Here's Why Analysts Are Scratching Their Heads After USDA's New WASDE Report

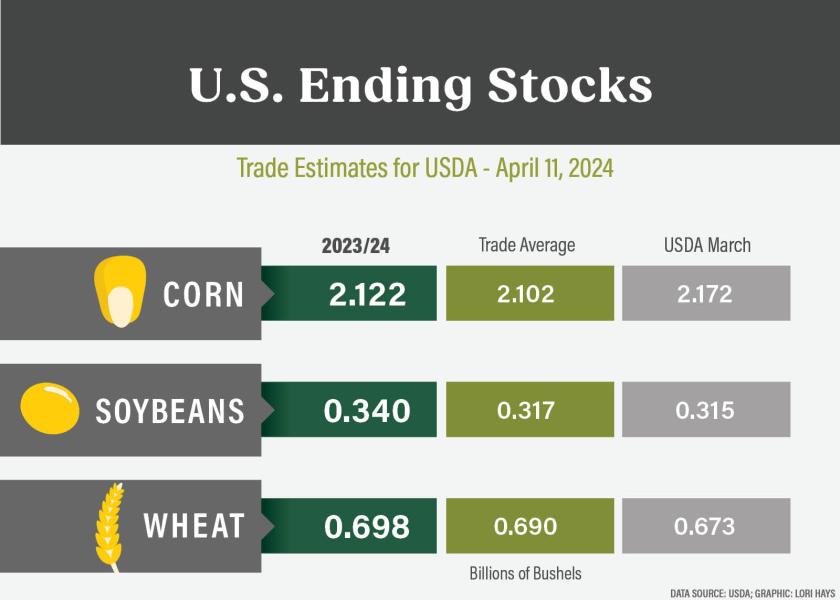

USDA’s monthly look at supply and demand offered a few surprises, including the lack of changes to South America’s crops. The April World Agricultural Supply and Demand Estimates (WASDE) showed larger wheat and soybean ending stocks, but smaller ending stocks for corn.

USDA's estimates for corn, soybeans and wheat ending stocks all came in higher than what the trade expected.

• Corn ending stocks: 2.1 billion bushels, 50-million bushels lower than last month

• Soybean ending stocks: Up 25 million bushels to 340 million

• Wheat ending stocks: 698 million bushels, up 25 million bushes

“The cut in corn ending stocks have certainly been justified,” says Arlan Suderman, chief economist for StoneX Group. “Cheap prices generate demand, and that's happening in corn. I think the bigger cuts yet to come are going to be related to added ethanol demand.”

Suderman says if you look at the marketing year to date, ethanol use for corn exceeds the seasonal pace needed to hit USDA’s newly revised target by 98 million bushels.

“We could see that ethanol demand go up considerably, yet we're still going to be above 2 billion bushels. So I don't want to get anyone overly bullish on that,” says Suderman.

On soybeans, Suderman says the 25-milion-bushel increase in ending stocks was caused by USDA’s cut to soybean exports.

“I think that was justified, but they continue to hold the line on crush, and I think they're going to be forced to increase crush,” says Suderman. “And that's going to pull us back toward that 300-million-bushel ending stocks estimate, still not bullish, but not as bearish as where they currently have us.”

