Jerry Gulke: A Paradigm Shift in Soybeans

We lose beneficial interest in our crops when we dump grain into a buyer’s grain pit, as we have lost basic ownership rights unless stored. The same can happen eventually with a hedge-to-arrive contract.

The accumulator programs are similar but are designed to make the decision- making process easier as they offer a premium initially with a contractual right to buy more as prices rise.

HTA and accumulator programs seem to rise out of the dust during times of price volatility in bullish markets. While both have many benefits, there are downsides.

HTA Contracts:

- Service charges can be higher than a low-cost brokerage futures commission.

- Regulations might prevent exiting and re-entering a previous position, with production problems being an exception.

- Rollovers to another delivery are permitted, but you pay the delivery month price difference.

- Beneficial interest and flexibility are gone.

Accumulator Contracts:

- Price premiums are paid to the seller initially for entering into a contract.

- The buyer can purchase at increasing price intervals.

- The seller could sell out of a crop before they intended, especially with price volatility.

- As prices rise, more sales are required; you could exceed you comfort zone or actual production.

- If you face a production shortfall, rolling ahead to another time is permitted (less price differential).

- If prices fall, the buyer has no obligation to buy more.

MARKET OUTLOOK

Generally, I am skeptical of buyers offering deals too good to be true. Naturally a buyer would want to own the physical inventory if their outlook is for higher prices.

From a buyer’s standpoint, should price outlook fall below a certain bandwidth, sales are not obligated as the odds would favor buying cheaper. Why would a buyer add to purchases if their outlook is negative?

There is a time and place for both contracts, but this year requires a “seller beware” mentality.

The word “outlook” looms big in decision-making. Being knowledgeable in the global situation is as important as knowing local bids and basis — after all our prices are more globally influenced.

SOUTH AMERICAN SITUATION

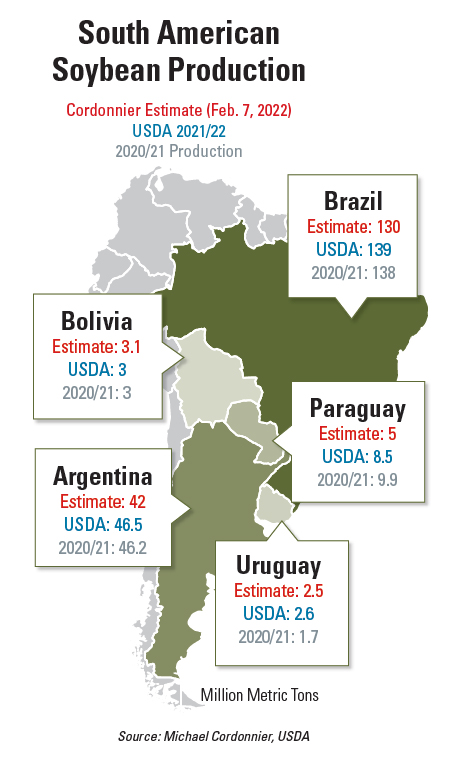

For example, let’s look at South America’s quickly dwindling soybean complex supply:

- Early Brazil estimates were around 145 million metric tons (MMT) of soybeans. It is down to 130 MMT. That’s a 500-million-bushel shortfall, which might still be underestimated. Read more: USDA Drops Global Soybean Production by 10 MMT

- Considering the remaining South American production, total supply could be nearly 1 billion bushels less than expectations from three months ago. That is equal to nearly 20 million acres of production.

- USDA is behind the curve and needs to reduce Brazil production at least another 10 MMT from the February WASDE report.

- The collapse in supply happened fast, making it difficult for the global market to get its arms around the dilemma. Denial could continue until May until U.S. acres are more defined.

- The U.S. and Canada cannot respond with sufficient acres.

- Price rationing could last at least 15 months, or until the 2023 South American soybean crop is seen as a record.

WHAT NEEDS TO HAPPEN

We need no government interference with price discovery and maximum soybean acres in the U.S. this spring to help meet demand.

Soybean meal will have to be rationed in every country, including China. We need alternative meal substitutes. U.S. soybean oil stocks also could be severely curtailed.

We must reduce demand from livestock. Look for these types of cuts in future WASDE reports. The September, October and November prices will respond accordingly.

Today’s volatile markets in the soy complex are starting to reflect the biggest drop in South American production in my lifetime, requiring a constant and realistic view of fundamental and technical analysis. Understand the longer- term implications of today’s markets. The buck stops with us.

Read More

Jerry Gulke: 10 Thoughts on the Paradigm Shift in Global Agriculture

The Gulke Group conference is set for March 17-18 near Chicago. Speakers will cover weather, fertilizer and market outlooks, and special guest Dr. Mark Jekanowski, Chairman, WASDE, who just concluded the Annual Outlook Forum. If you’d like to attend, visit GulkeGroup.com for more information.

Check the latest market prices in AgWeb's Commodity Markets Center.

Get in Touch with Jerry

Do you have questions for Jerry? Contact him at info@gulkegroup.com or 312-896-2090 or GulkeGroup.com

Jerry Gulke farms in Illinois and North Dakota. He is president of Gulke Group Advisory Services. Disclaimer: There is substantial risk of loss in trading futures or options, and each investor and trader must consider whether this is a suitable investment. There is no guarantee the advice we give will result in profitable trades. Past performance is not indicative of future results.