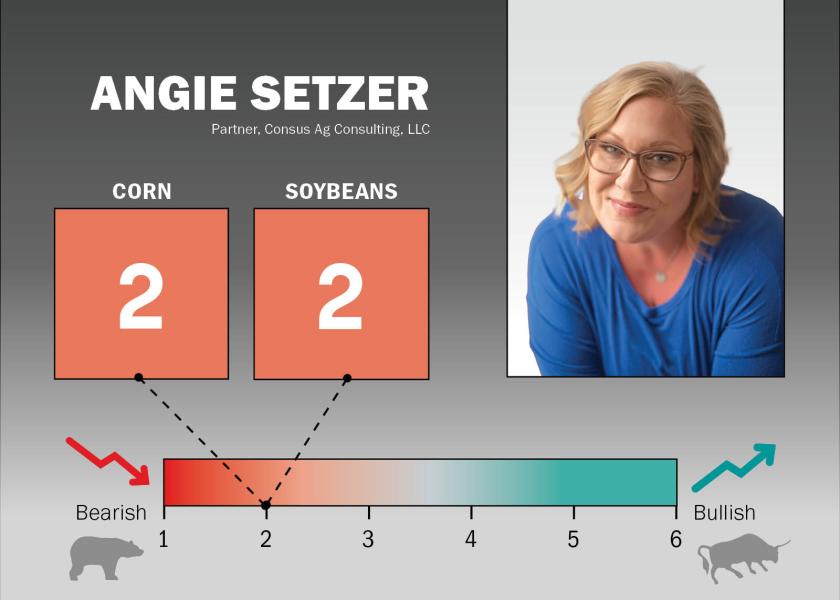

Angie Setzer: This Year Will Underscore The Importance Of Your Marketing Plan

2024 will reinforce the importance of having a plan in your grain marketing. The past couple of years have been volatile, but pricing opportunities were plentiful; this year we are likely to see more in the way of a rangebound trade punctuated by an occasional spike in price.

Back to ‘Old Normal’ Buying Habits

The entire market structure is different this year as end users, both domestically and around the world, have returned to “just in time” buying. While we have been seeing logistical constraints, supplies remain somewhat plentiful while demand has been rationed from the recent run of high prices.

The lackluster supply and demand dynamics combined with the speculator transitioning from buying to selling has the market starting the year under pressure. However, with the recent market strength so fresh in the minds of many, and the ever-present threat of China returning to the market as a buyer, I feel we will be able to find and maintain support well into the growing season.

In grains, I am watching Brazil’s second crop corn production, Black Sea production and exports, Chinese demand and domestic demand here in the U.S. In soybeans, it is great we have seen the surge in domestic crush demand that we have, with continued expectations of demand growth in that sector keeping support under the market. Soybean exports will likely continue to disappoint though as Chinese margins remain depressed and downstream demand remains poor.

More Outlooks:

Dan Basse: Prepare For Abrupt And Sizable Price Swings in 2024

Naomi Blohm: Soybeans Could Find New Country For Demand

Chip Nellinger: There Will Be At Least One Perceived Threat to Production

Mike North: Markets To Stay In the Doldrums

Jon Scheve: Expect To See Seasonal Rallies and Weather Risk