What Russia does with Ukraine and what China does when it comes to Taiwan will likely be the two biggest influencers when it comes to market direction from a geo-political standpoint. A war between Russia and Ukraine would be bullish for commodities, while I feel Chinese aggression would be bearish.

It’s no longer about just breaking even — now it is all about establishing profitability for your farm. Take the time to recognize your points of profitability, so you have a clearer picture when it comes to the marketing steps you should take.

Once you reach your initial point of profitability, begin incremental sales with higher priced targets in place for additional incremental sales. Capture and maintain profits by using options, hedges, cash sales or, best yet, a combination of all three tools.

Use the tools you feel comfortable with to manage risk. You must know your costs and be honest with yourself about what they are and how you need to manage them.

Read More

Naomi Blohm: Corn and Soybean Market Factors to Watch

Bill Biederman: A Dichotomy of Possibilities

Brian Basting: Market Tools That Turn Uncertainty Into Opportunity

Disclaimer: This material has been prepared by a sales or trading employee or agent of these analysts and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions and agree that you are not, and will not, rely solely on this communication in making trading decisions. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that these analysts believe are reliable. Such information is not guaranteed to be accurate or complete, and it should not be relied upon as such. Trading advice reflects good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice provided will result in profitable trades.