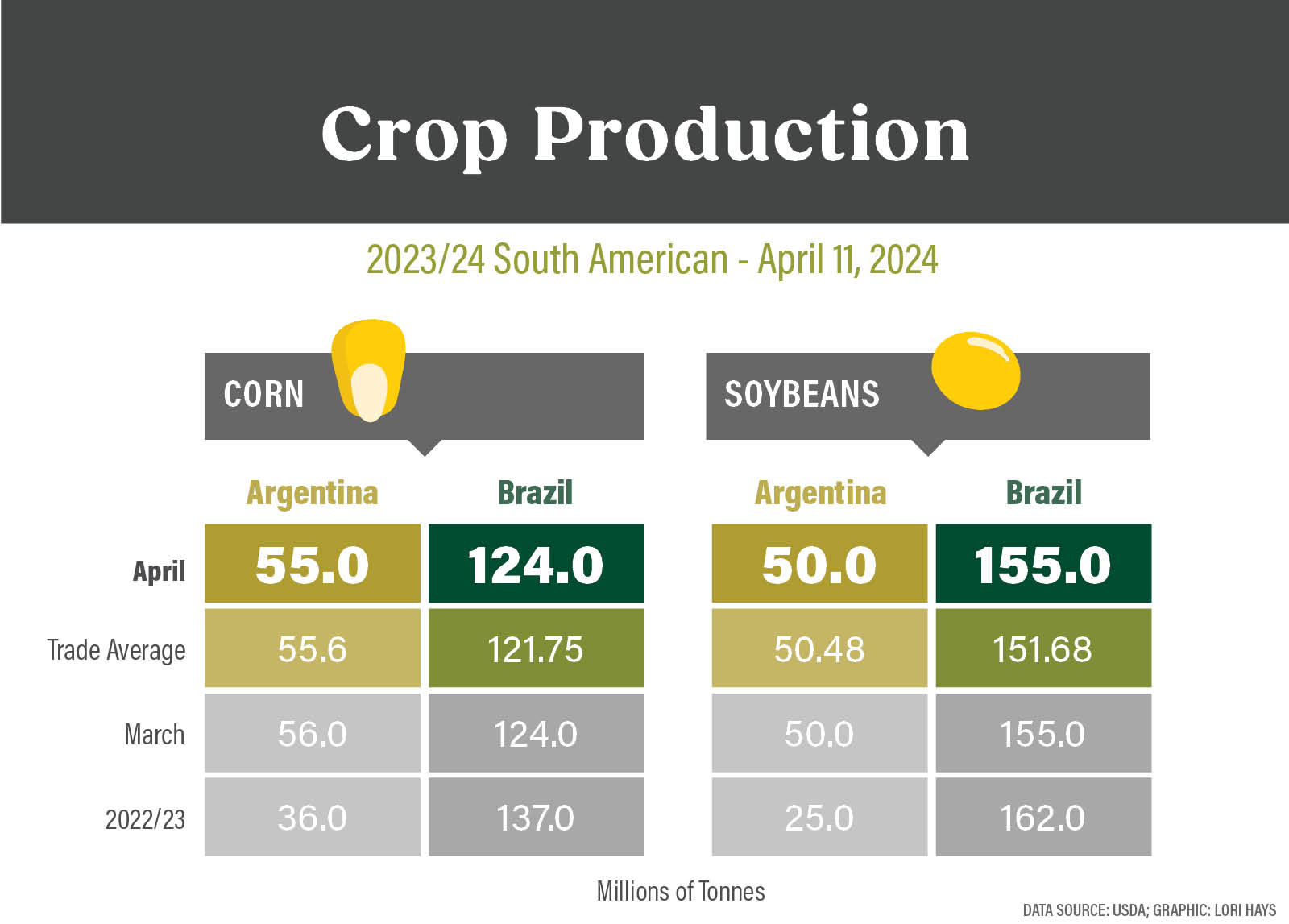

South American Numbers are Suspect

USDA made small changes to South American crop production numbers by lowering corn production in Argentina by 1 mmt. Those revisions were due to drought’s impact on the crop there. USDA made no change to Argentina’s soybean crop estimate.

The agency also made no changes to its forecast for Brazil’s corn or soybean crop size. Chip Nellinger, owner of Blue Reef Agri-Marketing, says USDA’s updated South American crop forecast was the bigger surprise in Thursday’s report.

“To me, the biggest surprise is the lack of changes that we saw from the USDA versus some of the numbers that are coming out of like CONAB and the Rosario Grain Exchange in Argentina. It just seems like USDA has a massive disconnect, still about a 500-million-plus-bushel difference with where CONAB came out on Thursday versus where the USDA came out for the Brazil bean crop.”

Nellinger says the difference in estimates is also leaving traders confused.

“It is going to have a direct influence, no matter what the crop size is on our exports. I think there's still some unknowns out there as far as what the ultimate crop size is in the Southern Hemisphere,” says Nellinger.

What Now?

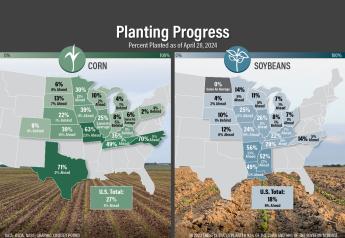

Now that USDA’s April report and the Prospective Plantings report are both out of the way, Nellinger says the market will shift its focus to planting and the weather forecast in the U.S. Currently, it’s a story of the East versus the West, with dry conditions continuing to consume the areas west of the Mississippi. In the east, more rain means not as much planting is underway.

“It was this way last year, as well,” says Nellinger. “You look at the drought map that came out this week, even though there were some decent rains around there in the western Corn Belt, it's still a worse setup at this point in the calendar than what we had in 2012. I'm not saying we're going to have a repeat of the 2012 growing season weather, but there needs to be some regular rainfall in that western Corn Belt during the growing season.”

Nellinger says the dry weather will initially be a bearish factor for the grain markets due to the quick planting pace, but he says there’s a tremendous amount of uncertainty about how the weather could shift during the growing season.

“Just add on about the wheat. We're going to need some rain in the Black Sea area and in Russia, and we're going to need rain in the Southern Plains to get the wheat crop worldwide across the finish line,” says Nellinger. “So, there's still some question there. And then when you look at how planting is going and this line of what La Nina will mean to summer temperatures and rainfall, especially the western Corn Belt. There’s just a tremendous amount of uncertainty going forward.”